Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On merchandise with a list price totaling $2,520, a wholesale buyer is offered trade discounts of 40 percent and 15 percent. For what

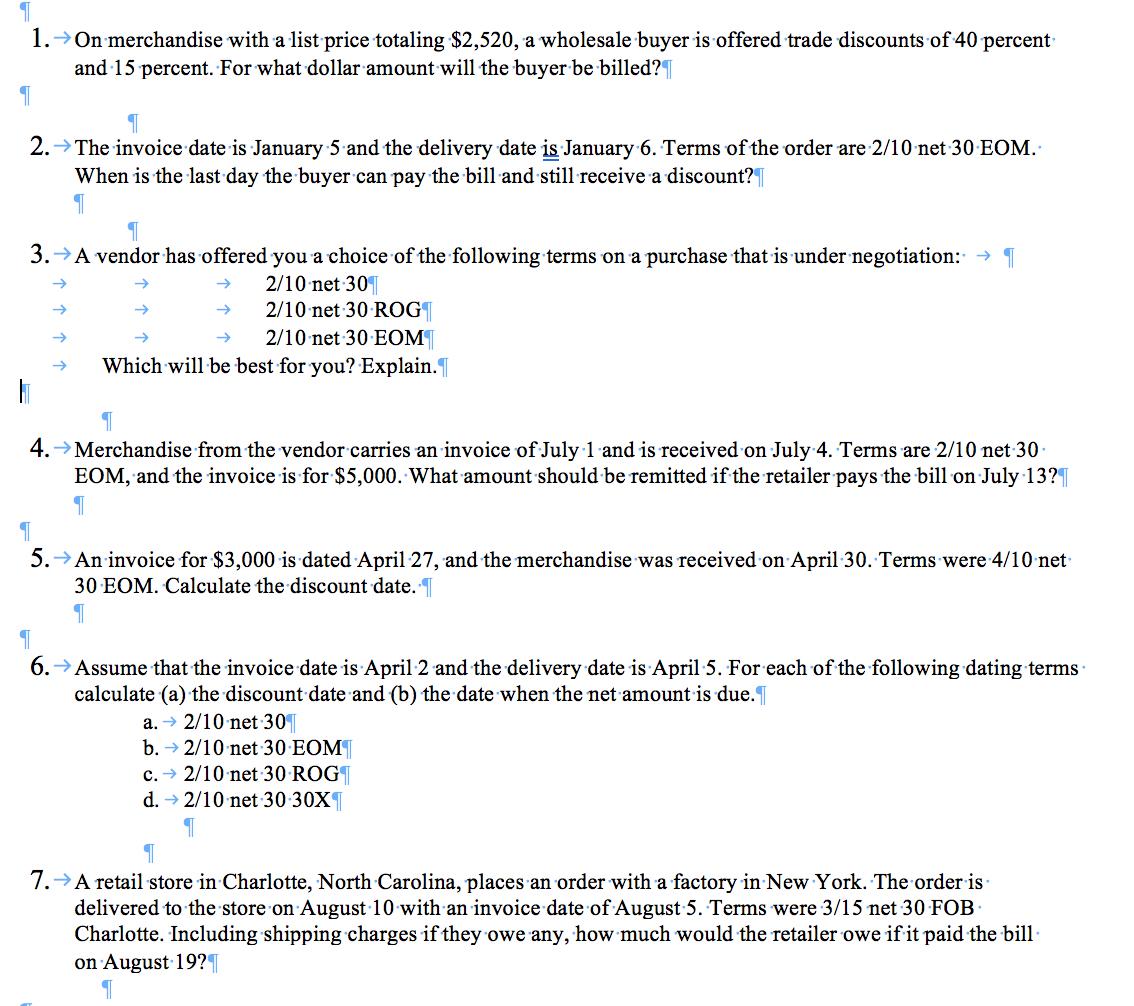

1. On merchandise with a list price totaling $2,520, a wholesale buyer is offered trade discounts of 40 percent and 15 percent. For what dollar amount will the buyer be billed? 2. The invoice date is January 5 and the delivery date is January 6. Terms of the order are 2/10 net 30 EOM. When is the last day the buyer can pay the bill and still receive a discount? T 1 3. A vendor has offered you a choice of the following terms on a purchase that is under negotiation: 2/10 net 30 2/10 net 30 ROG 2/10 net 30 EOM Which will be best for you? Explain. 4. Merchandise from the vendor carries an invoice of July 1 and is received on July 4. Terms are 2/10 net 30 EOM, and the invoice is for $5,000. What amount should be remitted if the retailer pays the bill on July 13? T 5. An invoice for $3,000 is dated April 27, and the merchandise was received on April 30. Terms were 4/10 net 30 EOM. Calculate the discount date. 6. Assume that the invoice date is April 2 and the delivery date is April 5. For each of the following dating terms calculate (a) the discount date and (b) the date when the net amount is due. a. 2/10 net 30 b. 2/10 net 30 EOM c. 2/10 net 30 ROG d. 2/10 net 30-30X 7. A retail store in Charlotte, North Carolina, places an order with a factory in New York. The order is delivered to the store on August 10 with an invoice date of August 5. Terms were 3/15 net 30 FOB Charlotte. Including shipping charges if they owe any, how much would the retailer owe if it paid the bill on August 19?

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

solution to 1 Discount rate 40 15 List Price 2520 2520 less Trade Discount 1008 378 Billed 1512 2142 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started