Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Seal C trls course Overview of Financial Management X Average: /3 Home Attention: Due to a bug in Google Chrome, this page may not function

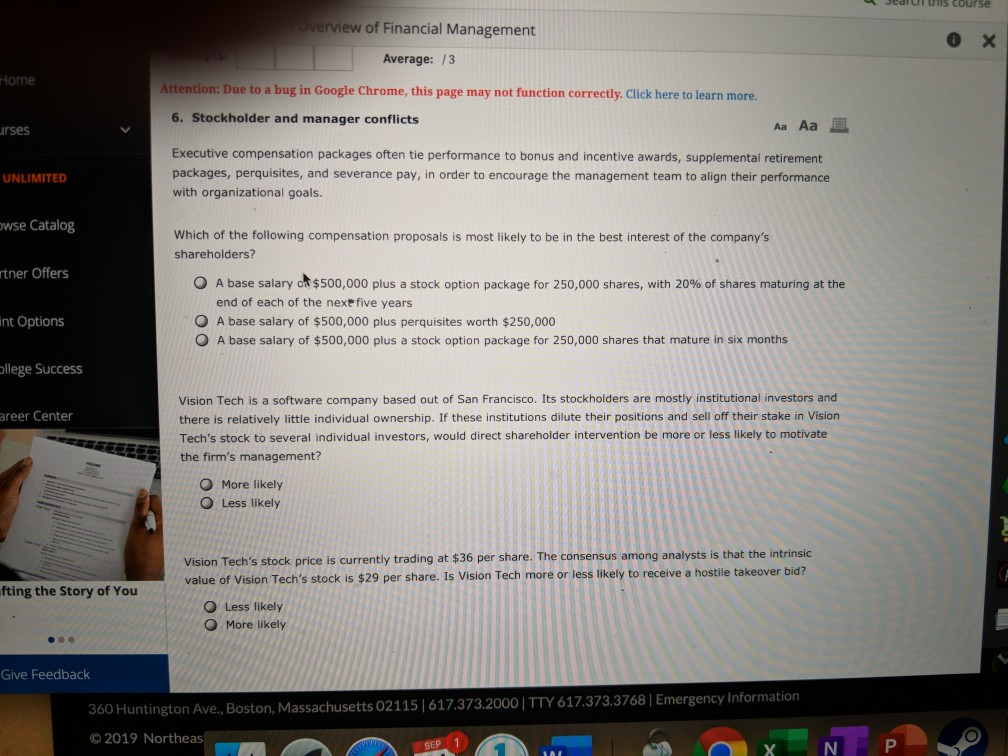

Seal C trls course Overview of Financial Management X Average: /3 Home Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more. 6. Stockholder and manager conflicts Aa Aa rses Executive compensation packages often tie performance to bonus and incentive awards, supplemental retirement packages, perquisites, and severance pay, in order to encourage the management team to align their performance with organizational goals. UNLIMITED owse Catalog Which of the following compensation proposals is most likely to be in the best interest of the company's shareholders? rtner Offers O A base salary c $500,000 plus a stock option package for 250,000 shares, with 20% of shares maturing at the end of each of the nexe five years int Options A base salary of $500,000 plus perquisites worth $250,000 A base salary of $500,000 plus a stock option package for 250,000 shares that mature in six months bllege Success Vision Tech is a software company based out of San Francisco. Its stockholders are mostly institutional investors and there is relatively little individual ownership. If these institutions dilute their positions and sell off their stake in Vision Tech's stock to several individual investors, would direct shareholder intervention be more or less likely to motivate the firm's management? areer Center O More likely O Less likely Vision Tech's stock price is currently trading at $36 per share. The consensus among analysts is that the intrinsic value of Vision Tech's stock is $29 per share. Is Vision Tech more or less likely to receive a hostile takeover bid? fting the Story of You O Less likely O More likely Give Feedback 360 Huntington Ave., Boston, Massachusetts 02115 | 617.373.2000 | TTY 617.373.3768 | Emergency Information O 2019 Northeas SEP 1 P N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started