Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SD Enterprises is considering a new three-year expansion project and is looking closely at investing in a new machine. The project will require an

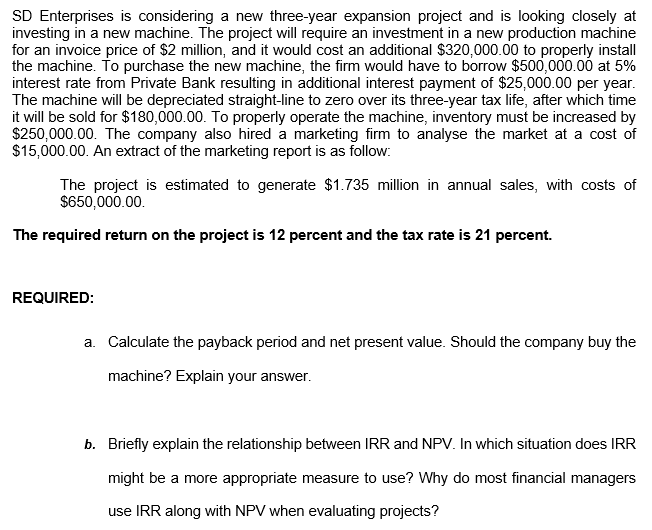

SD Enterprises is considering a new three-year expansion project and is looking closely at investing in a new machine. The project will require an investment in a new production machine for an invoice price of $2 million, and it would cost an additional $320,000.00 to properly install the machine. To purchase the new machine, the firm would have to borrow $500,000.00 at 5% interest rate from Private Bank resulting in additional interest payment of $25,000.00 per year. The machine will be depreciated straight-line to zero over its three-year tax life, after which time it will be sold for $180,000.00. To properly operate the machine, inventory must be increased by $250,000.00. The company also hired a marketing firm to analyse the market at a cost of $15,000.00. An extract of the marketing report is as follow: The project is estimated to generate $1.735 million in annual sales, with costs of $650,000.00. The required return on the project is 12 percent and the tax rate is 21 percent. REQUIRED: a. Calculate the payback period and net present value. Should the company buy the machine? Explain your answer. b. Briefly explain the relationship between IRR and NPV. In which situation does IRR might be a more appropriate measure to use? Why do most financial managers use IRR along with NPV when evaluating projects?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the payback period we need to determine the time it takes for the projects cash flows to recover the initial investment Initial Investment Invoice Price Installation Cost Inventory Incr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started