Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scout limited is reaching out for your suggestion to decide on the method of financing new equipment to test the efficacy of new therapeutic

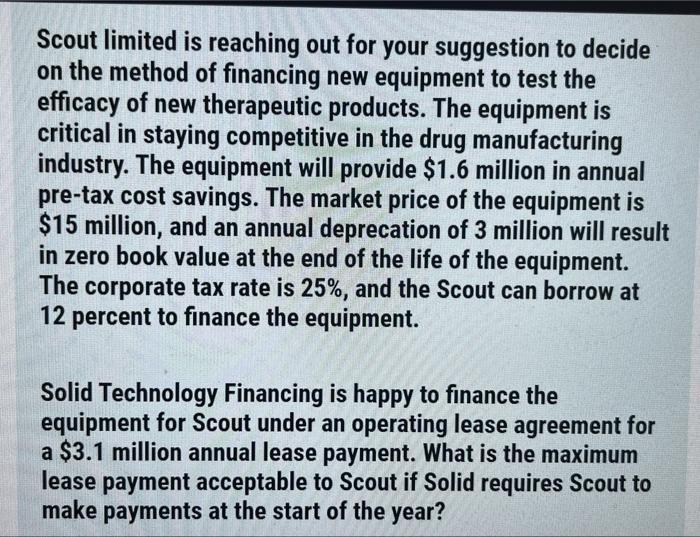

Scout limited is reaching out for your suggestion to decide on the method of financing new equipment to test the efficacy of new therapeutic products. The equipment is critical in staying competitive in the drug manufacturing industry. The equipment will provide $1.6 million in annual pre-tax cost savings. The market price of the equipment is $15 million, and an annual deprecation of 3 million will result in zero book value at the end of the life of the equipment. The corporate tax rate is 25%, and the Scout can borrow at 12 percent to finance the equipment. Solid Technology Financing is happy to finance the equipment for Scout under an operating lease agreement for a $3.1 million annual lease payment. What is the maximum lease payment acceptable to Scout if Solid requires Scout to make payments at the start of the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the maximum lease payment acceptable to Scout we need to compare the cost of leasing wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started