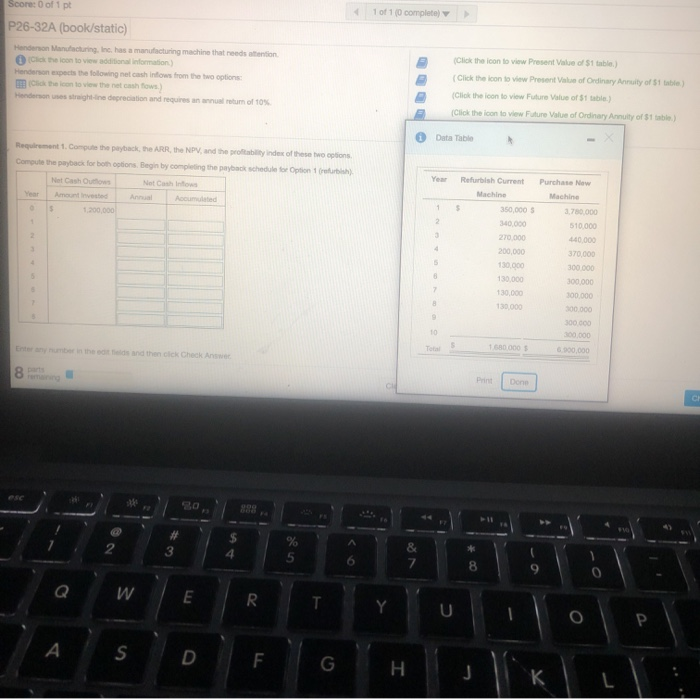

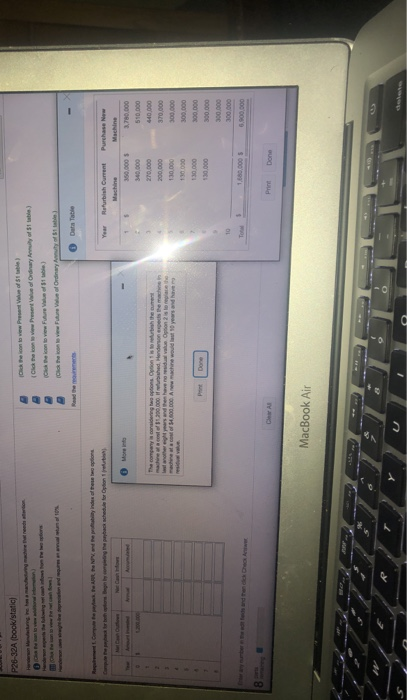

Scoreof pt 1 of 1 (0 complete) P26-32A (book/static) Henderson Mnacturing, Inc. has a manufacturing machine that needs attention che con to view additional information) Henderson expect the following net cash Infows from the two options Click the icon to view the net cash flows) Hendersonnes straight-ine depreciation and requires annual rum of 10% (Click the icon to view Present Value of S1 table) Click the icon to view Present Value of Ordinary Annuity of 51 table) (Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Data Table Requirement Compute the payback, the ARR, the NPV and the profitability index of these two options Compute the payback for both options. Begin by completing the payback schedule for Option treh Net Cash Outions Net Cash In Year Accumulated 1.200,000 Yea 1 2 Refurbish Current Machine $ 350,000 340,000 270.000 200,000 130.000 130.000 130.000 130.000 Purchase New Machine 3.700.000 510.000 440.000 370.000 300.000 2 4 5 8 2 300 000 300 000 200 000 B 9 10 000 Ethere and the chick And Tera TODO 6.900.000 8 Print Done 2 # 3 7 8 W E R Y U O S D F G H L L P26-32A (book/static) Catheon Presente al Ordinary of State) Con to view Future of we Covo Ordinary Read the 0 Data Table Year Rohurbish Current Purchase New Machine Machine 350,000 $ 3,780.000 340.000 510 000 270.000 The company considering options Options the 100.000 donderson the machine wanted the verside in the $4,600.000. Amachine would years and have 200,000 130.000 130 000 130.000 130,000 370,000 300.000 300,000 100.000 300.000 300.000 300.000 Done 10 5.900.000 CAR Print Done MacBook Air Scoreof pt 1 of 1 (0 complete) P26-32A (book/static) Henderson Mnacturing, Inc. has a manufacturing machine that needs attention che con to view additional information) Henderson expect the following net cash Infows from the two options Click the icon to view the net cash flows) Hendersonnes straight-ine depreciation and requires annual rum of 10% (Click the icon to view Present Value of S1 table) Click the icon to view Present Value of Ordinary Annuity of 51 table) (Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Data Table Requirement Compute the payback, the ARR, the NPV and the profitability index of these two options Compute the payback for both options. Begin by completing the payback schedule for Option treh Net Cash Outions Net Cash In Year Accumulated 1.200,000 Yea 1 2 Refurbish Current Machine $ 350,000 340,000 270.000 200,000 130.000 130.000 130.000 130.000 Purchase New Machine 3.700.000 510.000 440.000 370.000 300.000 2 4 5 8 2 300 000 300 000 200 000 B 9 10 000 Ethere and the chick And Tera TODO 6.900.000 8 Print Done 2 # 3 7 8 W E R Y U O S D F G H L L P26-32A (book/static) Catheon Presente al Ordinary of State) Con to view Future of we Covo Ordinary Read the 0 Data Table Year Rohurbish Current Purchase New Machine Machine 350,000 $ 3,780.000 340.000 510 000 270.000 The company considering options Options the 100.000 donderson the machine wanted the verside in the $4,600.000. Amachine would years and have 200,000 130.000 130 000 130.000 130,000 370,000 300.000 300,000 100.000 300.000 300.000 300.000 Done 10 5.900.000 CAR Print Done MacBook Air