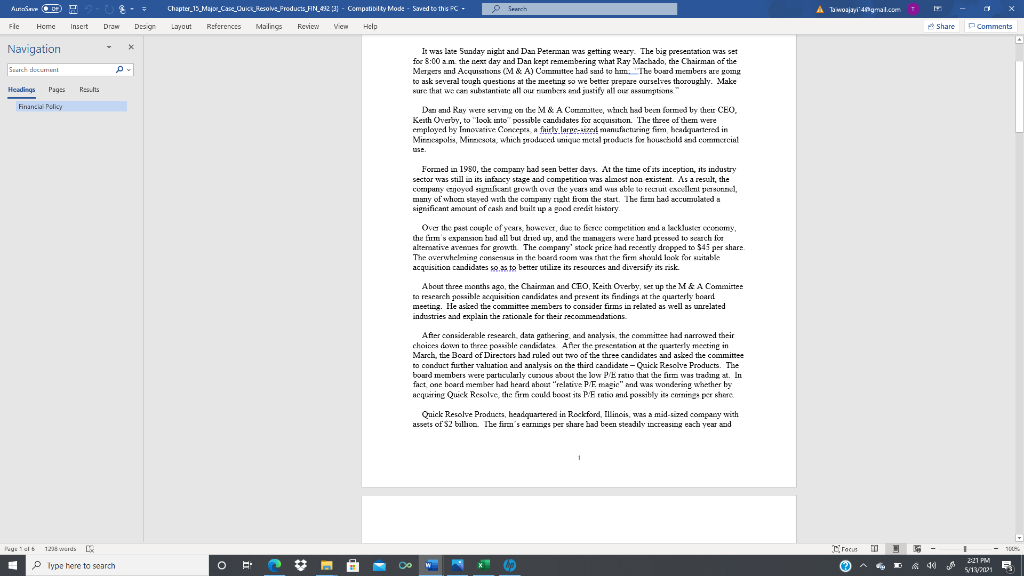

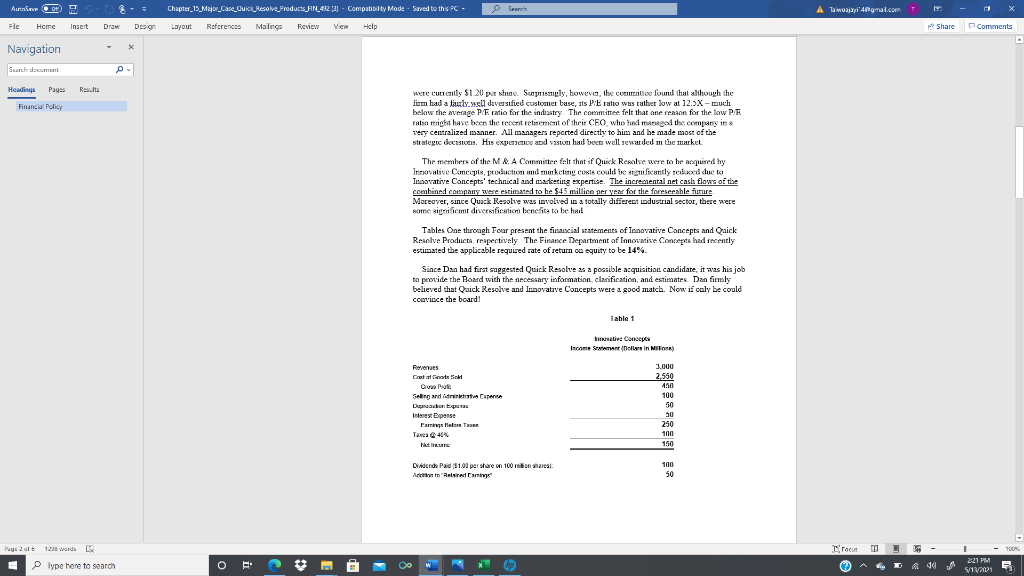

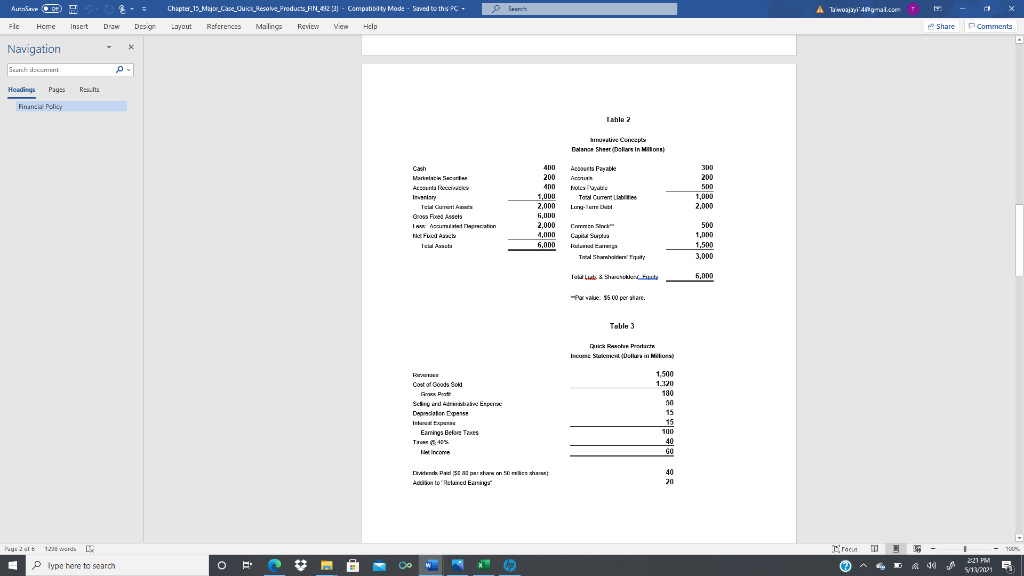

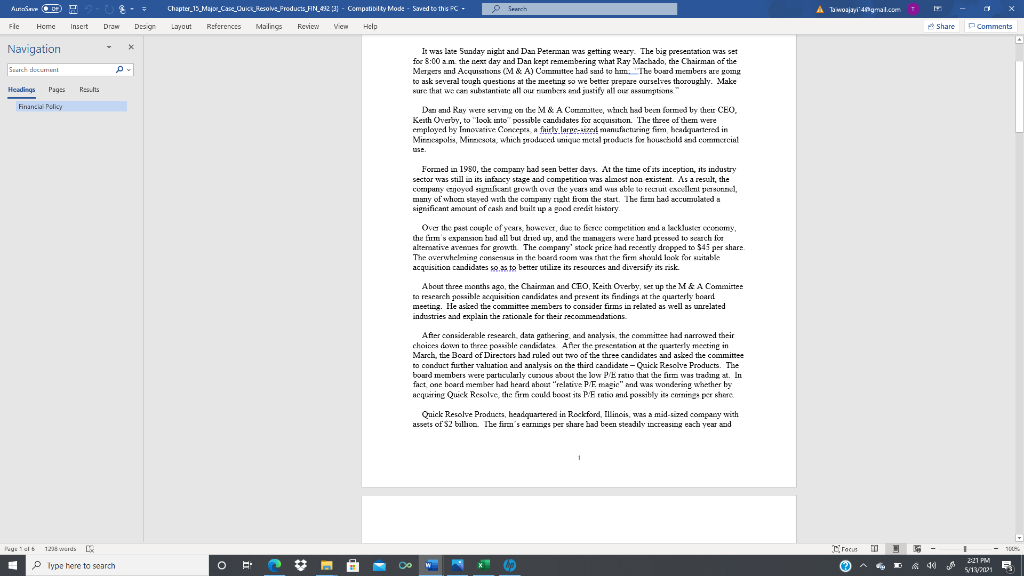

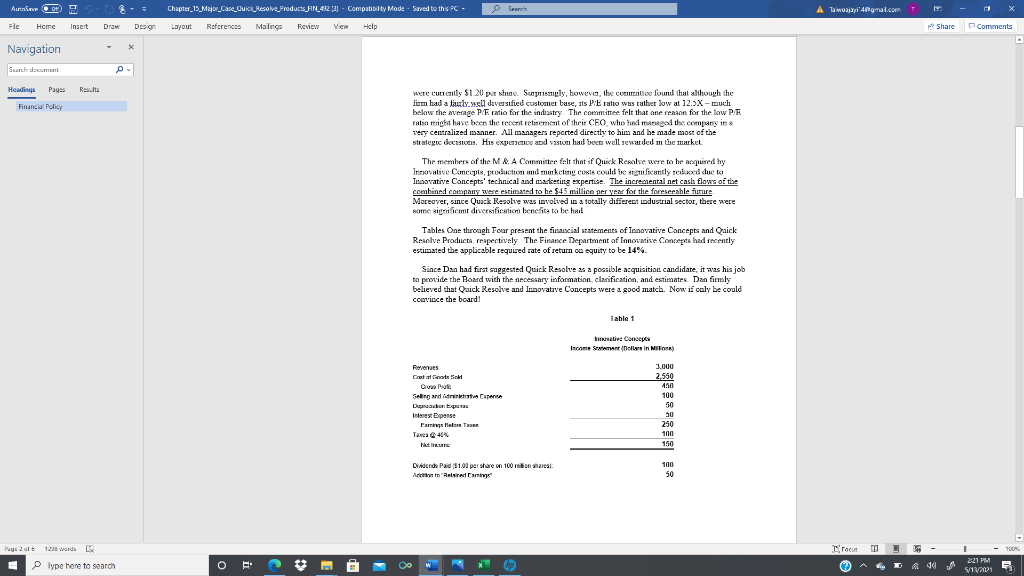

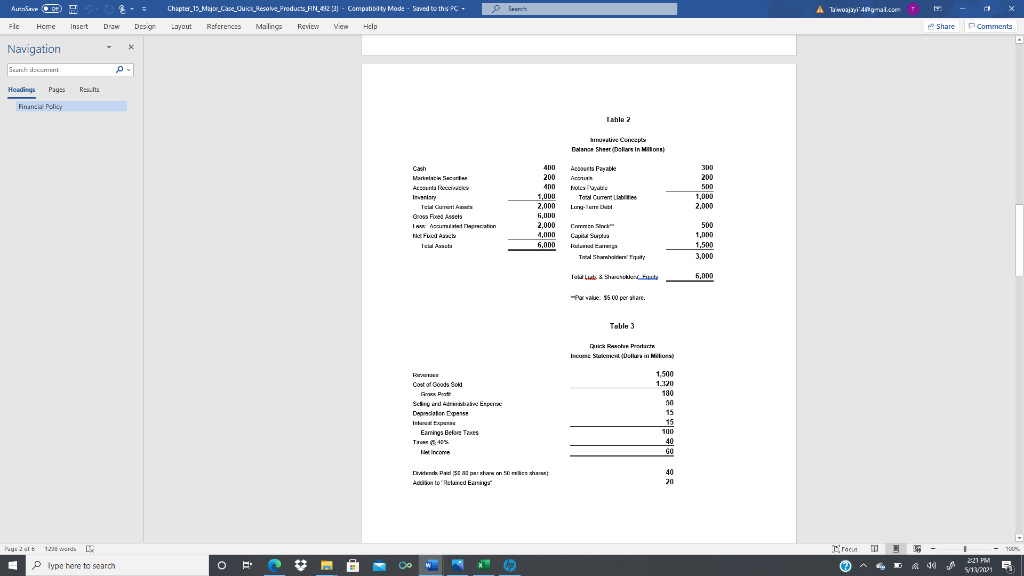

Search A Tomoajayi 4gmail.com Auni 0 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments Navigation x Search document It was late Sunday night and Dan Peterman was getting weary. The big presentation was set for 8:00 am the next day and Dan kept remembering what Ray Machado, the Chairman of the Mergeas and Acquisitions (M&A) Commitee had sad to hum: "The board members are going to ask several tough questions at the meeting so we better prepare ourselves thoroughly. Make sure that we can substantiate all over time and justify all our surrons Headings Pages Results Financial Policy Dan and Ray were serving on the M&A Cuottee, winch had been founded by the CEO Kesth Overby, to look into possible candidates for acquisition. The three of them were employed by Innovative Concrpo a fairly larpe-sized manufacturing for headquartered in Mimapolis, Minesos, winch groduced unique metal producte for hous. old and commercial Formed in 1980, the company bad seen better days. At the time of its inception, its industry sector was still in its infancy stage and competition was almost non existent. As a result, the company cajoyed mulkan prowth ova the years and was able to rest collen pesund, many of who stayed with the company right from the start. The firm bad accumulated a significant amount of cash and bailt up a good credit history Over the past couple of years, however, dac to face correlation and a lackluster cockmy, the Lim's expansion Bed all but dried up, and the managers were hard pressed to search for altemative avemes for growth. The company' stock price had recently dropped to $45 per share The overwhelming comes in the board room was that the firm should look for itable acquisition candidates so as to better utilize its resources and diversify its risk About three months ago, the Chairman and CEO, Keith Onezby, ser up the M&A Comunittes to research possible acquisition candidates and present its findings at the quarterly heard meeting. He asked the committee members to consider firms in related as well as unrelated industries and explain the rationale for their recommendations After considerable research data gathering and analysis, the committee had narrowed their choices down to three parible candidates After the presentation at the quarterly meeting in March, the Board of Directors had ruled out two of the three candidates and asked the committee to conchuct further valuation and analysis on the third candidate - Quick Resolve Products. The boud members were particularly cursous about the low PE ratio that the fire was trading at. In fact on board member had heard about "relative P/E magic" and was wondering whether by acquiring Quick Resolve the form cld boost its PE ratio mil possibly it comes por share Quick Resolve Products, headquartered in Rockford, Illinois, was a mid-sized company with assets of S2 billion. The firm's earnings per share bad been steadily increasing each year and Crocus m 100% Pays 6 123 words LU Type here to search p 2:21 PM 5/18/2021 Search A Tamoajayi 4gmail.com Aunin 01 Fle Home Chapter_15_Major_Case_Quick Ricole_Froducts_AN_43273) - Compatibilty Mode - Saved to this FC Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Search document Headings Pages Results Financial Policy WETE CUCly $1.20 pastae. Sunprimigly, however, the content found that although the firm had a fanly.xxl daversified customer base, its PE ratio was rather low at 12.5X -Duch below the average PE ratio for the industry The committee felt that one reason for the low PE ratio might have been the rescat retirement of their CEO who had managed the company in very centralized manner. All managers reported directly to him and be made most of the strategic decusweis. His exparence and vaston had been well rewarded the market The member of the M&A Committee felt that if Quick Resolve were to be acquired by Trnavalve Concepts, production and marketing costs could be significantly reduced due to Inovative Concepts' technical and marketing expertise. The incremental net casla flows of the combined company were estimated to be $45 millica per year for the foreseeable fine Moreover, since Quick Resolve was involved in a totally different industrial sector, there were some significant diversification benefits to be had Tables One throach Foar present the financial statements of Innovative Concepts and Quick Resolve Product respectively. The Finance Department of Innovative Concepts had recently estimated the applicable required rate of return a equity to be 14%. Since Dan had first suggested Quick Resolve x a possible acquisition candidate, it was his job to provide the Board with the necessary information, clarification and estimates. Dan firmly believed that Quick Resolve and Innovative Concepts were a good match. Now if caly be could convince the board! Table 1 Innovative Concept Income Swews in Mins) Reves Cataracts First Die Poli Geling and admit Capensa Dubotas Interest ponse Faming HT Taxes Menu 3.000 2,550 490 100 50 250 100 150 Dideride Paid 51.03 per share on 100 million shares Ar to Relsiradaris 100 50 rocus 100% Pays 2016 123 wurds LR Type here to search a p 2:21 PM 5/18/2021 Search A Tamoajayi 4gmail.com Auni 0 Fle Home Chapter_15_Major_Case_Quick Ricole_Froducts_AN_43273) - Compatibilty Mode - Saved to this FC Layout References Malings Review View Help Insert Draw Des on Share Comments Navigation x Search document Headings Pages Results Financial Policy Table 2 met Correeply Balance Sheet (Oollars In Milone) Accounts Payable AR Hulle Total Care 400 200 400 1.000 2.000 6,000 2,000 4,000 6,000 300 200 500 1,000 2.000 Marketinec Account Pro Inventory Terme Ads Gross Fred Assets I AR Areation Net Fach Ich sta Cance Culas 500 1.000 1,500 3,000 To Lid & Shachoker_ 6,000 Per value 55.00 per share Table 3 Dura Rache Products Inicum Sen (Dues in Milan) Cost of Goods Soal Grass Paste eating austin ITS Deprecation pense Earnings Before Taxes Tiger = 48% Hat Income 1.500 1.320 180 :50 15 15 100 40 GO Dudent per Action Detailed Earnings 40 20 rocus 100% Pays 2016 123 wurds LR Type here to search a 2:21 PM 5/18/2021 e Search A Tamoajayi 4gmail.com Aunin 01 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Table Search document De er Balance Sheet (Dollar in Millions Headings Pages Results Account Path Financial Policy Cal Markettle Securities r: 300 200 200 300 1,000 1,400 400 1,000 2.000 150 130 500 780 600 Insardy Tet CTATUR Com Food Asasta Low Auction Total Arts Total Current Listics Im Taman TA Comen Cale Find 100 340 180 Total Shahidere 620 Tall Limb Sheer Futy 2.000 Questions 1. Assume that Quick Resolve a shunchaldes teveed to an ange ratio of one shume of Innovulve Concepts cuanton stock for every two shares of Quick Resolves CCLIC stock. Assume that the combined "Net Income" of the two firms is the sum of their respective Net Incomes" prior to the completion of the nexquisition Calculate the "Pars Per Shute" (EPS) of Innovative Comceps prior to the acquisition b. Calculate the "Earnings Per Share (EPS) of Quick Resolve prior to the acquisition rocus 100% Pays 4016 123 wurds 2 Type here to search a p 2:21 PM 5/18/2021 A Ta moaja/i4gmail.com Aunin 01 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Search document Headings Pages Results Financial Policy c Calentate the "Faringe Per Share" (EPS) of the combined entity after the acquisto 2. Umg the "Horiz Value formula conec in Chapter 9 of the textbook and shown Slide 413 of the Chapter 9 Powiat file, calculate the bat olie gawe that Innovative Concepts would be justified in making for Quick Resolve Products 3. Assume that Innovative Concepts is able to close the acquisitice at the value that you calculated in Question #2 above, by paying cash OR by exchanging coe share of its Common stock for each two shares of Quick Resolve's common stock that as outstanding. & Should Imovative Conceptele cash or stock as the payment mechaniem? Why? (Note: When answering this question, you may wish to consider Innovative Concepts' current "Cash" and "Marketable Securities"alues, as shown on its Balance Sheet) 4. If Quick Resolve wants to block the takeover attempt, wat can it do? Please explain the rationale and possible outcome of your suggestion(s). rocus 100% Page 5 of 6 123 wurds LR Type here to search 2:21 PM 5/18/2021 Search A Tamoajayi 4gmail.com Aunin 01 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Search document Headings Pages Results Financial Policy 5. One of the M&A Committee members bad told Dan that the main advantage of this acquisition to Innovative Concepts is the diversificatio benefit that exists from the two Compemes being in totally different industry sectors and that tins aspect be stressed most in the presentation. Do you agree? Explain. rocus 100% Page 5 of 6 123 wurds LR Type here to search a p 2:21 PM 5/18/2021 I e Search A Tomoajayi 4gmail.com Annie CP HOUSE Fle Home Insert Draw Design Chapter_13_Ou dresove_Products_Homework_Hints_FIN_42) Layout References Malings Review View Help Share Comments Navigation x Helpful Hints! Search document Headings Pages Results Create animative using you document , It's a great way to keep track of where you are ut quickly move your content around, To get started go to the Humne tab und esply Heading styles to the head nos in your document, Question #l: The total number of stock shares that each finn currently has outstanding can be found in the footnotes to their respective income statements. Innovative Concepta income statement appears in Table 1 at the bottom of page two: Quick Resolve Products income statement appears in Table 3 at the bottom of page three of this case study. Question tha. The formala for "Earnings Per Share" (EPS) is as follows: Net income - EPS Number of common stock shares outstanding The inimulan needed to calculate EPS for Irawative Concepts can be wond Goon the firms come statement Table 1 at the bottom of page 2 of this case study Question lb. The informatice needed to calculate EPS for Quick Resohre Products can be obtained from the firm's income statements in Table 3 on page 3 of this case study. Question #LC The EPS for the combined entity requires that you first combine the two "Ner Theoene" values for these two fim "Net Income for Innovative Concepts in Table 1 "Net Income for Quick Resolve Products Table 3 Total Overall "Net Income To obtain the denominator of the EPS equation - "Number of Commca Stock Shares Outstanding - you would assume that the stock exchange described in Question #I actually OCCUES. Pe the description of the stock exchange in Question il, for each two shares of stock that a Quick Resolve shareholder currently owns, the shareholder will receive one sbare of Innovative Comcepts' common stock in chun. After the exchange of stock, Quick Resolve Products will have only balfe may common stock shares outstanding as they had prior to the merger Question #2: Note that no bounce of increasinely forget Free Cash Flow" (FCF) value ja given anywhere in this case study. Tislead, the value of Quick Resolve Products is all "perpetaity." I..., a "perpetuity" is a series of continuous periodic payments of the same amount that have a specific conclusion date. Therefore, the "hoz vala" formule can be used to calculate the estimated worth of Quick Resolve Products' operations. The "Horizon Value formula apgrens om Stile 13 of the Chapter 9 Descuesint file The FCF value for the uma of the hosz value muls can be obtained from the second full paragraph on Page Two of this case study. Since no growth rate is expected (i.e. the FCF value will remain constant in each future year), the annual growth rate" (8) in the 'horizon value formula will have a value of 0% 0.00. After you play in these values into the horizon Talue" equation, you would then rocus m 100% Page 1 2 3 words LX Type here to search 2:23 PM 5/12/2011 Search A Tamoajayi 4gmail.com Annie CP HOUSE Fle Home Insert Draw Design Chapter_13_Ou dresove_Products_Homework_Hints_FIN_42) Layout References Malings Review View Help Share Comments Navigation x Search document Headings Pages Results soke the "esz value cuestion. The result of these calculations ie the maximum value that Invovalve Concepts would be willing to pay for Quack Resolve Products = HV Create animative using you document , FCF GO It's a great way to keep track of where you are ut quickly move your content around, The vandables in the Horiza Value formula can be defined as follows: FCF = Aml"Free Cash Flow, in this case of a comtemt datter amount To get started go to the Humne tab und esply Heading styles to the head nos in your document, r- Annual rule ofrelon un equity e Constantamal growth rate in this case, with the FCF remaining ematant cach year in dolle value, the small growth rate=0% HY - Maximuan theoretical value of the fut Questions through #5 of this creatudy are qualitative in natwe, as kulations are not requod. However, in Question 3, ny behulplul to cutit Innovative Comceps cuarent "Cash" and "Marketable Securities" values, as shown on its Balance Sheet. The values of these two accounts are an important consideration when determining whether to pay cash for an acquisition. rocus m 100% Puye 2012 S3 wards LX Type here to search p 2:23 PM 5/13/201 Search A Tomoajayi 4gmail.com Auni 0 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments Navigation x Search document It was late Sunday night and Dan Peterman was getting weary. The big presentation was set for 8:00 am the next day and Dan kept remembering what Ray Machado, the Chairman of the Mergeas and Acquisitions (M&A) Commitee had sad to hum: "The board members are going to ask several tough questions at the meeting so we better prepare ourselves thoroughly. Make sure that we can substantiate all over time and justify all our surrons Headings Pages Results Financial Policy Dan and Ray were serving on the M&A Cuottee, winch had been founded by the CEO Kesth Overby, to look into possible candidates for acquisition. The three of them were employed by Innovative Concrpo a fairly larpe-sized manufacturing for headquartered in Mimapolis, Minesos, winch groduced unique metal producte for hous. old and commercial Formed in 1980, the company bad seen better days. At the time of its inception, its industry sector was still in its infancy stage and competition was almost non existent. As a result, the company cajoyed mulkan prowth ova the years and was able to rest collen pesund, many of who stayed with the company right from the start. The firm bad accumulated a significant amount of cash and bailt up a good credit history Over the past couple of years, however, dac to face correlation and a lackluster cockmy, the Lim's expansion Bed all but dried up, and the managers were hard pressed to search for altemative avemes for growth. The company' stock price had recently dropped to $45 per share The overwhelming comes in the board room was that the firm should look for itable acquisition candidates so as to better utilize its resources and diversify its risk About three months ago, the Chairman and CEO, Keith Onezby, ser up the M&A Comunittes to research possible acquisition candidates and present its findings at the quarterly heard meeting. He asked the committee members to consider firms in related as well as unrelated industries and explain the rationale for their recommendations After considerable research data gathering and analysis, the committee had narrowed their choices down to three parible candidates After the presentation at the quarterly meeting in March, the Board of Directors had ruled out two of the three candidates and asked the committee to conchuct further valuation and analysis on the third candidate - Quick Resolve Products. The boud members were particularly cursous about the low PE ratio that the fire was trading at. In fact on board member had heard about "relative P/E magic" and was wondering whether by acquiring Quick Resolve the form cld boost its PE ratio mil possibly it comes por share Quick Resolve Products, headquartered in Rockford, Illinois, was a mid-sized company with assets of S2 billion. The firm's earnings per share bad been steadily increasing each year and Crocus m 100% Pays 6 123 words LU Type here to search p 2:21 PM 5/18/2021 Search A Tamoajayi 4gmail.com Aunin 01 Fle Home Chapter_15_Major_Case_Quick Ricole_Froducts_AN_43273) - Compatibilty Mode - Saved to this FC Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Search document Headings Pages Results Financial Policy WETE CUCly $1.20 pastae. Sunprimigly, however, the content found that although the firm had a fanly.xxl daversified customer base, its PE ratio was rather low at 12.5X -Duch below the average PE ratio for the industry The committee felt that one reason for the low PE ratio might have been the rescat retirement of their CEO who had managed the company in very centralized manner. All managers reported directly to him and be made most of the strategic decusweis. His exparence and vaston had been well rewarded the market The member of the M&A Committee felt that if Quick Resolve were to be acquired by Trnavalve Concepts, production and marketing costs could be significantly reduced due to Inovative Concepts' technical and marketing expertise. The incremental net casla flows of the combined company were estimated to be $45 millica per year for the foreseeable fine Moreover, since Quick Resolve was involved in a totally different industrial sector, there were some significant diversification benefits to be had Tables One throach Foar present the financial statements of Innovative Concepts and Quick Resolve Product respectively. The Finance Department of Innovative Concepts had recently estimated the applicable required rate of return a equity to be 14%. Since Dan had first suggested Quick Resolve x a possible acquisition candidate, it was his job to provide the Board with the necessary information, clarification and estimates. Dan firmly believed that Quick Resolve and Innovative Concepts were a good match. Now if caly be could convince the board! Table 1 Innovative Concept Income Swews in Mins) Reves Cataracts First Die Poli Geling and admit Capensa Dubotas Interest ponse Faming HT Taxes Menu 3.000 2,550 490 100 50 250 100 150 Dideride Paid 51.03 per share on 100 million shares Ar to Relsiradaris 100 50 rocus 100% Pays 2016 123 wurds LR Type here to search a p 2:21 PM 5/18/2021 Search A Tamoajayi 4gmail.com Auni 0 Fle Home Chapter_15_Major_Case_Quick Ricole_Froducts_AN_43273) - Compatibilty Mode - Saved to this FC Layout References Malings Review View Help Insert Draw Des on Share Comments Navigation x Search document Headings Pages Results Financial Policy Table 2 met Correeply Balance Sheet (Oollars In Milone) Accounts Payable AR Hulle Total Care 400 200 400 1.000 2.000 6,000 2,000 4,000 6,000 300 200 500 1,000 2.000 Marketinec Account Pro Inventory Terme Ads Gross Fred Assets I AR Areation Net Fach Ich sta Cance Culas 500 1.000 1,500 3,000 To Lid & Shachoker_ 6,000 Per value 55.00 per share Table 3 Dura Rache Products Inicum Sen (Dues in Milan) Cost of Goods Soal Grass Paste eating austin ITS Deprecation pense Earnings Before Taxes Tiger = 48% Hat Income 1.500 1.320 180 :50 15 15 100 40 GO Dudent per Action Detailed Earnings 40 20 rocus 100% Pays 2016 123 wurds LR Type here to search a 2:21 PM 5/18/2021 e Search A Tamoajayi 4gmail.com Aunin 01 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Table Search document De er Balance Sheet (Dollar in Millions Headings Pages Results Account Path Financial Policy Cal Markettle Securities r: 300 200 200 300 1,000 1,400 400 1,000 2.000 150 130 500 780 600 Insardy Tet CTATUR Com Food Asasta Low Auction Total Arts Total Current Listics Im Taman TA Comen Cale Find 100 340 180 Total Shahidere 620 Tall Limb Sheer Futy 2.000 Questions 1. Assume that Quick Resolve a shunchaldes teveed to an ange ratio of one shume of Innovulve Concepts cuanton stock for every two shares of Quick Resolves CCLIC stock. Assume that the combined "Net Income" of the two firms is the sum of their respective Net Incomes" prior to the completion of the nexquisition Calculate the "Pars Per Shute" (EPS) of Innovative Comceps prior to the acquisition b. Calculate the "Earnings Per Share (EPS) of Quick Resolve prior to the acquisition rocus 100% Pays 4016 123 wurds 2 Type here to search a p 2:21 PM 5/18/2021 A Ta moaja/i4gmail.com Aunin 01 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Search document Headings Pages Results Financial Policy c Calentate the "Faringe Per Share" (EPS) of the combined entity after the acquisto 2. Umg the "Horiz Value formula conec in Chapter 9 of the textbook and shown Slide 413 of the Chapter 9 Powiat file, calculate the bat olie gawe that Innovative Concepts would be justified in making for Quick Resolve Products 3. Assume that Innovative Concepts is able to close the acquisitice at the value that you calculated in Question #2 above, by paying cash OR by exchanging coe share of its Common stock for each two shares of Quick Resolve's common stock that as outstanding. & Should Imovative Conceptele cash or stock as the payment mechaniem? Why? (Note: When answering this question, you may wish to consider Innovative Concepts' current "Cash" and "Marketable Securities"alues, as shown on its Balance Sheet) 4. If Quick Resolve wants to block the takeover attempt, wat can it do? Please explain the rationale and possible outcome of your suggestion(s). rocus 100% Page 5 of 6 123 wurds LR Type here to search 2:21 PM 5/18/2021 Search A Tamoajayi 4gmail.com Aunin 01 Fle Home Chapter_15_Major_Care_Quicklesolve_Products_HN_4323) - Compatibilty Mode - Saved to this FC - Layout References Malings Review View Help Insert Draw Des on Share Comments x Navigation Search document Headings Pages Results Financial Policy 5. One of the M&A Committee members bad told Dan that the main advantage of this acquisition to Innovative Concepts is the diversificatio benefit that exists from the two Compemes being in totally different industry sectors and that tins aspect be stressed most in the presentation. Do you agree? Explain. rocus 100% Page 5 of 6 123 wurds LR Type here to search a p 2:21 PM 5/18/2021 I e Search A Tomoajayi 4gmail.com Annie CP HOUSE Fle Home Insert Draw Design Chapter_13_Ou dresove_Products_Homework_Hints_FIN_42) Layout References Malings Review View Help Share Comments Navigation x Helpful Hints! Search document Headings Pages Results Create animative using you document , It's a great way to keep track of where you are ut quickly move your content around, To get started go to the Humne tab und esply Heading styles to the head nos in your document, Question #l: The total number of stock shares that each finn currently has outstanding can be found in the footnotes to their respective income statements. Innovative Concepta income statement appears in Table 1 at the bottom of page two: Quick Resolve Products income statement appears in Table 3 at the bottom of page three of this case study. Question tha. The formala for "Earnings Per Share" (EPS) is as follows: Net income - EPS Number of common stock shares outstanding The inimulan needed to calculate EPS for Irawative Concepts can be wond Goon the firms come statement Table 1 at the bottom of page 2 of this case study Question lb. The informatice needed to calculate EPS for Quick Resohre Products can be obtained from the firm's income statements in Table 3 on page 3 of this case study. Question #LC The EPS for the combined entity requires that you first combine the two "Ner Theoene" values for these two fim "Net Income for Innovative Concepts in Table 1 "Net Income for Quick Resolve Products Table 3 Total Overall "Net Income To obtain the denominator of the EPS equation - "Number of Commca Stock Shares Outstanding - you would assume that the stock exchange described in Question #I actually OCCUES. Pe the description of the stock exchange in Question il, for each two shares of stock that a Quick Resolve shareholder currently owns, the shareholder will receive one sbare of Innovative Comcepts' common stock in chun. After the exchange of stock, Quick Resolve Products will have only balfe may common stock shares outstanding as they had prior to the merger Question #2: Note that no bounce of increasinely forget Free Cash Flow" (FCF) value ja given anywhere in this case study. Tislead, the value of Quick Resolve Products is all "perpetaity." I..., a "perpetuity" is a series of continuous periodic payments of the same amount that have a specific conclusion date. Therefore, the "hoz vala" formule can be used to calculate the estimated worth of Quick Resolve Products' operations. The "Horizon Value formula apgrens om Stile 13 of the Chapter 9 Descuesint file The FCF value for the uma of the hosz value muls can be obtained from the second full paragraph on Page Two of this case study. Since no growth rate is expected (i.e. the FCF value will remain constant in each future year), the annual growth rate" (8) in the 'horizon value formula will have a value of 0% 0.00. After you play in these values into the horizon Talue" equation, you would then rocus m 100% Page 1 2 3 words LX Type here to search 2:23 PM 5/12/2011 Search A Tamoajayi 4gmail.com Annie CP HOUSE Fle Home Insert Draw Design Chapter_13_Ou dresove_Products_Homework_Hints_FIN_42) Layout References Malings Review View Help Share Comments Navigation x Search document Headings Pages Results soke the "esz value cuestion. The result of these calculations ie the maximum value that Invovalve Concepts would be willing to pay for Quack Resolve Products = HV Create animative using you document , FCF GO It's a great way to keep track of where you are ut quickly move your content around, The vandables in the Horiza Value formula can be defined as follows: FCF = Aml"Free Cash Flow, in this case of a comtemt datter amount To get started go to the Humne tab und esply Heading styles to the head nos in your document, r- Annual rule ofrelon un equity e Constantamal growth rate in this case, with the FCF remaining ematant cach year in dolle value, the small growth rate=0% HY - Maximuan theoretical value of the fut Questions through #5 of this creatudy are qualitative in natwe, as kulations are not requod. However, in Question 3, ny behulplul to cutit Innovative Comceps cuarent "Cash" and "Marketable Securities" values, as shown on its Balance Sheet. The values of these two accounts are an important consideration when determining whether to pay cash for an acquisition. rocus m 100% Puye 2012 S3 wards LX Type here to search p 2:23 PM 5/13/201