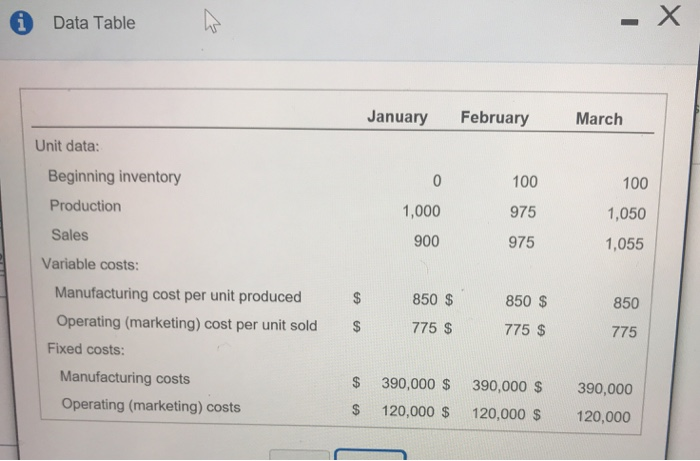

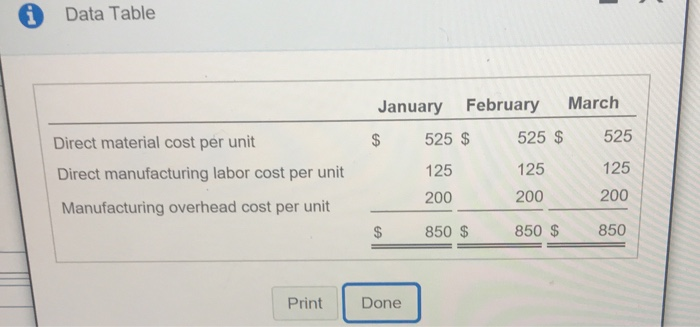

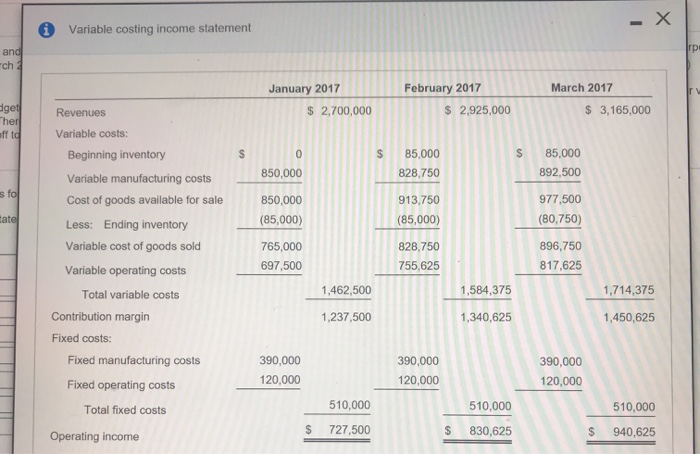

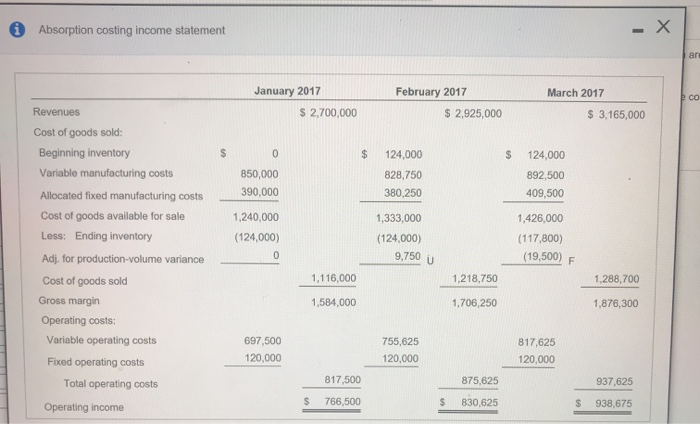

Score: U of9 pis EQuestion Help E9-24 (similar to) The variable manufacturing costs per unit of Chicago Screen Corporation are as follows (Cick the loon to view the variable manufacturing cost data) Chicago Screen Corporation manufactures and sells 50-inch television sets and uses standard costing. Actual data relating to January, February, and March 2017 are as folows m(Cick the icon to view the actual data ) Chicago Soreen prepared the following income statements under variable costing and absorption costing Click the lcon to view the variable costing statement) The selling price per unit is $3,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 1,000 units. There are no price, efficlency, or spending variances Any production-volume variance is weitten off to cost of goods sold in the month in which it ocours (Cick the locon to view the absorption costing statement )y Read the requirements Requirement 1. Prepare income statements for Chicago Soreen in January, February, and March 2017 under throughput costing. Begin by completing the top portion of the statement, then the botom portion (Enter a "0 for any zero balance accounts) March 2017 January 2017 February 2017 Revenues Choose from any list or enter any number in the input fields and then click Check Answer - X Data Table January February March Unit data: Beginning inventory 0 100 100 Production 1,000 975 1,050 Sales 900 975 1,055 Variable costs: Manufacturing cost per unit produced 850 $ 850 $ 850 Operating (marketing) cost per unit sold 775 $ 775 $ 775 Fixed costs: Manufacturing costs 390,000 $ 390,000 $ 390,000 Operating (marketing) costs $ 120,000 $ 120,000 $ 120,000 EA Data Table March February January 525 $ 525 525 $ Direct material cost per unit 125 125 125 Direct manufacturing labor cost per unit 200 200 200 Manufacturing overhead cost per unit 850 $ 850 850 $ Print Done - X Variable costing income statement rpr and ch 2 January 2017 February 2017 March 2017 dget Ther off to $ 2,925,000 $3,165,000 2,700,000 Revenues Variable costs: 85,000 S 0 S 85,000 Beginning inventory 828.750 892,500 850,000 Variable manufacturing costs s fo 977,500 Cost of goods available for sale 850,000 913,750 ate (80,750) (85,000) (85,000) Less: Ending inventory 828.750 896,750 Variable cost of goods sold 765,000 697,500 755,625 817,625 Variable operating costs 1,584,375 1,714,375 1,462,500 Total variable costs Contribution margin 1,237,500 1,340,625 1,450,625 Fixed costs: Fixed manufacturing cos 390,000 390,000 390,000 120,000 120,000 120,000 Fixed operating costs 510,000 510,000 510,000 Total fixed costs S 727,500 830,625 S 940,625 Operating income e - X Absorption costing income statement are January 2017 February 2017 March 2017 CC Revenues $ 2,700,000 S 2,925,000 $3,165,000 Cost of goods sold: Beginning inventory S 124,000 124,000 Variable manufacturing costs 850,000 828,750 892.500 390,000 380.250 409,500 Allocated fixed manufacturing costs Cost of goods available for sale 1,240,000 1,333,000 1,426,000 Less: Ending inventory (124,000) (124,000) (117,800) 9,750 U 0 (19,500) Adj. for production-volume variance F 1,116,000 1,218,750 1,288,700 Cost of goods sold Gross margin 1,584,000 1,706,250 1,876,300 Operating costs: Variable operating costs 697,500 755,625 817.625 120,000 120,000 120,000 Fixed operating costs 817,500 875,625 937,625 Total operating costs S 766,500 830,625 938,675 Operating income ary 201 1. Prepare income statements for Chicago Screen in January, February, and March 2017 under throughput costing. 2. Contrast the results in requirement 1 with the operating income results under variable costing and absorption costing. 3. Give one motivation for Chicago Screen to adopt throughput costing