Question

Scott Duffney, CPA, has randomly selected and audited a sample of 100 of Will-Marts accounts receivable. Will-Mart has 3,000 accounts receivable accounts with a total

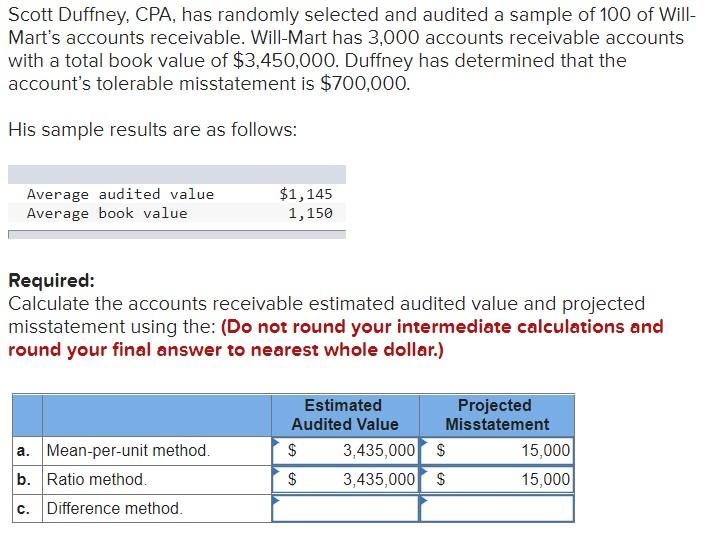

Scott Duffney, CPA, has randomly selected and audited a sample of 100 of Will-Marts accounts receivable. Will-Mart has 3,000 accounts receivable accounts with a total book value of $3,450,000. Duffney has determined that the accounts tolerable misstatement is $700,000. His sample results are as follows: Average audited value $ 1,145 Average book value 1,150 Calculate the accounts receivable estimated audited value and projected misstatement using the: (Do not round your intermediate calculations and round your final answer to nearest whole dollar.)

I don't think my calculations are correct. Can anyone assist?

Scott Duffney, CPA, has randomly selected and audited a sample of 100 of Will- a Mart's accounts receivable. Will-Mart has 3,000 accounts receivable accounts with a total book value of $3,450,000. Duffney has determined that the account's tolerable misstatement is $700,000. His sample results are as follows: Average audited value Average book value $1,145 1,150 Required: Calculate the accounts receivable estimated audited value and projected misstatement using the: (Do not round your intermediate calculations and round your final answer to nearest whole dollar.) a. Mean-per-unit method. b. Ratio method Difference method. $ $ Estimated Projected Audited Value Misstatement 3,435,000 $ 15,000 3,435,000 $ 15,000 cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started