Answered step by step

Verified Expert Solution

Question

1 Approved Answer

se Study of Paying Extra Principal on a Mortgage Student Worksheet (1) - Word View Tell me what you want to do... AaBBCI AabbCc) AaBbCcD

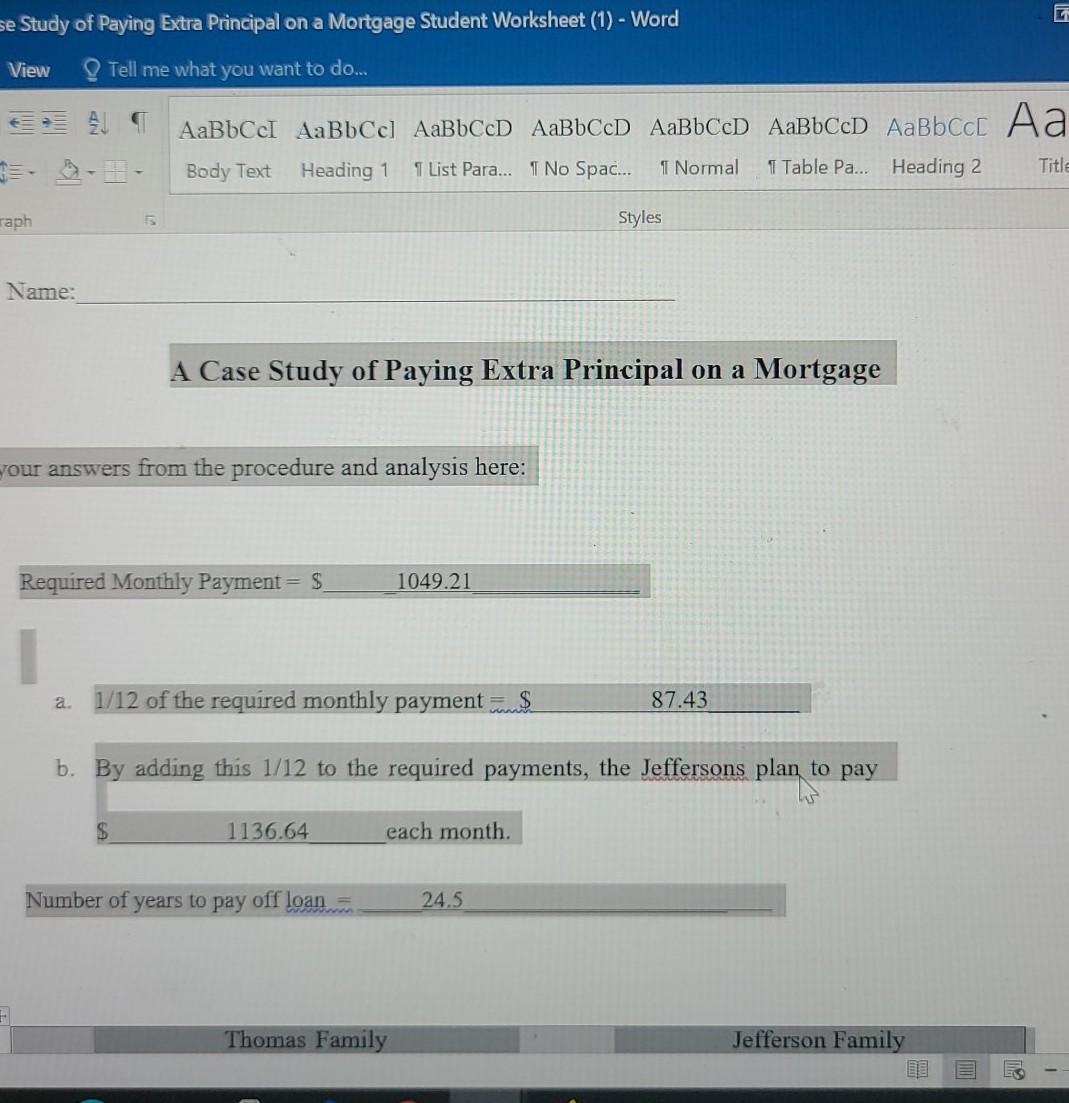

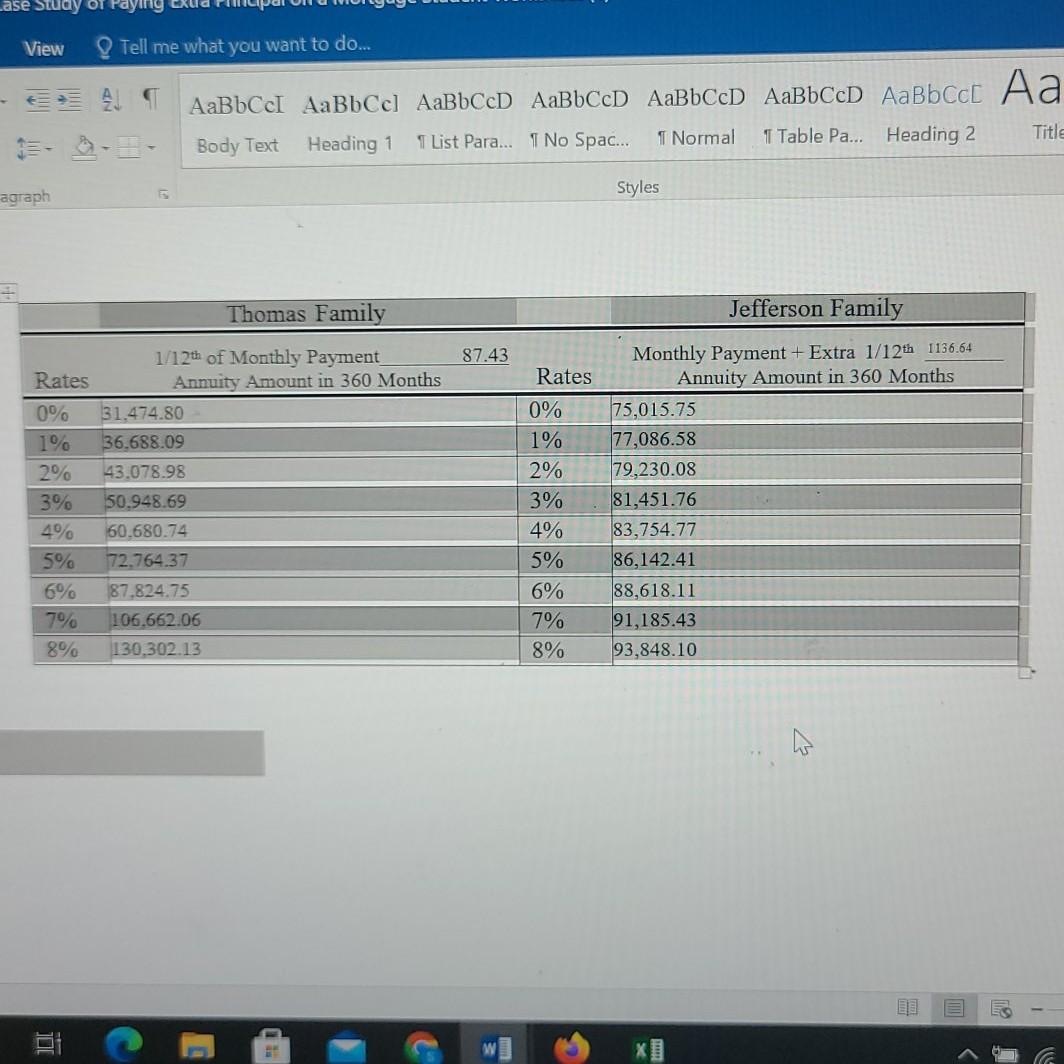

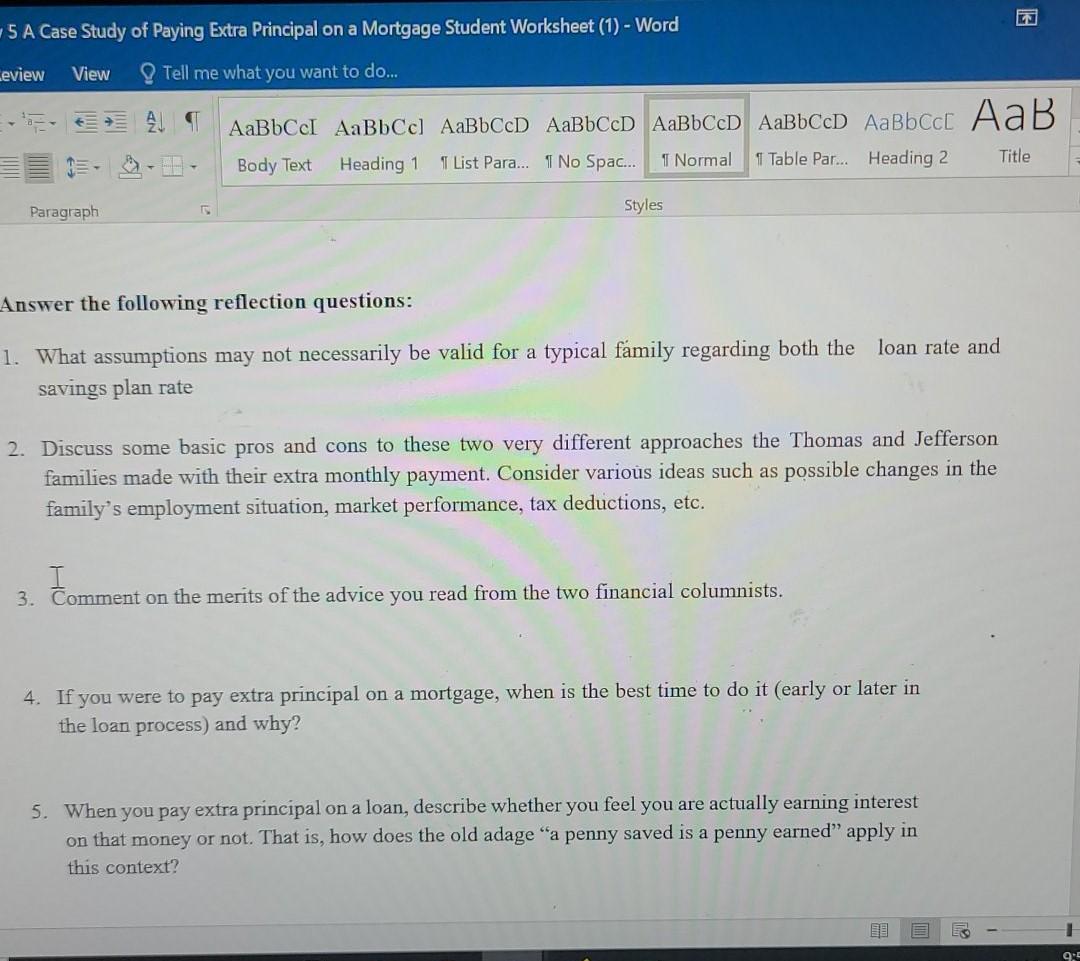

se Study of Paying Extra Principal on a Mortgage Student Worksheet (1) - Word View Tell me what you want to do... AaBBCI AabbCc) AaBbCcD ABBCcD AaBbCcD AaBbCcD AaBbcc Aa Body Text Heading 1 1 List Para... 1 No Spac... I Normal Title 1 Table Pa... Heading 2 raph Styles Name: A Case Study of Paying Extra Principal on a Mortgage your answers from the procedure and analysis here: Required Monthly Payment = $ 1049.21 a. 1/12 of the required monthly payments 87.43 b. By adding this 1/12 to the required payments, the Jeffersons plan to pay $ 1136.64 each month. Number of years to pay off loan. 24.5 Thomas Family Jefferson Family ELE ase Study of Fayl View Tell me what you want to do.. AaBbcc AaBbCc) AaBbccd AaBbCcD AaBbCD AaBbCcd AaBbcc Aa Body Text Heading 1 List Para... I No Spac... I Normal 1 Table Pa... Heading 2 Title agraph Styles Thomas Family Jefferson Family 87.43 Rates 0% 1% 2% 1/12th of Monthly Payment Rates Annuity Amount in 360 Months 0% 31.474.80 1% 36.688.09 2% 43.078.98 3% 50.948.69 60.680.74 5% 72.764.37 6% 87,824.75 7% 106.662.06 8% 130,302.13 3% Monthly Payment + Extra 1/12th 1136.64 Annuity Amount in 360 Months 75,015.75 77,086.58 79,230.08 81,451.76 83,754.77 86,142.41 88,618.11 91,185.43 93,848.10 4% 4% 5% 6% 7% 8% 5 A Case Study of Paying Extra Principal on a Mortgage Student Worksheet (1) - Word Leview View Tell me what you want to do... AaBbCcI AaBbCd) AalbCcD AaBbCcD AaBbCcD AalbCD AaBbccc AaB Body Text Heading 1 I List Para... 1 No Spac... Title I Normal 1 Table Par... Heading 2 Paragraph Styles Answer the following reflection questions: 1. What assumptions may not necessarily be valid for a typical family regarding both the loan rate and savings plan rate 2. Discuss some basic pros and cons to these two very different approaches the Thomas and Jefferson families made with their extra monthly payment. Consider various ideas such as possible changes in the family's employment situation, market performance, tax deductions, etc. T 3. Comment on the merits of the advice you read from the two financial columnists. 4. If you were to pay extra principal on a mortgage, when is the best time to do it (early or later in the loan process) and why? 5. When you pay extra principal on a loan, describe whether you feel you are actually earning interest on that money or not. That is, how does the old adage "a penny saved is a penny earned" apply in this context? E 1 9E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started