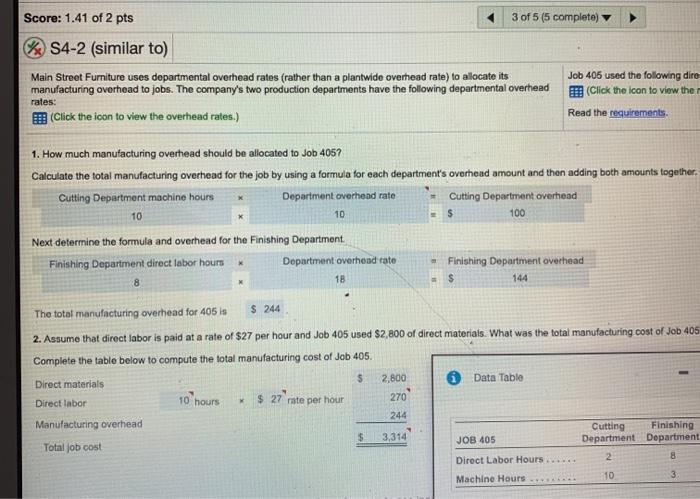

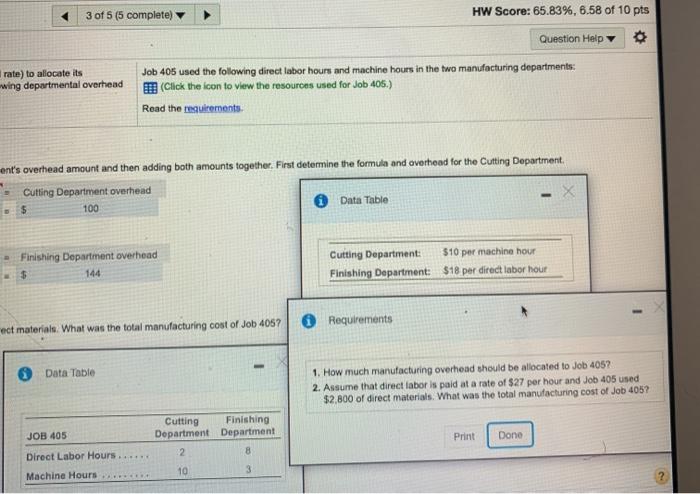

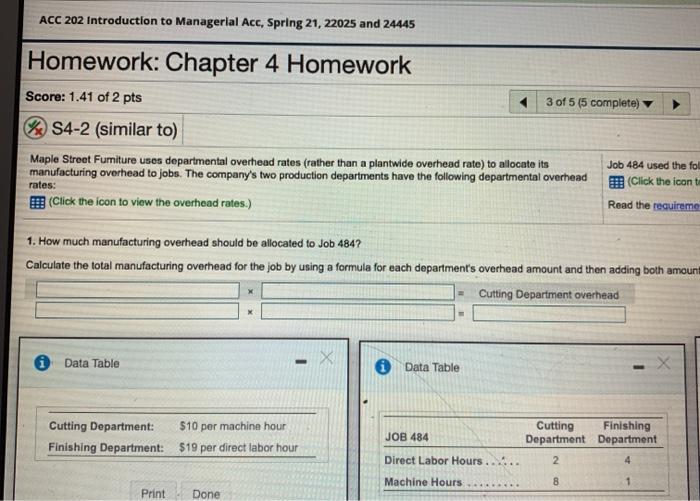

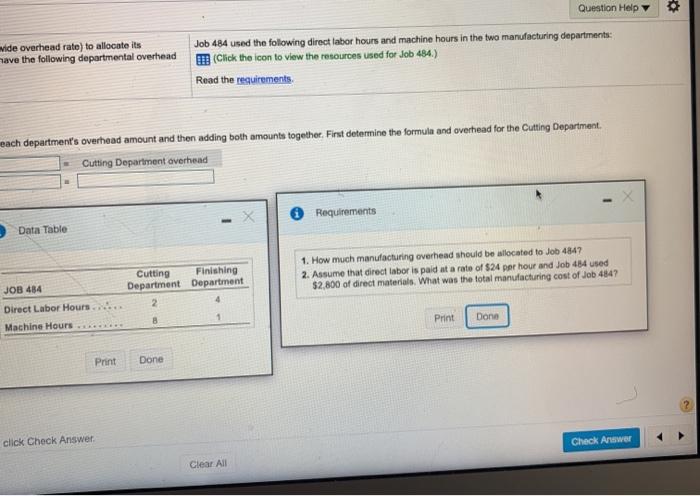

Score: 1.41 of 2 pts 3 of 5 (5 complete) S4-2 (similar to) Main Street Furniture uses departmental overhead rates (rather than a plantwide overhead rate) to allocate its manufacturing overhead to jobs. The company's two production departments have the following departmental overhead (Click the icon to view the overhead rates.) Job 405 used the following dire (Click the icon to view the Read the requirements rates: 1. How much manufacturing overhead should be allocated to Job 4057 Calculate the total manufacturing overhead for the job by using a formula for each department's overhead amount and then adding both amounts together. Cutting Department machine hours Department overhead rate Cutting Department overhead 10 100 Next determine the formula and overhead for the Finishing Department. Finishing Department direct labor hours Department overhead rato Finishing Department overhead 8 10 $ 18 $ 144 The total manufacturing overhead for 405 is $ 244 2. Assume that direct labor is paid at a rate of $27 per hour and Job 405 used $2,800 of direct materials. What was the total manufacturing cost of Job 405 Complete the table below to compute the total manufacturing cost of Job 405. Direct materials $ 2,800 Data Table $ 27"rate per hour Direct labor 270 Manufacturing overhead Cutting Finishing 3,314 Total job cost JOB 405 Department Department Direct Labor Hours..... 2 Machine Hours 10 10 hours 244 3 of 5 (5 complete) HW Score: 65.83%, 6.58 of 10 pts Question Help rate) to allocate its wing departmental overhead Job 405 used the following direct labor hours and machine hours in the two manufacturing departments: (Click the icon to view the resources used for Job 406.) Read the requirements ent's overhead amount and then adding both amounts together. First determine the formula and overhead for the Cutting Department - Cutting Department overhead $ 100 Data Table Finishing Department overhead 144 Cutting Department: $10 per machine hour Finishing Department: $18 per direct labor hour Requirements ect materials. What was the total manufacturing cost of Job 4057 - Data Table 1. How much manufacturing overhead should be allocated to Job 405? 2. Assume that direct labor is paid at a rate of $27 per hour and Job 405 used $2,800 of direct materials. What was the total manufacturing cost of Job 405? Cutting Finishing Department Department 2 8 Print Done JOB 405 Direct Labor Hours..... Machine Hours 10 3 ACC 202 Introduction to Managerial Acc, Spring 21, 22025 and 24445 Homework: Chapter 4 Homework Score: 1.41 of 2 pts 3 of 5 (5 complete) S4-2 (similar to) Maple Street Fumiture uses departmental overhead rates (rather than a plantwide overhead rate) to allocate its Job 484 used the fol manufacturing overhead to jobs. The company's two production departments have the following departmental overhead (Click the icon rates: Read the requireme (Click the icon to view the overhead rates.) 1. How much manufacturing overhead should be allocated to Job 484? Calculate the total manufacturing overhead for the job by using a formula for each department's overhead amount and then adding both amount Cutting Department overhead Data Table i Data Table Cutting Department: $10 per machine hour Finishing Department: $19 per direct labor hour JOB 484 Cutting Finishing Department Department 2 Direct Labor Hours .... Machine Hours 8 . Print Done vide overhead rate) to allocate its have the following departmental overhead Question Help Job 484 used the following direct labor hours and machine hours in the two manufacturing departments: m (Click the icon to view the resources used for Job 484.) Read the requirements each department's overhead amount and then adding both amounts together. First determine the formula and overhead for the Cutting Department. Cutting Department overhead Requirements Data Table Cutting Finishing Department Department 2 1. How much manufacturing overhead should be allocated to Job 4847 2. Assume that direct labor is paid at a rate of $24 per hour and Job 484 used $2.800 of direct materials. What was the total manufacturing cost of Job 484? JOB 484 Direct Labor Hours Machine Hours Print Dono Done Print Done click Check Answer Check Answer Clear All