Answered step by step

Verified Expert Solution

Question

1 Approved Answer

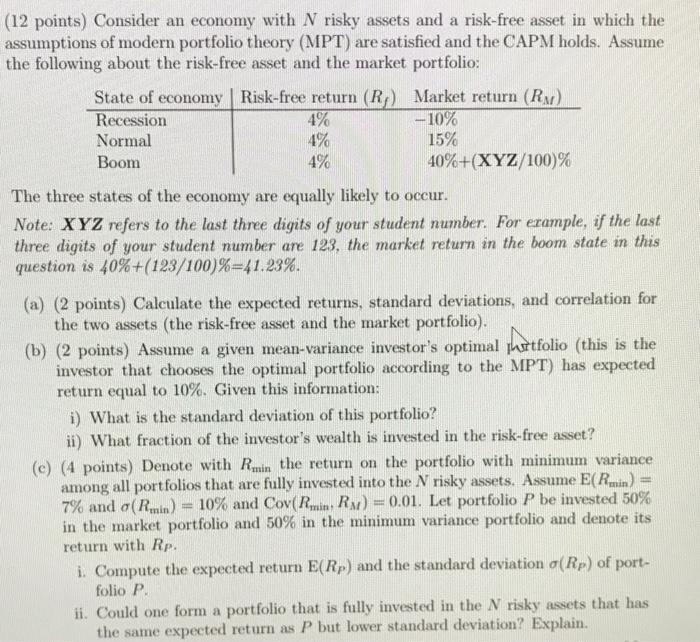

(12 points) Consider an economy with N risky assets and a risk-free asset in which the assumptions of modern portfolio theory (MPT) are satisfied

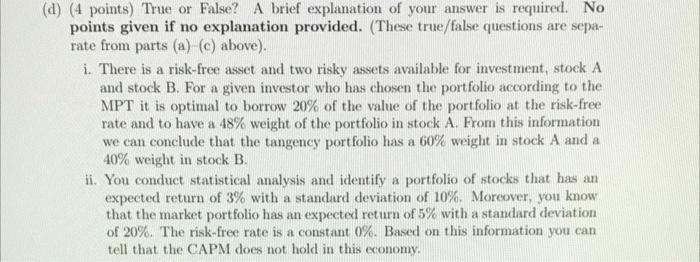

(12 points) Consider an economy with N risky assets and a risk-free asset in which the assumptions of modern portfolio theory (MPT) are satisfied and the CAPM holds. Assume the following about the risk-free asset and the market portfolio: State of economy Risk-free return (R) Market return (RM) -10% 15% Recession Normal Boom 4% 4% 4% 40%+(XYZ/100) % The three states of the economy are equally likely to occur. Note: XYZ refers to the last three digits of your student number. For example, if the last three digits of your student number are 123, the market return in the boom state in this question is 40% +(123/100) % -41.23%. (a) (2 points) Calculate the expected returns, standard deviations, and correlation for the two assets (the risk-free asset and the market portfolio). (b) (2 points) Assume a given mean-variance investor's optimal portfolio (this is the investor that chooses the optimal portfolio according to the MPT) has expected return equal to 10%. Given this information: i) What is the standard deviation of this portfolio? ii) What fraction of the investor's wealth is invested in the risk-free asset? (c) (4 points) Denote with Rmin the return on the portfolio with minimum variance among all portfolios that are fully invested into the N risky assets. Assume E(Rin) = 7% and a(Rmin) = 10% and Cov(Rmin R)=0.01. Let portfolio P be invested 50% in the market portfolio and 50% in the minimum variance portfolio and denote its return with Rp. i. Compute the expected return E(Rp) and the standard deviation (Rp) of port- folio P. ii. Could one form a portfolio that is fully invested in the N risky assets that has the same expected return as P but lower standard deviation? Explain. (d) (4 points) True or False? A brief explanation of your answer is required. No points given if no explanation provided. (These true/false questions are sepa- rate from parts (a) (c) above). i. There is a risk-free asset and two risky assets available for investment, stock A and stock B. For a given investor who has chosen the portfolio according to the MPT it is optimal to borrow 20% of the value of the portfolio at the risk-free rate and to have a 48% weight of the portfolio in stock A. From this information we can conclude that the tangency portfolio has a 60% weight in stock A and a 40% weight in stock B. ii. You conduct statistical analysis and identify a portfolio of stocks that has an expected return of 3% with a standard deviation of 10%. Moreover, you know that the market portfolio has an expected return of 5% with a standard deviation of 20%. The risk-free rate is a constant 0%. Based on this information you can tell that the CAPM does not hold in this economy.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The expected returns standard deviations and correlation of the two assets the riskfree asset and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started