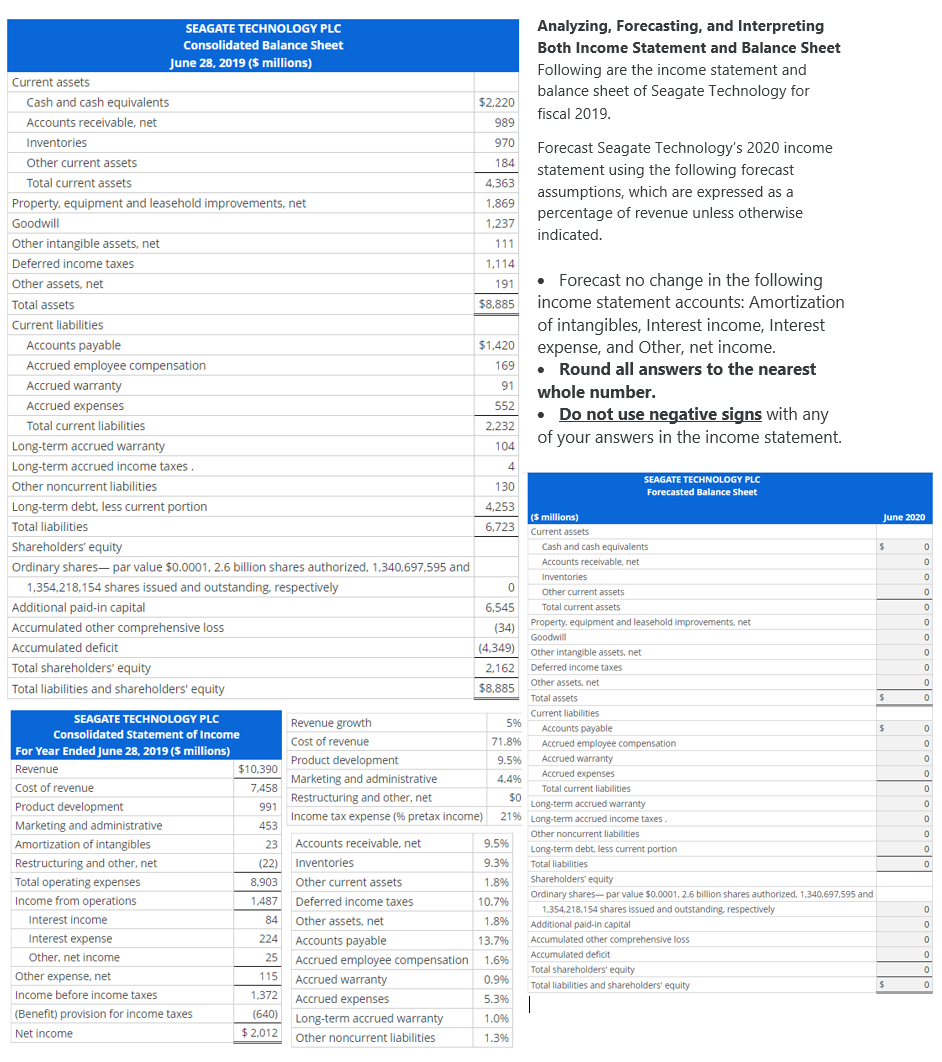

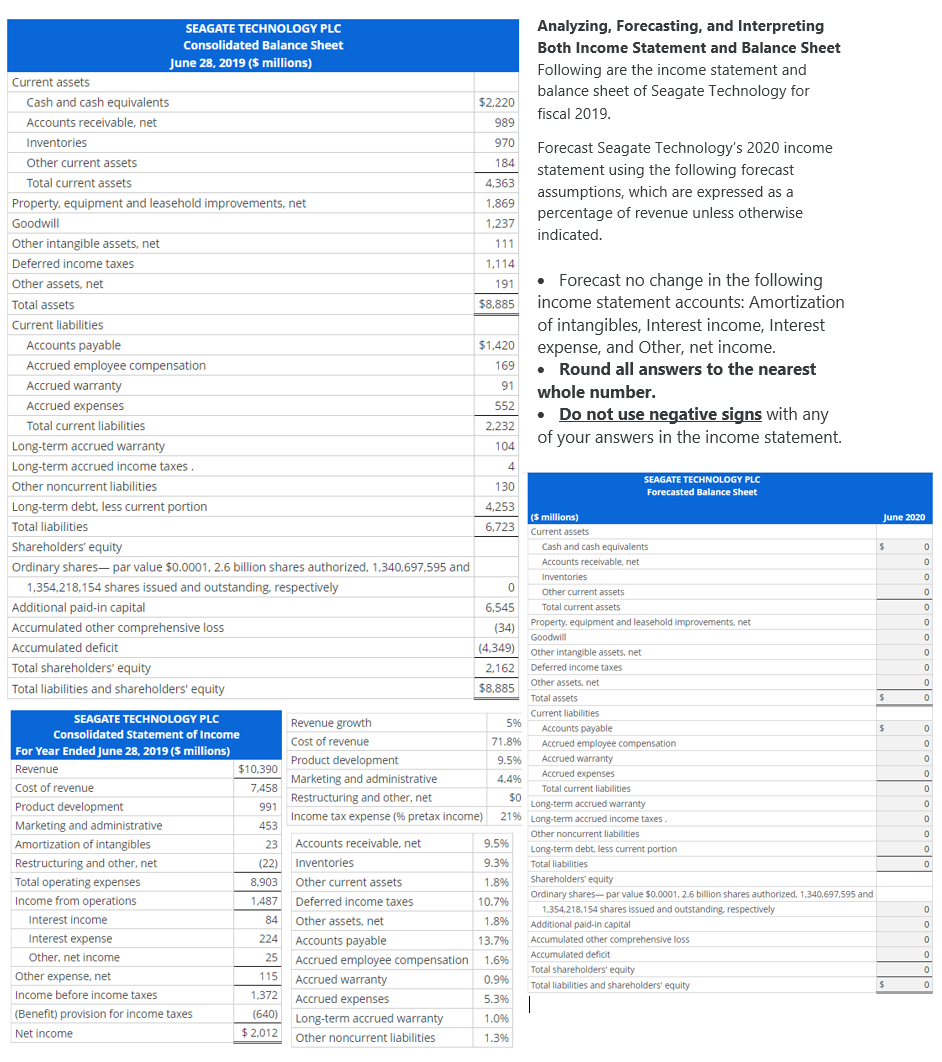

SEAGATE TECHNOLOGY PLC Analyzing, Forecasting, and Interpreting Consolidated Balance Sheet Both Income Statement and Balance Sheet June 28, 2019 ($ millions) Following are the income statement and Current assets balance sheet of Seagate Technology for Cash and cash equivalents $2.220 fiscal 2019. Accounts receivable, net 989 Inventories 970 Forecast Seagate Technology's 2020 income Other current assets 184 statement using the following forecast Total current assets 4,363 assumptions, which are expressed as a Property, equipment and leasehold improvements, net 1.869 percentage of revenue unless otherwise Goodwill 1.237 indicated. Other intangible assets, net 111 Deferred income taxes 1,114 Other assets, net 191 Forecast no change in the following Total assets $8.885 income statement accounts: Amortization Current liabilities of intangibles, Interest income, Interest Accounts payable $1,420 expense, and Other, net income. Accrued employee compensation 169 Round all answers to the nearest Accrued warranty 91 whole number. Accrued expenses 552 Do not use negative signs with any Total current liabilities 2.232 of your answers in the income statement. Long-term accrued warranty 104 Long-term accrued income taxes. 4 SEAGATE TECHNOLOGY PLC Other noncurrent liabilities 130 Forecasted Balance Sheet Long-term debt, less current portion 4,253 (5 millions) June 2020 Total liabilities 6,723 Current assets Shareholders' equity Cash and cash equivalents $ Accounts receivable, net Ordinary shares- par value $0.0001, 2.6 billion shares authorized, 1,340.697.595 and Inventories 1,354,218,154 shares issued and outstanding, respectively 0 Other current assets 0 Additional paid-in capital 6.545 Total current assets 0 Property, equipment and leasehold improvements.net 0 Accumulated other comprehensive loss (34) Goodwill 0 Accumulated deficit (4.349) Other intangible assets.net 0 0 Total shareholders' equity 2.162 Deferred income taxes 0 Other assets, net 0 Total liabilities and shareholders' equity $8.885 Total assets $ Current liabilities SEAGATE TECHNOLOGY PLC Revenue growth 5% Accounts payable Consolidated Statement of Income Cost of revenue 71.8% Accrued employee compensation For Year Ended June 28, 2019 ($ millions) Product development 9.5% Accrued warranty Revenue $10.390 Marketing and administrative Accrued expenses 4.4% Cost of revenue 7.458 Total current liabilities Restructuring and other, net $0 Product development 991 Long-term accrued warranty Income tax expense (% pretax income) 21% Long-term accrued income taxes . Marketing and administrative 453 Other noncurrent liabilities 0 Amortization of intangibles 23 Accounts receivable, net 9.5% Long-term debt less current portion Restructuring and other, net (22) Inventories 9.3% Total liabilities Total operating expenses 8,903 Other current assets 1.8% Shareholders' equity Income from operations 1,487 Deferred income taxes 10.7% Ordinary shares- par value $0.0001, 2.6 billion shares authorized, 1,340,697,595 and 1.354.218.154 shares issued and outstanding, respectively Interest income 84 Other assets, net 1.8% Additional paid-in capital Interest expense 224 Accounts payable 13.7% Accumulated other comprehensive loss Other, net income 25 Accrued employee compensation 1.6% Accumulated deficit Total shareholders' equity 0 Other expense, net 115 Accrued warranty 0.9% Total liabilities and shareholders' equity $ 0 Income before income taxes 1,372 Accrued expenses 5.3% 1 (Benefit) provision for income taxes (640) Long-term accrued warranty 1.0% Net income $ 2.012 Other noncurrent liabilities 1.3% 0 0 0 0 $ 0 0 0 0 0 0 0 0 0 0 0 0 0 0 SEAGATE TECHNOLOGY PLC Analyzing, Forecasting, and Interpreting Consolidated Balance Sheet Both Income Statement and Balance Sheet June 28, 2019 ($ millions) Following are the income statement and Current assets balance sheet of Seagate Technology for Cash and cash equivalents $2.220 fiscal 2019. Accounts receivable, net 989 Inventories 970 Forecast Seagate Technology's 2020 income Other current assets 184 statement using the following forecast Total current assets 4,363 assumptions, which are expressed as a Property, equipment and leasehold improvements, net 1.869 percentage of revenue unless otherwise Goodwill 1.237 indicated. Other intangible assets, net 111 Deferred income taxes 1,114 Other assets, net 191 Forecast no change in the following Total assets $8.885 income statement accounts: Amortization Current liabilities of intangibles, Interest income, Interest Accounts payable $1,420 expense, and Other, net income. Accrued employee compensation 169 Round all answers to the nearest Accrued warranty 91 whole number. Accrued expenses 552 Do not use negative signs with any Total current liabilities 2.232 of your answers in the income statement. Long-term accrued warranty 104 Long-term accrued income taxes. 4 SEAGATE TECHNOLOGY PLC Other noncurrent liabilities 130 Forecasted Balance Sheet Long-term debt, less current portion 4,253 (5 millions) June 2020 Total liabilities 6,723 Current assets Shareholders' equity Cash and cash equivalents $ Accounts receivable, net Ordinary shares- par value $0.0001, 2.6 billion shares authorized, 1,340.697.595 and Inventories 1,354,218,154 shares issued and outstanding, respectively 0 Other current assets 0 Additional paid-in capital 6.545 Total current assets 0 Property, equipment and leasehold improvements.net 0 Accumulated other comprehensive loss (34) Goodwill 0 Accumulated deficit (4.349) Other intangible assets.net 0 0 Total shareholders' equity 2.162 Deferred income taxes 0 Other assets, net 0 Total liabilities and shareholders' equity $8.885 Total assets $ Current liabilities SEAGATE TECHNOLOGY PLC Revenue growth 5% Accounts payable Consolidated Statement of Income Cost of revenue 71.8% Accrued employee compensation For Year Ended June 28, 2019 ($ millions) Product development 9.5% Accrued warranty Revenue $10.390 Marketing and administrative Accrued expenses 4.4% Cost of revenue 7.458 Total current liabilities Restructuring and other, net $0 Product development 991 Long-term accrued warranty Income tax expense (% pretax income) 21% Long-term accrued income taxes . Marketing and administrative 453 Other noncurrent liabilities 0 Amortization of intangibles 23 Accounts receivable, net 9.5% Long-term debt less current portion Restructuring and other, net (22) Inventories 9.3% Total liabilities Total operating expenses 8,903 Other current assets 1.8% Shareholders' equity Income from operations 1,487 Deferred income taxes 10.7% Ordinary shares- par value $0.0001, 2.6 billion shares authorized, 1,340,697,595 and 1.354.218.154 shares issued and outstanding, respectively Interest income 84 Other assets, net 1.8% Additional paid-in capital Interest expense 224 Accounts payable 13.7% Accumulated other comprehensive loss Other, net income 25 Accrued employee compensation 1.6% Accumulated deficit Total shareholders' equity 0 Other expense, net 115 Accrued warranty 0.9% Total liabilities and shareholders' equity $ 0 Income before income taxes 1,372 Accrued expenses 5.3% 1 (Benefit) provision for income taxes (640) Long-term accrued warranty 1.0% Net income $ 2.012 Other noncurrent liabilities 1.3% 0 0 0 0 $ 0 0 0 0 0 0 0 0 0 0 0 0 0 0