Answered step by step

Verified Expert Solution

Question

1 Approved Answer

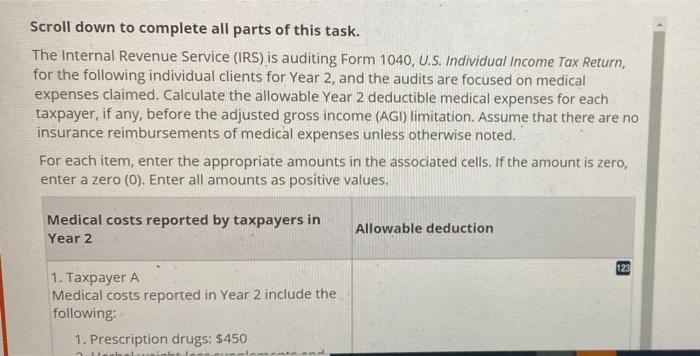

Scroll down to complete all parts of this task. The Internal Revenue Service (IRS) is auditing Form 1040, U.S. Individual Income Tax Return, for

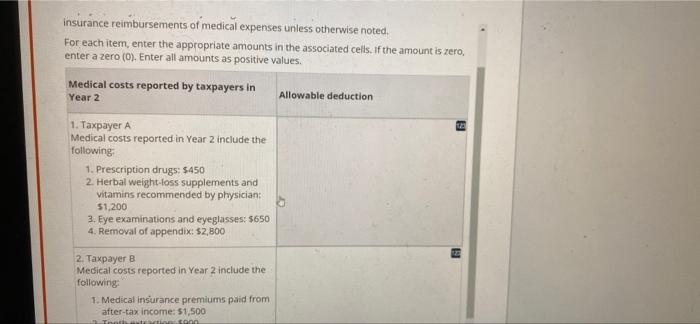

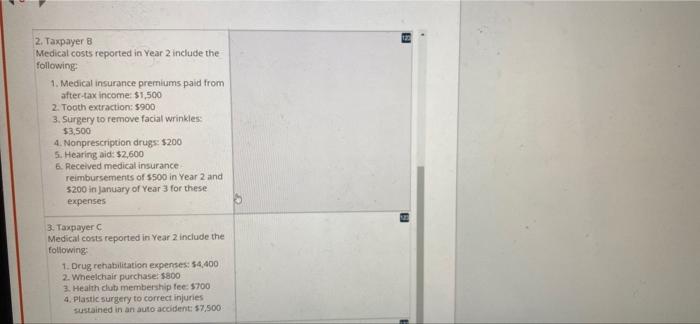

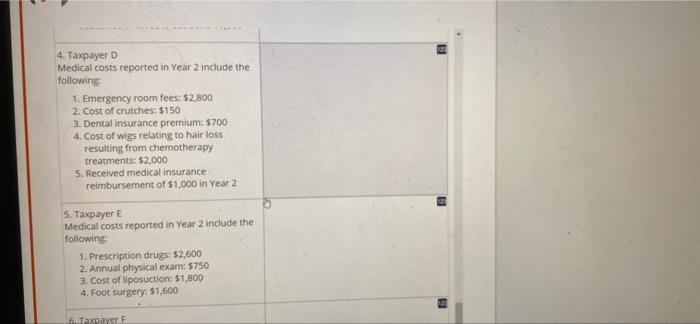

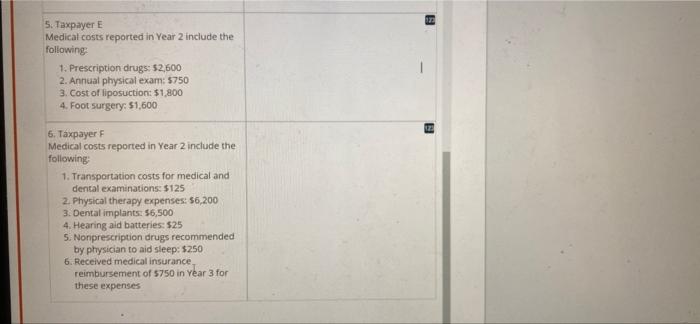

Scroll down to complete all parts of this task. The Internal Revenue Service (IRS) is auditing Form 1040, U.S. Individual Income Tax Return, for the following individual clients for Year 2, and the audits are focused on medical expenses claimed. Calculate the allowable Year 2 deductible medical expenses for each taxpayer, if any, before the adjusted gross income (AGI) limitation. Assume that there are no insurance reimbursements of medical expenses unless otherwise noted. For each item, enter the appropriate amounts in the associated cells. If the amount is zero, enter a zero (0). Enter all amounts as positive values. Medical costs reported by taxpayers in Year 2 1. Taxpayer A Medical costs reported in Year 2 include the following: 1. Prescription drugs: $450 3 Herbalsightile Allowable deduction 123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started