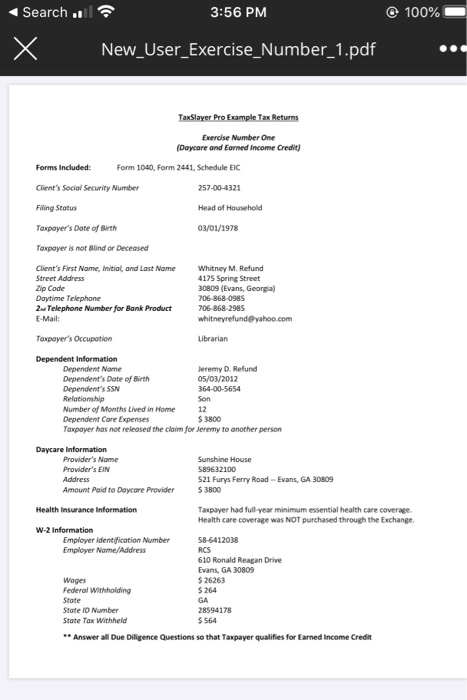

Search. 3:56 PM @ 100% X_ New_User_Exercise_Number_1.pdf TaxSlayer Pro Example Tax Returns Exercise Number One (Daycare and Earned Income Credit) Forms Included: Form 1040, Form 2441. Schedule EIC Client's Social Security Number 257-00-4321 Filing Status Head of Household Toxpayer's Date of Birth 03/01/1978 Toxpayer is not Blind or Deceased Client's First Name, Initial, and Last Name Street Address Zip Code Daytime Telephone 2. Telephone Number for Bank Product E-Mail: Whitney M. Refund 4175 Spring Street 30809 (Evans, Georgia) 206 868 099 706 868 2995 whitneyrefund@yahoo.com Taxpayer's Occupation Librarian Dependent Information Dependent Name Jeremy D. Refund Dependent's Date of Birth 05/03/2012 Dependent's SSN 364-00-5654 Relationship Number of Months Lived in Home Dependent Care Expenses $ 3800 Taxpayer has not released the claim for Jeremy to another person Son Daycare Information Provider's Name Provider's EIN Address Amount Paid to Daycare Provider Sunshine House 589632100 S21 Furys Ferry Road Evans, GA 30809 $ 3800 Health Insurance Information Taxpayer had full-year minimum essential health care coverage Health care coverage was NOT purchased through the Exchange W-2 Information Employer identification Number Employer Nome/Address 58-6412038 610 Ronald Reagan Drive Evans, GA 30809 $ 26263 $ 264 Wages Federal Withholding Stote State ID Number State Tax Withheld 28594178 ** Answer all Due Diligence Questions so that Taxpayer qualifies for Earned Income Credit Search. 3:56 PM @ 100% X_ New_User_Exercise_Number_1.pdf TaxSlayer Pro Example Tax Returns Exercise Number One (Daycare and Earned Income Credit) Forms Included: Form 1040, Form 2441. Schedule EIC Client's Social Security Number 257-00-4321 Filing Status Head of Household Toxpayer's Date of Birth 03/01/1978 Toxpayer is not Blind or Deceased Client's First Name, Initial, and Last Name Street Address Zip Code Daytime Telephone 2. Telephone Number for Bank Product E-Mail: Whitney M. Refund 4175 Spring Street 30809 (Evans, Georgia) 206 868 099 706 868 2995 whitneyrefund@yahoo.com Taxpayer's Occupation Librarian Dependent Information Dependent Name Jeremy D. Refund Dependent's Date of Birth 05/03/2012 Dependent's SSN 364-00-5654 Relationship Number of Months Lived in Home Dependent Care Expenses $ 3800 Taxpayer has not released the claim for Jeremy to another person Son Daycare Information Provider's Name Provider's EIN Address Amount Paid to Daycare Provider Sunshine House 589632100 S21 Furys Ferry Road Evans, GA 30809 $ 3800 Health Insurance Information Taxpayer had full-year minimum essential health care coverage Health care coverage was NOT purchased through the Exchange W-2 Information Employer identification Number Employer Nome/Address 58-6412038 610 Ronald Reagan Drive Evans, GA 30809 $ 26263 $ 264 Wages Federal Withholding Stote State ID Number State Tax Withheld 28594178 ** Answer all Due Diligence Questions so that Taxpayer qualifies for Earned Income Credit