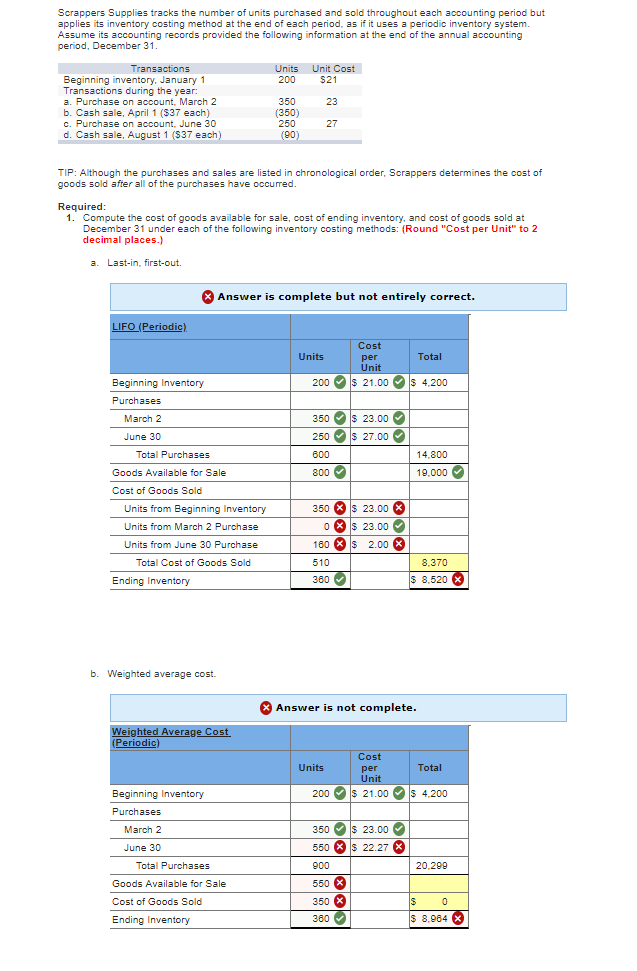

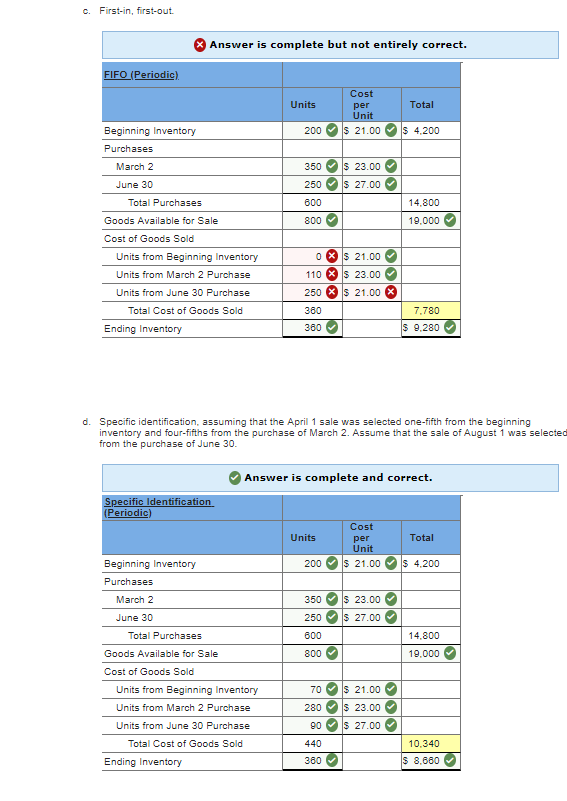

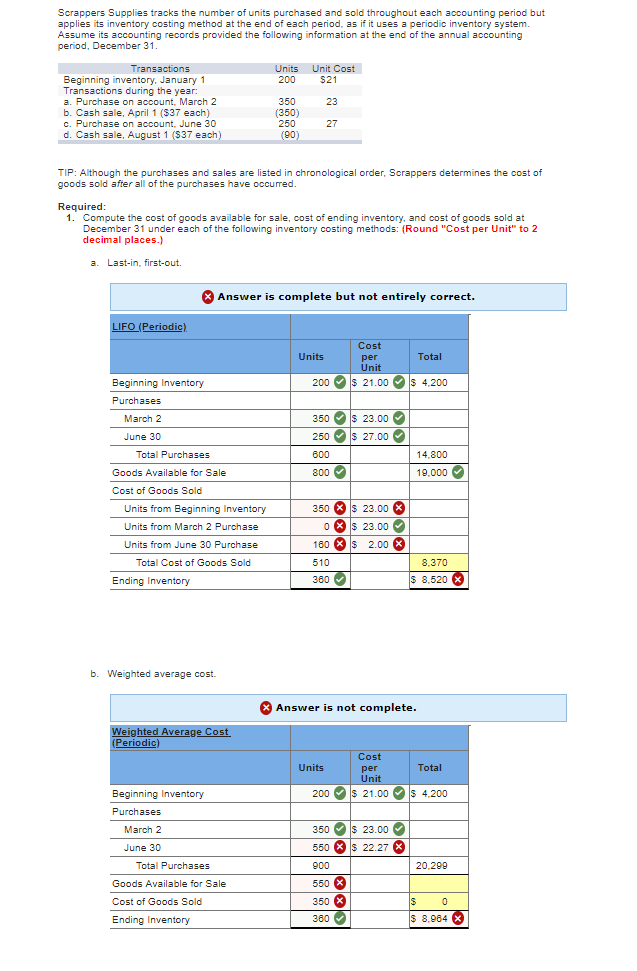

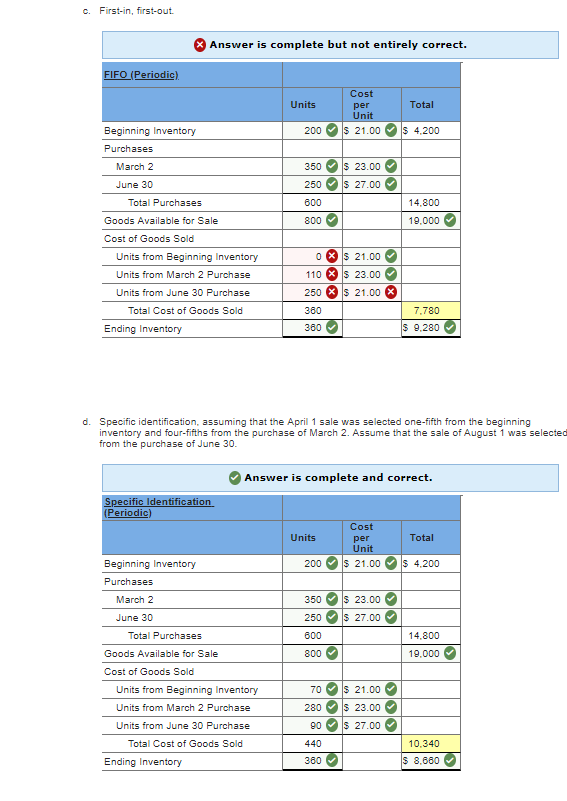

Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31 Transactions Units Unit Cost Beginning inventory, January 1 Transactions during the year a. Purchase on account, March 2 b. Cash sale, April 1 ($37 each) C. Furchase on account, June 3 d. Cash sale, August 1 (537 each) 200 350 (350) 250 90 $21 23 27 TIP: Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold after all of the purchases have occurred Required 1. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: (Round "Cost per Unit" to 2 decimal places.) a. Last-in, first-out. Answer is complete but not entirely correct. Fo (Periodic) Cost per Units Total Beginning Inventory 200 S 21.004.200 Purchases March 2 June 30 350 s 23.00 250 S 27.00 600 800 Total Purchases 14,800 Goods Available for Sale 19,000 Cost of Goods Sold 350 $ 23.00 Units from Beginning Inventory Units from March 2 Purchase Units from June 30 Purchase Total Cost of Goods Sold 0 31$ 23.00 160 X) S 2.00 510 360 8.370 S 8,520 Ending Inventory b. Weighted average cost. Answer is not complete Weighted Averag Periodic) Cost per Units Total Beginning Inventory 200 S 21.004.200 Purchases March 2 June 30 350 s 23.00 550 XS 22.27 900 550 350 Total Purchases 20,299 Goods Available for Sale Cost of Goods Sold Ending Inventory 8.984 c. First-in, first-out Answer is complete but not entirely correct. Fo (Periodic) Cost per Units Total Beginning Inventory 200 S 21.004.200 Purchases March 2 June 30 350 0$ 23.00 0 250 S 27.00 600 800 Total Purchases 14,800 Goods Available for Sale 19,000 Cost of Goods Sold o s Units from Beginning Inventory Units from March 2 Purchase Units from June 30 Purchase Total Cost of Goods Sold 0 8 21.00 110 s 23.00 250 $ 21.00 360 360 7.780 Ending Inventory S 9.280 d. Specific identification, assuming that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the purchase of March 2. Assume that the sale of August 1 was selected from the purchase of June 30 Answer is complete and correct. Specific Identificati Cost per Units Total Beginning Inventory 200 S 21.004.200 Purchases March 2 June 30 350 23.00 250 S 27.00 Total Purchases 600 14,800 Goods Available for Sale 19,000 Cost of Goods Sold Units from Beginning Inventory Units from March 2 Purchase Units from June 30 Purchase Total Cost of Goods Sold 70 21.00 280 s 23.00 90 01$ 27.00 > 440 10.340 Ending Inventory S 8,660