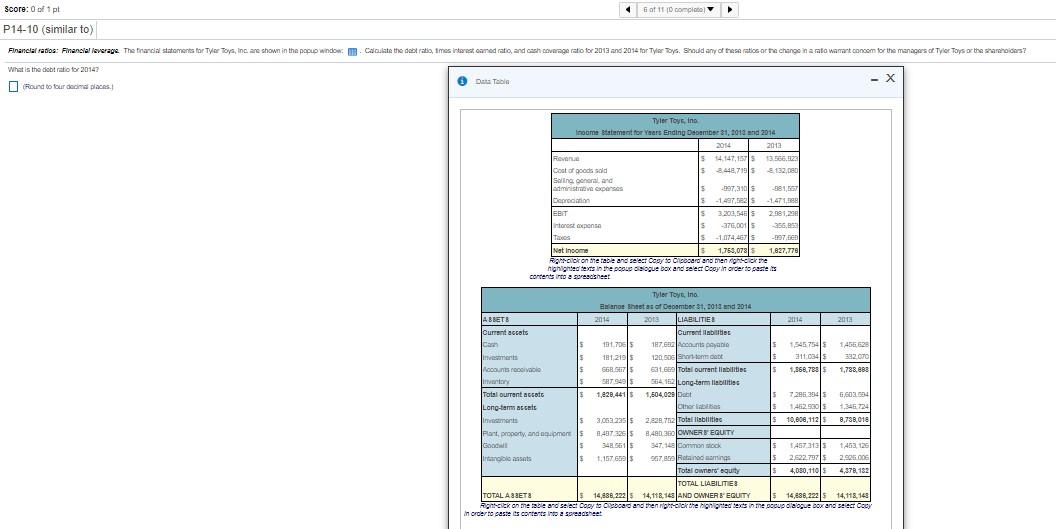

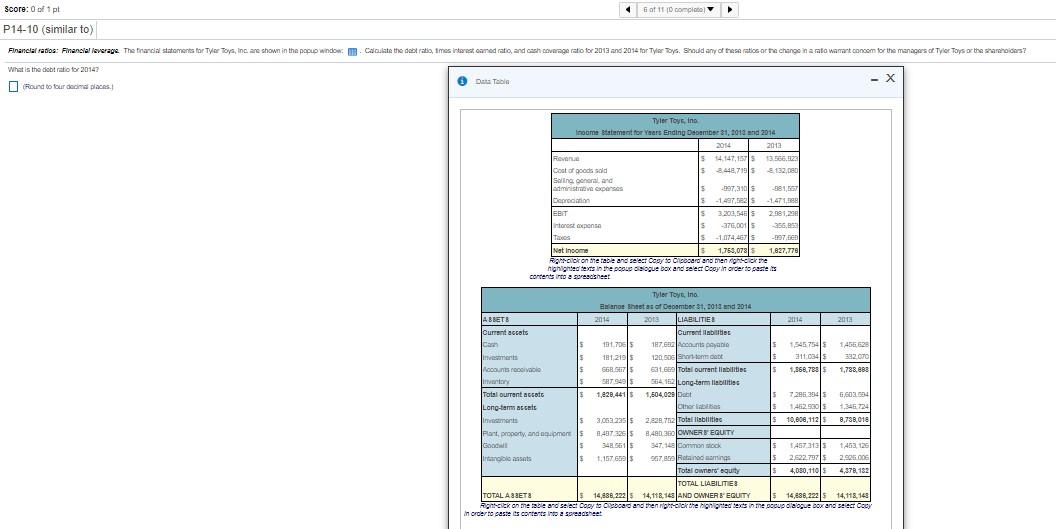

Score: 0 of 1 pt Got 10 completo compie P14-10 (similar to) Financial rados: Financial leverage The Financial statements for Troy, Inc. are shown in the popup window .. Calculate the debt ratio,imes interest and ratio, and cash coverage ratio for 2013 and 2014 for Ty Toys. Should any of these ratio or the change in a ratowamant concom for the managers of Tyler Toys or the shareholders? What is the debt ratio for 2014? -X Data Table n Round to four de places Tyler Toys, in Income statement for Years Ending December 31, 2018 and 2014 2014 2013 Reven 14.147,157 3,1231 Cost of goods sold 8.448,7195 5132,080 Sling general and administrative expenses $ -997,3105 -981, Der -1.407,1471,098 EBIT 5 3203,5461 2981,200 interest mpensa s -376,00115 -356,831 S -1.674,467 -997. Nat Income 1,759,0781 1,827,778 Rohook on the table and select Oogy to chocard and then ghecick the highlighted texts in the poor isoque box and select Oesy in order to gentes contents to sorscsheet Tyler Toytino Toy Balane het as of December 1, 2011 and 2014 A BETA 2014 2013 LIABILITIES 20114 2018 Current accots Current C 5 1317085 187 contato 1,545.75415 145662 monts 5 18121915 120.06 Sotomat $ 311 0341 332.070 Accounts 5 SGB 5 631.6Total Ourrent liabilities 1,868,788 1,788,000| Inry $ S879405 5541 Long-term liabilities Total Ourrent accett 3 1,828.4415 1,504,029 5 7296 29415 6,6024 Long-term as cats Others 15 1,346.724 remonts $3.05.2015 2.828 762 Total liabilities S 10,006,11215 8,788.010 Font, property and more 8497.32 $400 300 OWNERE EQUITY 5 348.00 347.14 Common sock 5 14573135 1,463.120 tangas $1,1576967.Rotanad memings 5 2.622.79715 2.500.000 Total owners uity 4,050 1105 4,378,182 TOTAL LIABILITIES TOTAL A BET 14,888.222 14,118,14 AND OWNERS EQUITY $ 14,638,225 14,118,145 Algick on the ble and select Copy to bbcad and then rights the highlighted texts in the coup laogue bow and select Copy In order to passets contents into a spreadsheet Score: 0 of 1 pt Got 10 completo compie P14-10 (similar to) Financial rados: Financial leverage The Financial statements for Troy, Inc. are shown in the popup window .. Calculate the debt ratio,imes interest and ratio, and cash coverage ratio for 2013 and 2014 for Ty Toys. Should any of these ratio or the change in a ratowamant concom for the managers of Tyler Toys or the shareholders? What is the debt ratio for 2014? -X Data Table n Round to four de places Tyler Toys, in Income statement for Years Ending December 31, 2018 and 2014 2014 2013 Reven 14.147,157 3,1231 Cost of goods sold 8.448,7195 5132,080 Sling general and administrative expenses $ -997,3105 -981, Der -1.407,1471,098 EBIT 5 3203,5461 2981,200 interest mpensa s -376,00115 -356,831 S -1.674,467 -997. Nat Income 1,759,0781 1,827,778 Rohook on the table and select Oogy to chocard and then ghecick the highlighted texts in the poor isoque box and select Oesy in order to gentes contents to sorscsheet Tyler Toytino Toy Balane het as of December 1, 2011 and 2014 A BETA 2014 2013 LIABILITIES 20114 2018 Current accots Current C 5 1317085 187 contato 1,545.75415 145662 monts 5 18121915 120.06 Sotomat $ 311 0341 332.070 Accounts 5 SGB 5 631.6Total Ourrent liabilities 1,868,788 1,788,000| Inry $ S879405 5541 Long-term liabilities Total Ourrent accett 3 1,828.4415 1,504,029 5 7296 29415 6,6024 Long-term as cats Others 15 1,346.724 remonts $3.05.2015 2.828 762 Total liabilities S 10,006,11215 8,788.010 Font, property and more 8497.32 $400 300 OWNERE EQUITY 5 348.00 347.14 Common sock 5 14573135 1,463.120 tangas $1,1576967.Rotanad memings 5 2.622.79715 2.500.000 Total owners uity 4,050 1105 4,378,182 TOTAL LIABILITIES TOTAL A BET 14,888.222 14,118,14 AND OWNERS EQUITY $ 14,638,225 14,118,145 Algick on the ble and select Copy to bbcad and then rights the highlighted texts in the coup laogue bow and select Copy In order to passets contents into a spreadsheet