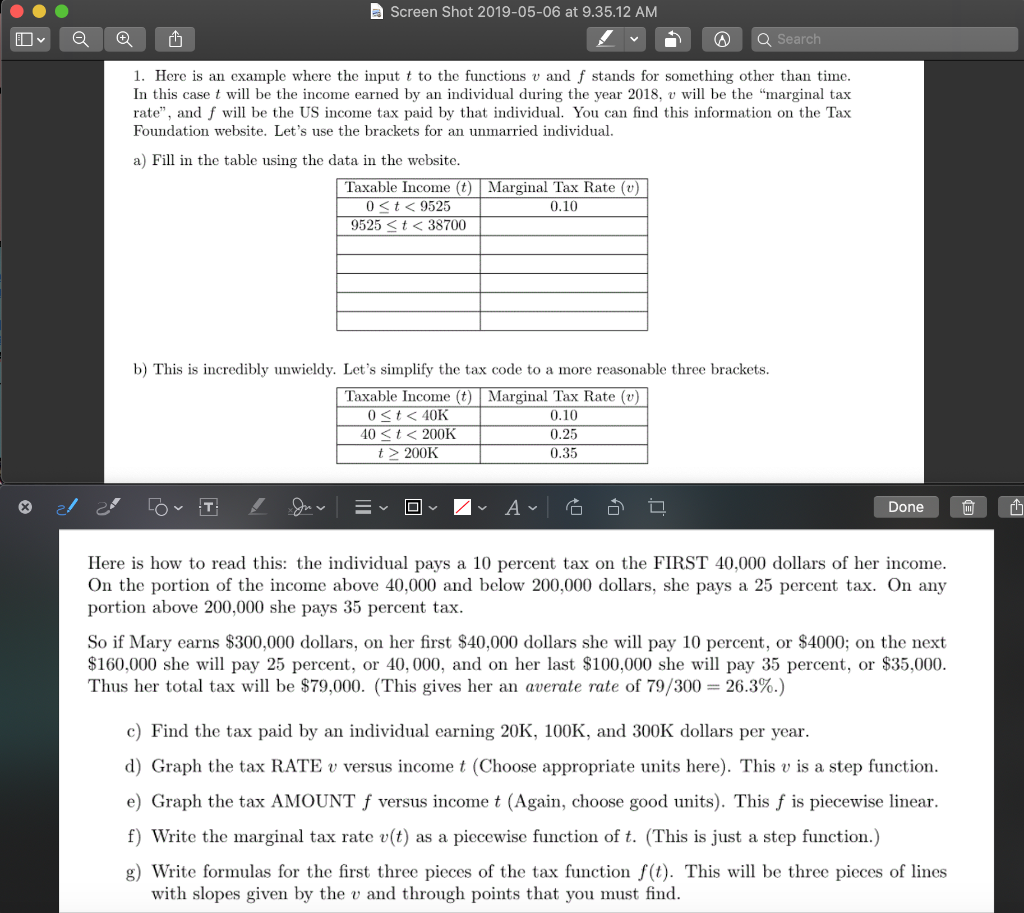

Screen Shot 2019-05-06 at 9.35.12 AM 1. Here is an example where the input t to the functions v and f stands for somcthing other than time In this casewill be the income earned by an individual during the year 2018, v will be the "marginal tax rate", and f will be the US income tax paid by that individual You can find this information on the Tax Foundation website. Let's use the brackets for an unmarried individual. a) Fill in the table using the data in the website Taxable Income () Marginal Tax Rate (v) 0t 200K 0.10 0.25 0.35 Done Here is how to read this: the individual pays a 10 percent tax on the FIRST 40,000 dollars of her income On the portion of the income above 40,000 and below 200,000 dollars, she pays a 25 percent tax. On any portion above 200,000 she pays 35 percent tax So if Mary earns $300,000 dollars, on her first $40,000 dollars she will pay 10 percent, or $4000; on the next $160,000 she wll pay 25 percent, or 40, 000, and on her last $100,000 she will pay 35 percent, or $35,000 Thus her total tax will be $79.000. (This gives her an averate rate of 79/300-= 26.3%.) c) Find the tax paid by an individual earning 20K, 100K, and 300K dollars per year d) Graph the tax RATE vversus income t (Choose appropriate units here). This v is a step function e) Graph the tax AMOUNT f versus income t (Again, choose good units). This f is piecewise linear. f) Write the marginal tax rate v(t) as a piccewise function of t. (This is just a step function.) g) Write formulas for the first three pieces of the tax function f(t). This will be three pieces of lines with slopes given by the v and through points that you must find Screen Shot 2019-05-06 at 9.35.12 AM 1. Here is an example where the input t to the functions v and f stands for somcthing other than time In this casewill be the income earned by an individual during the year 2018, v will be the "marginal tax rate", and f will be the US income tax paid by that individual You can find this information on the Tax Foundation website. Let's use the brackets for an unmarried individual. a) Fill in the table using the data in the website Taxable Income () Marginal Tax Rate (v) 0t 200K 0.10 0.25 0.35 Done Here is how to read this: the individual pays a 10 percent tax on the FIRST 40,000 dollars of her income On the portion of the income above 40,000 and below 200,000 dollars, she pays a 25 percent tax. On any portion above 200,000 she pays 35 percent tax So if Mary earns $300,000 dollars, on her first $40,000 dollars she will pay 10 percent, or $4000; on the next $160,000 she wll pay 25 percent, or 40, 000, and on her last $100,000 she will pay 35 percent, or $35,000 Thus her total tax will be $79.000. (This gives her an averate rate of 79/300-= 26.3%.) c) Find the tax paid by an individual earning 20K, 100K, and 300K dollars per year d) Graph the tax RATE vversus income t (Choose appropriate units here). This v is a step function e) Graph the tax AMOUNT f versus income t (Again, choose good units). This f is piecewise linear. f) Write the marginal tax rate v(t) as a piccewise function of t. (This is just a step function.) g) Write formulas for the first three pieces of the tax function f(t). This will be three pieces of lines with slopes given by the v and through points that you must find