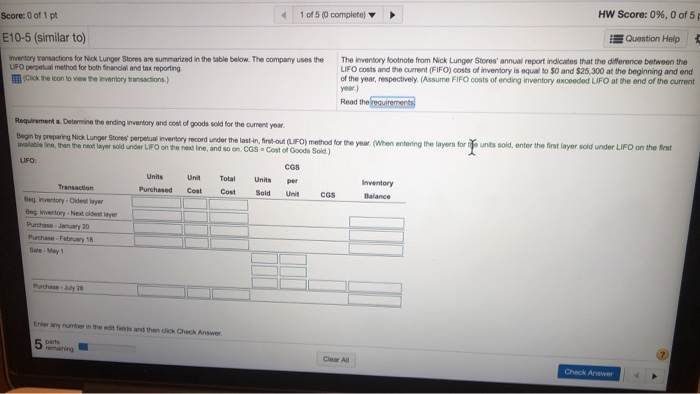

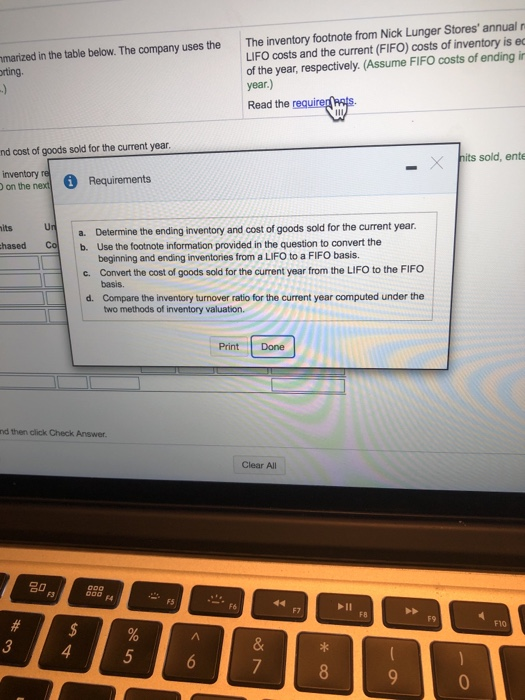

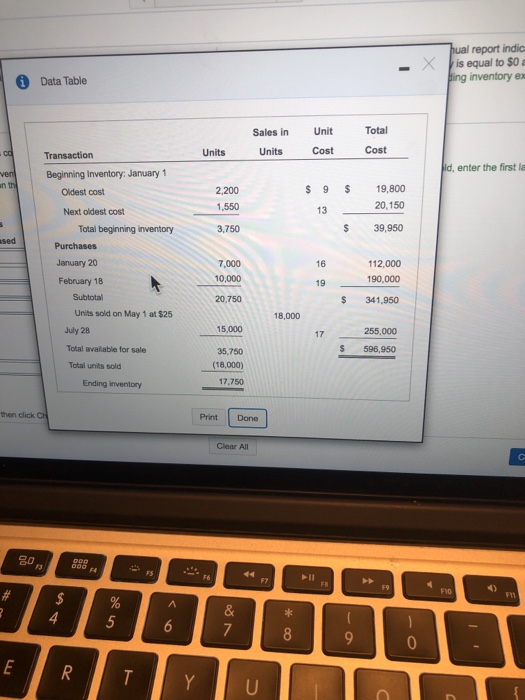

Score: 0 of 1 pt 1 of 5 (0 complete HW Score: 0%, 0 of 5 E10-5 (similar to) Question Help Inventory transactions for Nick Lunger Stores are summarized in the table below. The company uses the UFO perpetual method for both financial and tax reporting Click the icon to view the inventory actions.) The inventory footnote from Nick Lunger Stores annual report indicates that the difference between the LIFO costs and the current (FIFO) costs of inventory is equal to 30 and $25.300 at the beginning and and of the year, respectively. Assume FIFO costs of ending inventory exceeded LIFO at the end of the current year) Read the requirements Requirementa Begin by preparing N then the in the enginvertory and cost of goods sold for the current year urger S p inventory record under the last FO method for the year when entering the layers or y wonder on the next line and soon CGS Cost of Goods Sold) units sold enter the first layer sold under LIFO on the first UFO: Units Purchased Unit Cost Total Cost Units Sold COS per Unit Inventory Balance CGS Transaction Beg. Inventory Odeslayer Beginvertory - Nestl Purchase. January 20 Puchar February 18 er Purch Ehhorny number that and then click Check 5 Check marized in the table below. The company uses the orting The inventory footnote from Nick Lunger Stores' annual LIFO costs and the current (FIFO) costs of inventory is ec of the year, respectively. (Assume FIFO costs of ending in year.) Read the requireg was. nd cost of goods sold for the current year. X hits sold, ente inventory re on the nexdi Requirements hits chased UN Co a. Determine the ending inventory and cost of goods sold for the current year. b. Use the footnote information provided in the question to convert the beginning and ending inventories from a LIFO to a FIFO basis. c. Convert the cost of goods sold for the current year from the LIFO to the FIFO basis d. Compare the inventory turnover ratio for the current year computed under the two methods of inventory valuation. Print Done nd then click Check Answer. Clear All - X hual report indic is equal to $0 a Bing inventory ex i Data Table Sales in Units Unit Cost Total Cost od Units Transaction Beginning Inventory: January 1 Oldest cost bid, enter the first la ven enth $ 2,200 1,550 $ 9 13 19,800 2 0,150 Next oldest cost Total beginning inventory Purchases 3.750 $ 39,950 sed January 20 7.000 16 112,000 190,000 10,000 20,750 $ February 18 Subtotal Units sold on May 1 at $25 July 28 341,950 18,000 15.000 255,000 596,950 $ Total available for sale Total units sold Ending inventory 35,750 (18,000) 17.750 then click CH Print Done Clear All