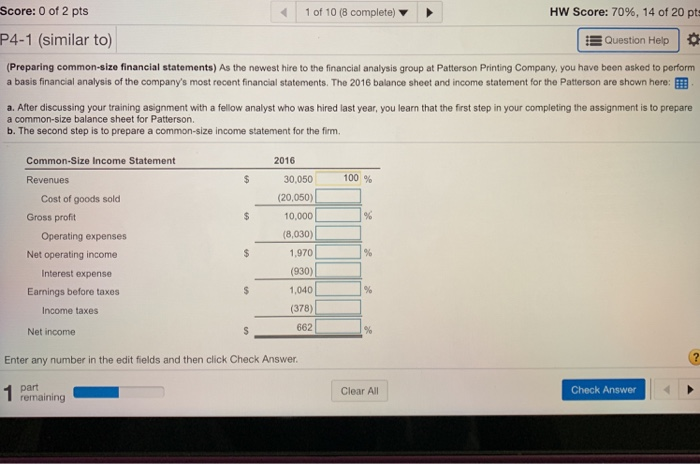

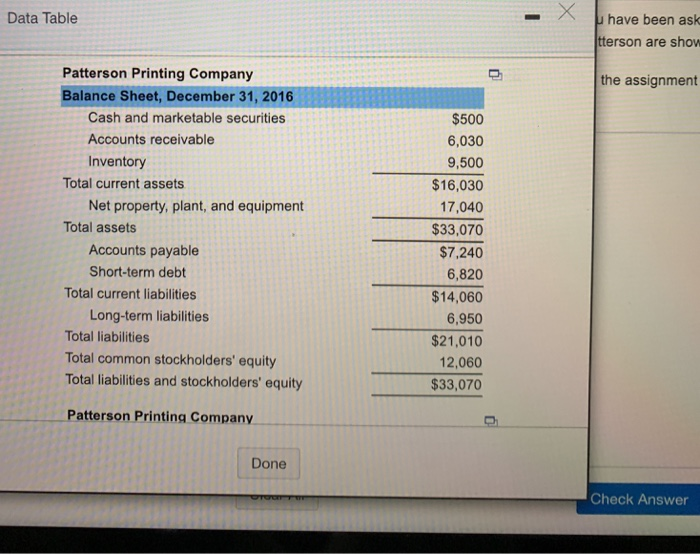

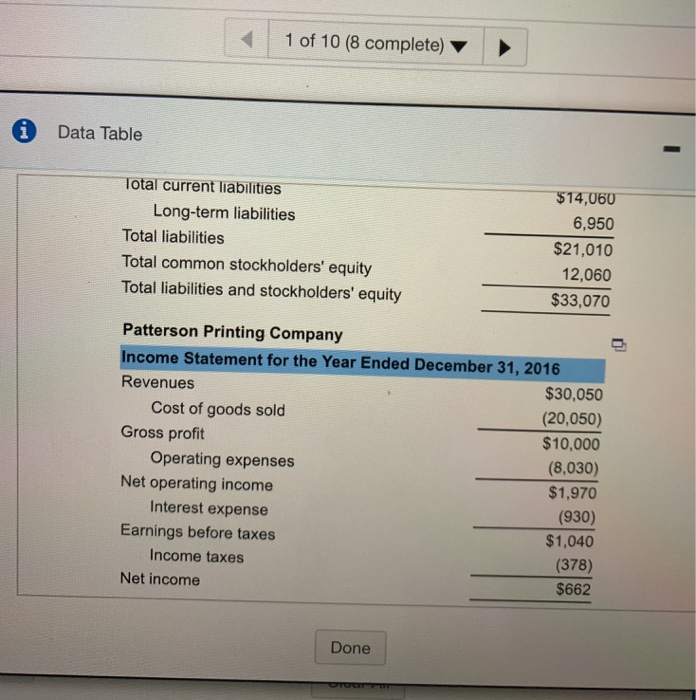

Score: 0 of 2 pts 1 of 10 (8 complete) Hw Score: 70%, 14 of 20 pts P4-1 (similar to) Question Help * (Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to perform a basis financial analysis of the company's most recent nancia statements. The 2016 balance sheet and income statement orthe Patterson are shown here: a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. b. The second step is to prepare a common-size income statement for the firm. Common-Size Income Statement 2016 Revenues S 30,050 100 % (20,050) 10,000 (8,030) 1,970 Cost of goods sold Gross profit Operating expenses Net operating income Interest expense Earnings before taxes ncome taxes 1,040 (378) 662 Net income Enter any number in the edit fields and then click Check Answer. part Clear All Check Answer Data Table u have been ask terson are show Patterson Printing Company Balance Sheet, December 31, 2016 the assignment Cash and marketable securities Accounts receivable Inventory $500 6,030 9,500 $16,030 17,040 $33,070 $7,240 6,820 $14,060 6,950 $21,010 12,060 $33,070 Total current assets Net property, plant, and equipment Total assets Accounts payable Short-term debt Total current liabilities Long-term liabilities Total liabilities Total common stockholders' equity Total liabilities and stockholders' equity Patterson Printing Company Done Check Answer 1 of 10 (8 complete) i Data Table Total current liabilities Long-term liabilities Total liabilities Total common stockholders' equity Total liabilities and stockholders' equity $14,060 6,950 $21,010 12,060 $33,070 Patterson Printing Company Income Statement for the Year Ended December 31, 2016 Revenues Gross profit Net operating income Earnings before taxes Cost of goods sold Operating expenses Interest expense $30,050 (20,050) $10,000 (8,030) $1,970 (930) $1,040 (378) $662 Income taxes Net income Done