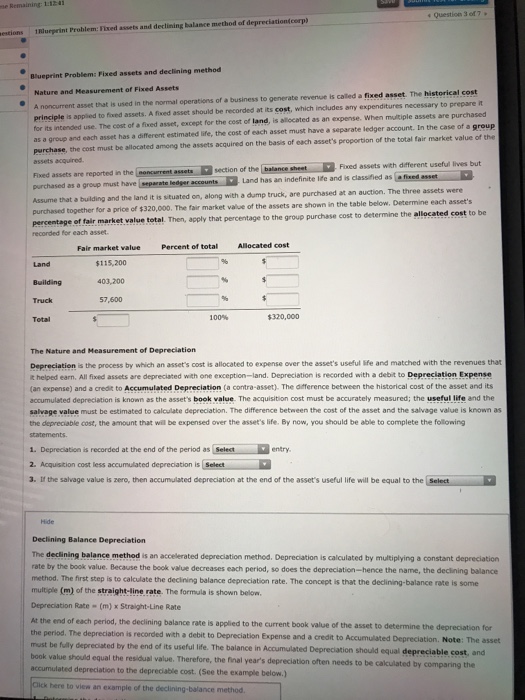

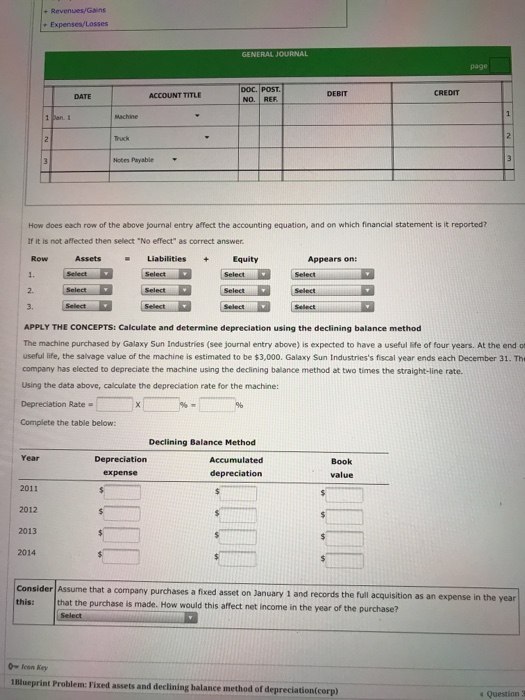

se Remaining 1:124 estions 1ueprint Problem: Fixed assets and declining balance method of depreciation(cerp) Blueprint Problem: Fixed assets and declining method Nature and Heasurement of Fixed Assets A noncurrent asset that is used in the normal operations of a business principle is applied to fioxed assets. A fixed asset should be recorded at its cost, which includes any expenditures necessary to prepare it or its intended use. The cost of a fixed asset, except for the cost of land, is allocated as an expense. When multiple assets are purchased as a group and each asset has a different estimated life, the cost of each asset must have a separate ledger account. In the case of a group purchase, the cost must be allocated among the assets acquired on the basis of each asset's proportion of the total fair market value of the assets acquired. to generate revenue is called a fixed asset. The historical cost F Fixed assets are reported in the (poncurrent assets section of the (balanceshet purchased as a group must have Fixed assets with dfferent useful lives but tLand has an indefinite Ife and is classified as Assume that a building and the land it is situated on, along with a dump truck, are purchased at an auction. The three purchased together for a price of $320,000. The fair market value of the assets are shown in the table below, Determine each asset's the allocated cost to be of fair market value total. Then, apply that percentage to the group purchase cost to determine recorded for each asse Percent of total Allocated cost Fair market value $115,200 403,200 57,600 Land Total 320,000 The Nature and Measurement of Depreciatiorn Depreciation is the process by which an asset's cost is allocated to expense over the asset's useful ife and matched with the revenues that t helped earn. All fixed assets are depreciated with one exception-land. Depreciation is recorded with a debit to Depreciation Expense (an expense) and a credit to Accumulated Depreciation (a contra-asset). The difference between the historical cost of the asset and its accumulated depreciation is known as the asset's book value. The acquisition cost must be accurately measured; the useful life and the salvage value must be estimated to calculate depreciation. The difference between the cost of the asset and the salvage value is known as the depreciable cost, the amount that will be expensed over the asset's life. By now, you should be able to complete the following 1. Depreciation is recorded at the end of the period as Select entry 2. Acquisition cost less accumulated depreciation is SelectY 3. If the salvage value is zero, then accumulated depreciation at the end of the asset's useful life will be equal to the Select Declining Balance Depreciation The declining balance method is an accelerated depreciation method. Depreciation is calculated by multiplying a constant depreciation rate by the book value. Because the book value decreases each period, so does the depreciation-hence the name, the declining balance method. The first step is to calculate the decining balance depreciation rate. The concept is that the declining-balance rate is some multiple (m) of the straight-line rate. The formula is shown below Depreciation Rate (m) x Straight-Line Rate At the end of each period, the declining balance rate is applied to the current book value of the asset to determine the the period. The depreciation is recorded with a debit to Depreciation Expense and a credit to Accumulated Depreciation. Note: The asset must be fully depreciated by the end of its useful life. The balance in book value should equal the residual value. Therefore, the final year's depreciation often needs to be accumulated depreciation to the depreciable cost. (See the example below.) depreciation for Accumulated Depreciation should equal depreciable cost, and cakculated by comparing the here to view an example of the declining-balance method