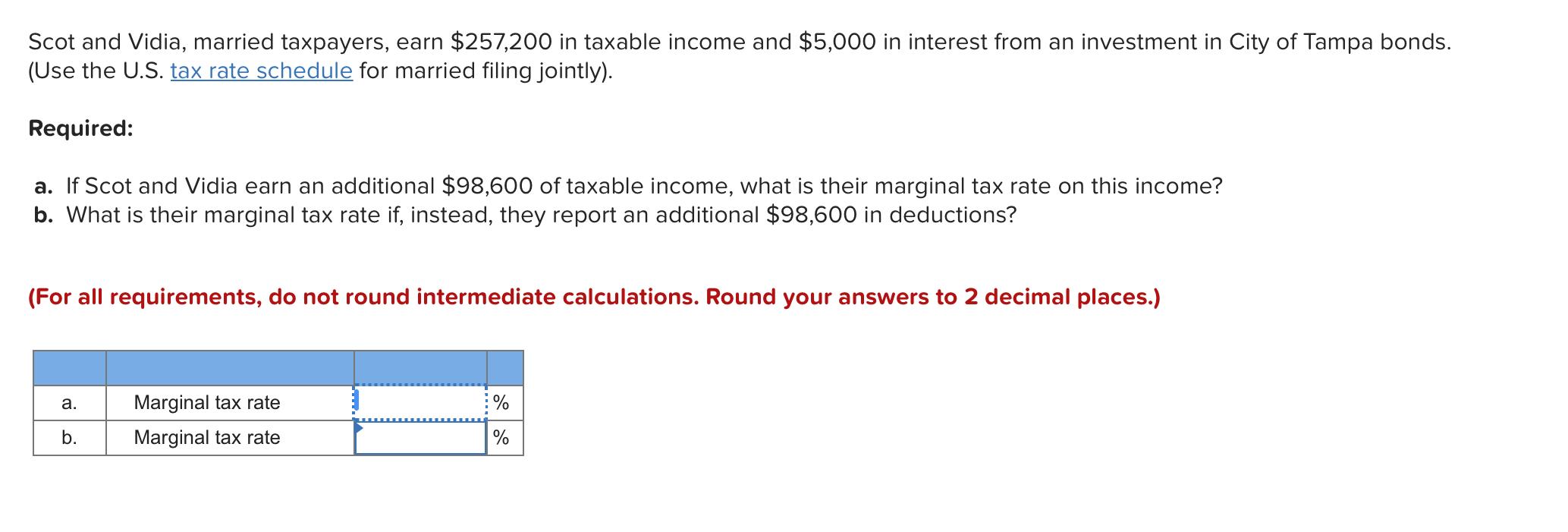

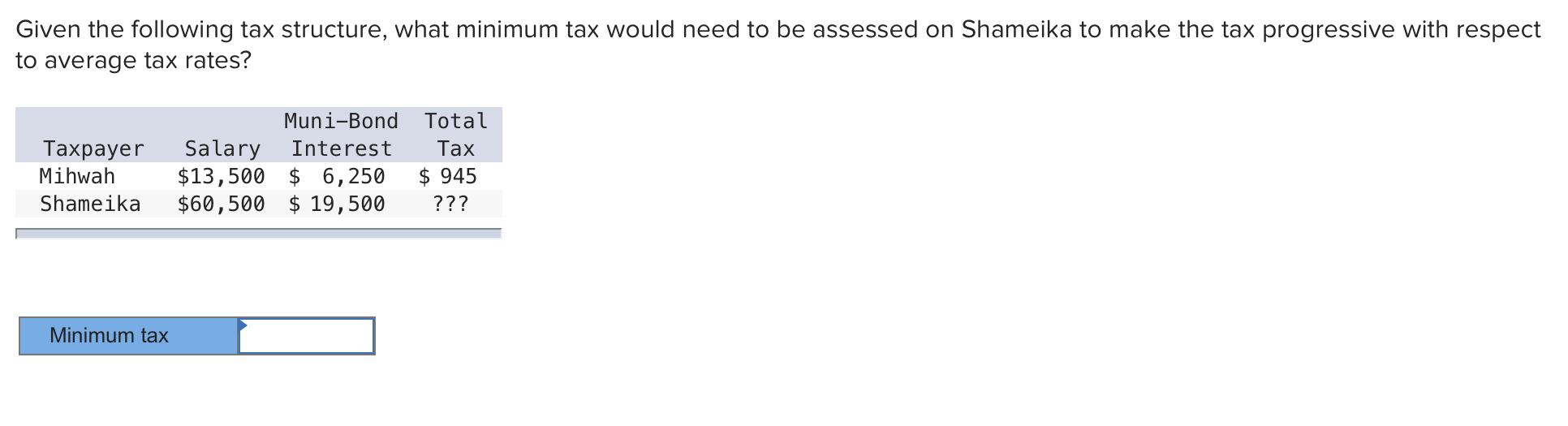

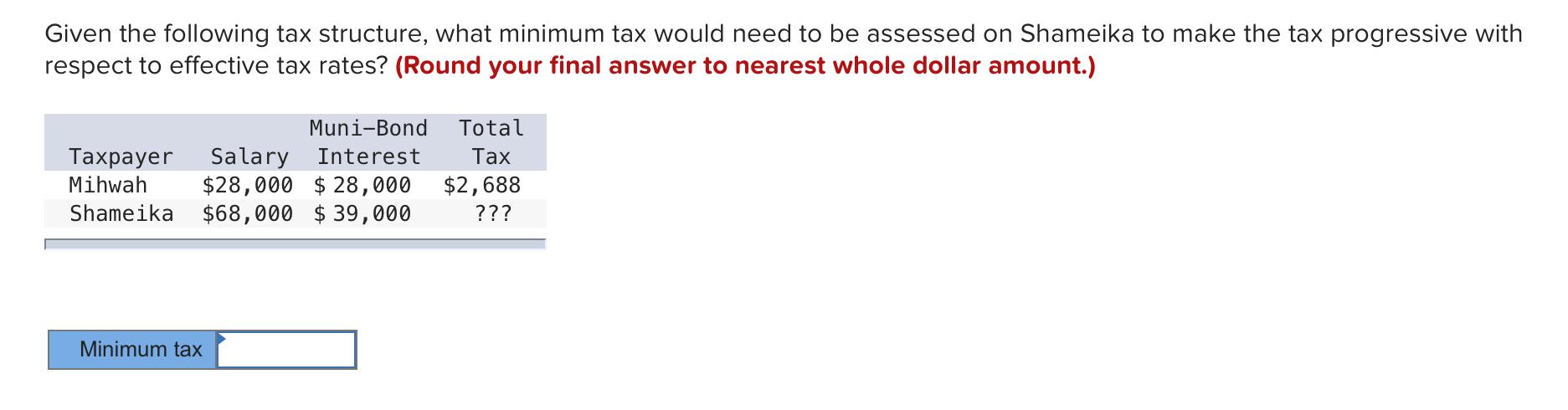

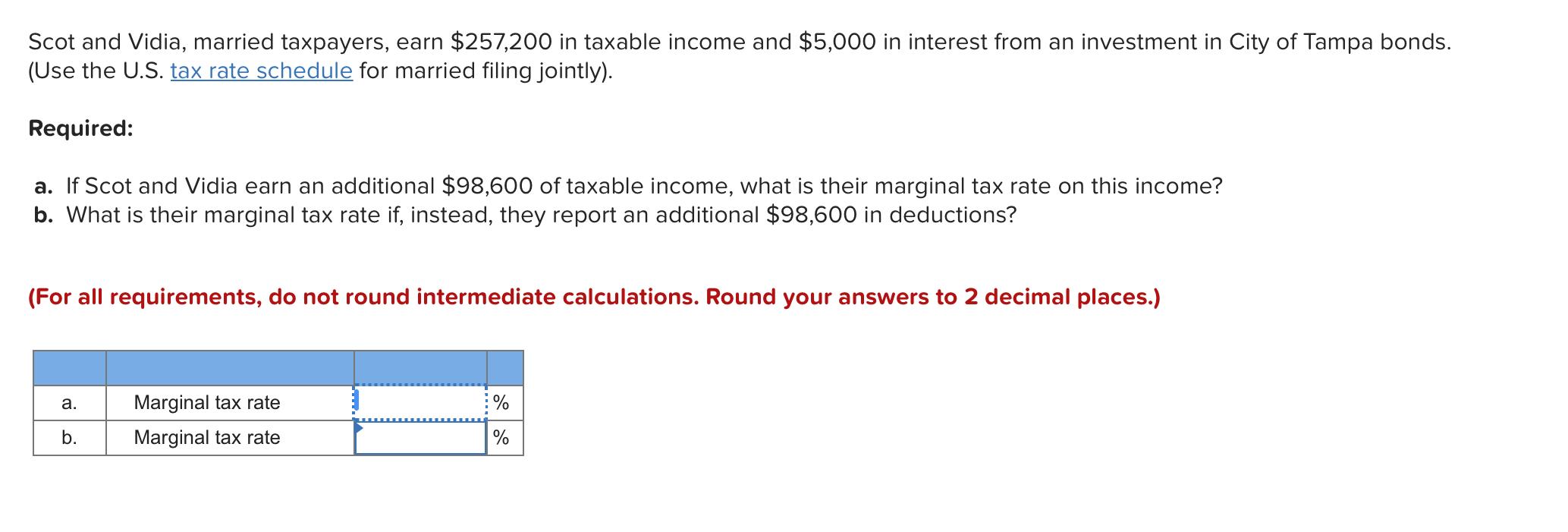

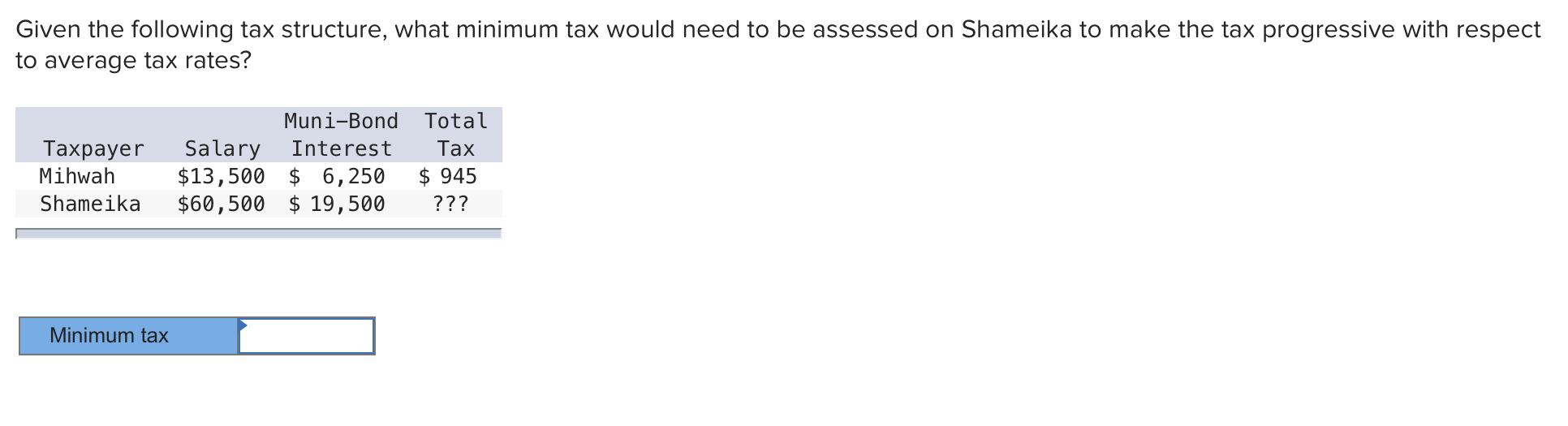

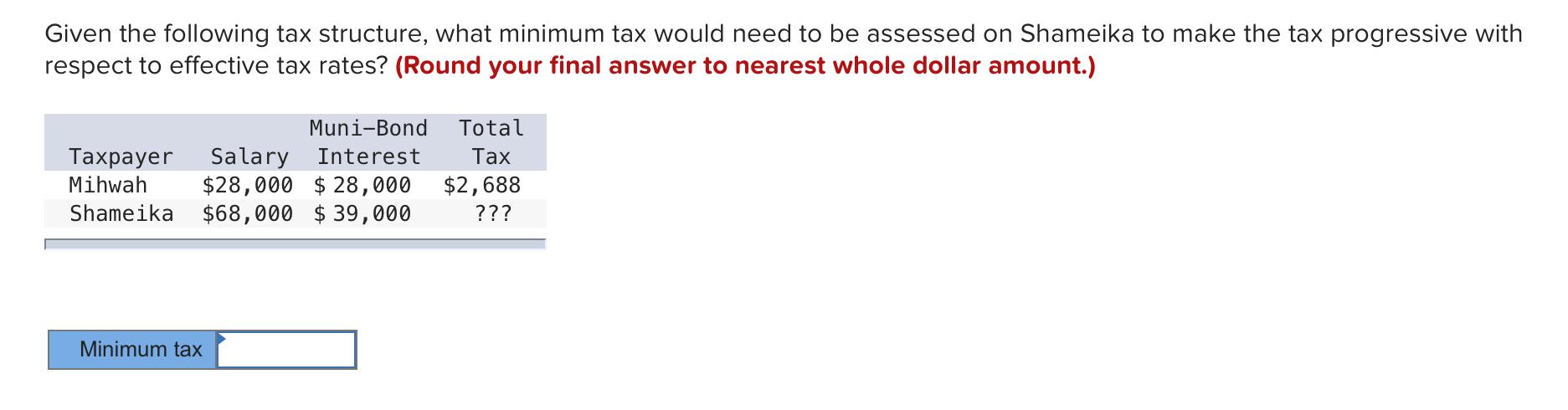

Scot and Vidia, married taxpayers, earn $257,200 in taxable income and $5,000 in interest from an investment in City of Tampa bonds. (Use the U.S. tax rate schedule for married filing jointly). Required: a. If Scot and Vidia earn an additional $98,600 of taxable income, what is their marginal tax rate on this income? b. What is their marginal tax rate if, instead, they report an additional $98,600 in deductions? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.) a. % Marginal tax rate Marginal tax rate b. % Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates? Taxpayer Mihwah Shameika Muni-Bond Salary Interest $13,500 $ 6,250 $60,500 $ 19,500 Total Tax $ 945 ??? Minimum tax Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to effective tax rates? (Round your final answer to nearest whole dollar amount.) Taxpayer Mihwah Shameika Muni-Bond Salary Interest $28,000 $ 28,000 $68,000 $ 39,000 Total Tax $2,688 ??? Minimum tax Scot and Vidia, married taxpayers, earn $257,200 in taxable income and $5,000 in interest from an investment in City of Tampa bonds. (Use the U.S. tax rate schedule for married filing jointly). Required: a. If Scot and Vidia earn an additional $98,600 of taxable income, what is their marginal tax rate on this income? b. What is their marginal tax rate if, instead, they report an additional $98,600 in deductions? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.) a. % Marginal tax rate Marginal tax rate b. % Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates? Taxpayer Mihwah Shameika Muni-Bond Salary Interest $13,500 $ 6,250 $60,500 $ 19,500 Total Tax $ 945 ??? Minimum tax Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to effective tax rates? (Round your final answer to nearest whole dollar amount.) Taxpayer Mihwah Shameika Muni-Bond Salary Interest $28,000 $ 28,000 $68,000 $ 39,000 Total Tax $2,688 ??? Minimum tax