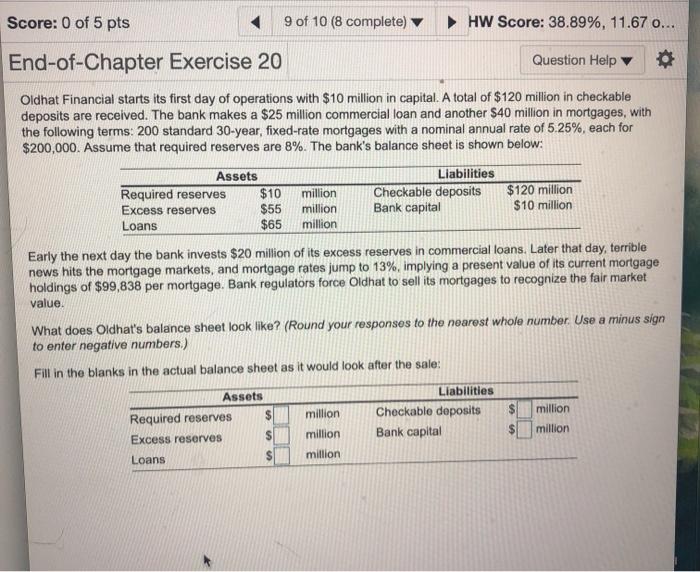

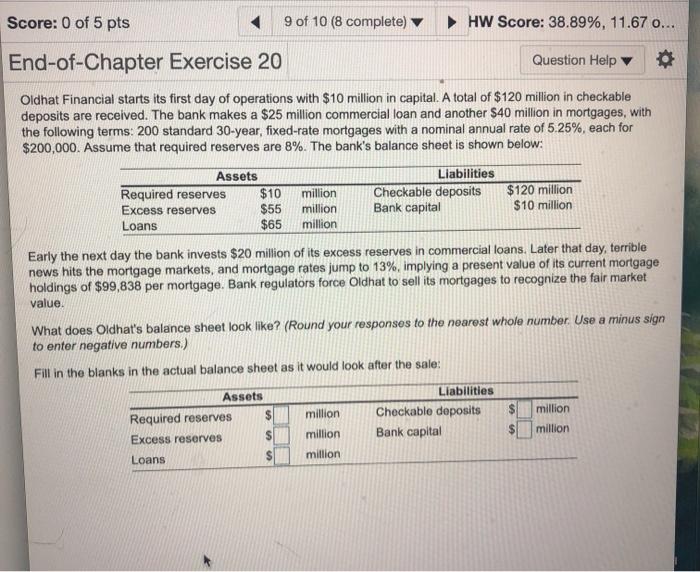

Score: 0 of 5 pts 9 of 10 (8 complete) HW Score: 38.89%, 11.67 0... End-of-Chapter Exercise 20 Question Help Oldhat Financial starts its first day of operations with $10 million in capital. A total of $120 million in checkable deposits are received. The bank makes a $25 million commercial loan and another $40 million in mortgages, with the following terms: 200 standard 30-year, fixed-rate mortgages with a nominal annual rate of 5.25%, each for $200,000. Assume that required reserves are 8%. The bank's balance sheet is shown below: Assets Liabilities Required reserves $10 million Checkable deposits $120 million Excess reserves $55 million Bank capital $10 million Loans $65 million Early the next day the bank invests $20 million of its excess reserves in commercial loans. Later that day, terrible news hits the mortgage markets, and mortgage rates jump to 13%, implying a present value of its current mortgage holdings of $99,838 per mortgage. Bank regulators force Oldhat to sell its mortgages to recognize the fair market value. What does Oldhat's balance sheet look like? (Round your responses to the nearest whole number. Use a minus sign to enter negative numbers.) Fill in the blanks in the actual balance sheet as it would look after the sale: $ Assets Required reserves $ Excess reserves S Loans Liabilities Checkable deposits Bank capital million million million $ million million Score: 0 of 5 pts 9 of 10 (8 complete) HW Score: 38.89%, 11.67 0... End-of-Chapter Exercise 20 Question Help Oldhat Financial starts its first day of operations with $10 million in capital. A total of $120 million in checkable deposits are received. The bank makes a $25 million commercial loan and another $40 million in mortgages, with the following terms: 200 standard 30-year, fixed-rate mortgages with a nominal annual rate of 5.25%, each for $200,000. Assume that required reserves are 8%. The bank's balance sheet is shown below: Assets Liabilities Required reserves $10 million Checkable deposits $120 million Excess reserves $55 million Bank capital $10 million Loans $65 million Early the next day the bank invests $20 million of its excess reserves in commercial loans. Later that day, terrible news hits the mortgage markets, and mortgage rates jump to 13%, implying a present value of its current mortgage holdings of $99,838 per mortgage. Bank regulators force Oldhat to sell its mortgages to recognize the fair market value. What does Oldhat's balance sheet look like? (Round your responses to the nearest whole number. Use a minus sign to enter negative numbers.) Fill in the blanks in the actual balance sheet as it would look after the sale: $ Assets Required reserves $ Excess reserves S Loans Liabilities Checkable deposits Bank capital million million million $ million million