Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Seattle Adventures, Incorporated, is trying to decide between the following two alternatives to finance its new $27 million gaming center: a. Issue $27 million,

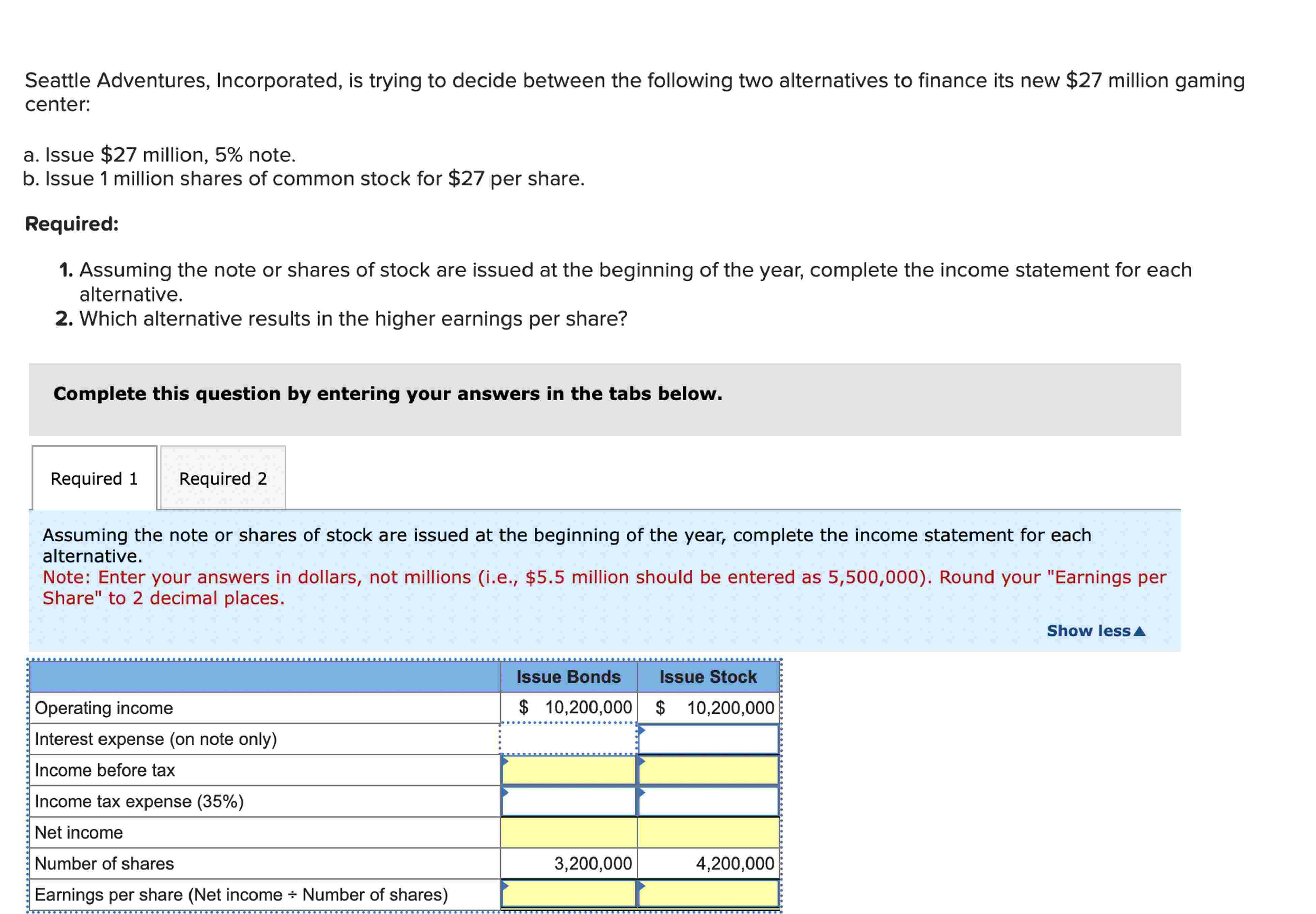

Seattle Adventures, Incorporated, is trying to decide between the following two alternatives to finance its new $27 million gaming center: a. Issue $27 million, 5% note. b. Issue 1 million shares of common stock for $27 per share. Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. 2. Which alternative results in the higher earnings per share? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. Note: Enter your answers in dollars, not millions (i.e., $5.5 million should be entered as 5,500,000). Round your "Earnings per Share" to 2 decimal places. Operating income Interest expense (on note only) Income before tax Income tax expense (35%) Net income Number of shares Issue Bonds Issue Stock $ 10,200,000 $ 10,200,000 3,200,000 4,200,000 Earnings per share (Net income + Number of shares) Show less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started