Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scott Smart, a hedge fund manager in Coral Gable Florida, agreed to buy 100 boxes or Arturo Fuente Opus X cigars in 3 months

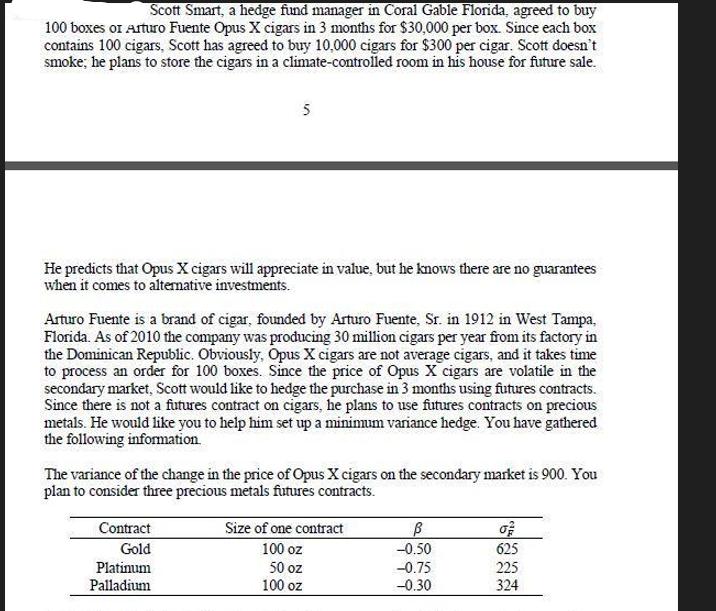

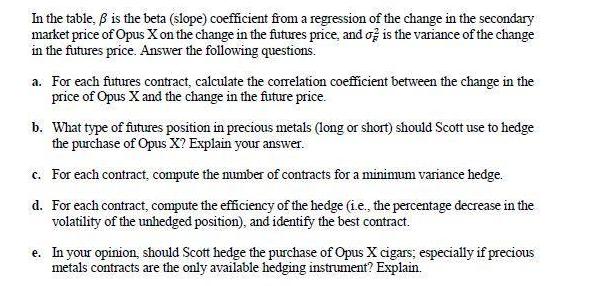

Scott Smart, a hedge fund manager in Coral Gable Florida, agreed to buy 100 boxes or Arturo Fuente Opus X cigars in 3 months for $30,000 per box. Since each box contains 100 cigars, Scott has agreed to buy 10,000 cigars for $300 per cigar. Scott doesn't smoke; he plans to store the cigars in a climate-controlled room in his house for future sale. 5 He predicts that Opus X cigars will appreciate in value, but he knows there are no guarantees when it comes to alternative investments. Arturo Fuente is a brand of cigar, founded by Arturo Fuente, Sr. in 1912 in West Tampa, Florida. As of 2010 the company was producing 30 million cigars per year from its factory in the Dominican Republic. Obviously, Opus X cigars are not average cigars, and it takes time to process an order for 100 boxes. Since the price of Opus X cigars are volatile in the secondary market, Scott would like to hedge the purchase in 3 months using futures contracts. Since there is not a futures contract on cigars, he plans to use futures contracts on precious metals. He would like you to help him set up a minimum variance hedge. You have gathered the following information. The variance of the change in the price of Opus X cigars on the secondary market is 900. You plan to consider three precious metals futures contracts. Contract Gold Platinum Palladium Size of one contract B 100 oz -0.50 625 50 oz -0.75 225 100 oz -0.30 324 In the table, is the beta (slope) coefficient from a regression of the change in the secondary market price of Opus X on the change in the futures price, and is the variance of the change in the futures price. Answer the following questions. a. For each futures contract, calculate the correlation coefficient between the change in the price of Opus X and the change in the future price. b. What type of futures position in precious metals (long or short) should Scott use to hedge the purchase of Opus X? Explain your answer. c. For each contract, compute the number of contracts for a minimum variance hedge. d. For each contract, compute the efficiency of the hedge (i.e., the percentage decrease in the volatility of the unhedged position), and identify the best contract. e. In your opinion, should Scott hedge the purchase of Opus X cigars; especially if precious metals contracts are the only available hedging instrument? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To set up a minimum variance hedge for Scott Smarts purchase of Opus X cigars using futures contracts on precious metals we need to calculate the number of futures contracts required for each metal based on their betas and contract sizes The goal is to minimize the variance of the portfolio consisting of the cigar purchase and the futures contracts Lets calculate the number of contracts needed for each metal Gold Beta 050 Size of one contract 100 oz Number of contracts N Beta of Cigars Beta of Gold Value of Cigars Value of Gold futures contract ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started