Answered step by step

Verified Expert Solution

Question

1 Approved Answer

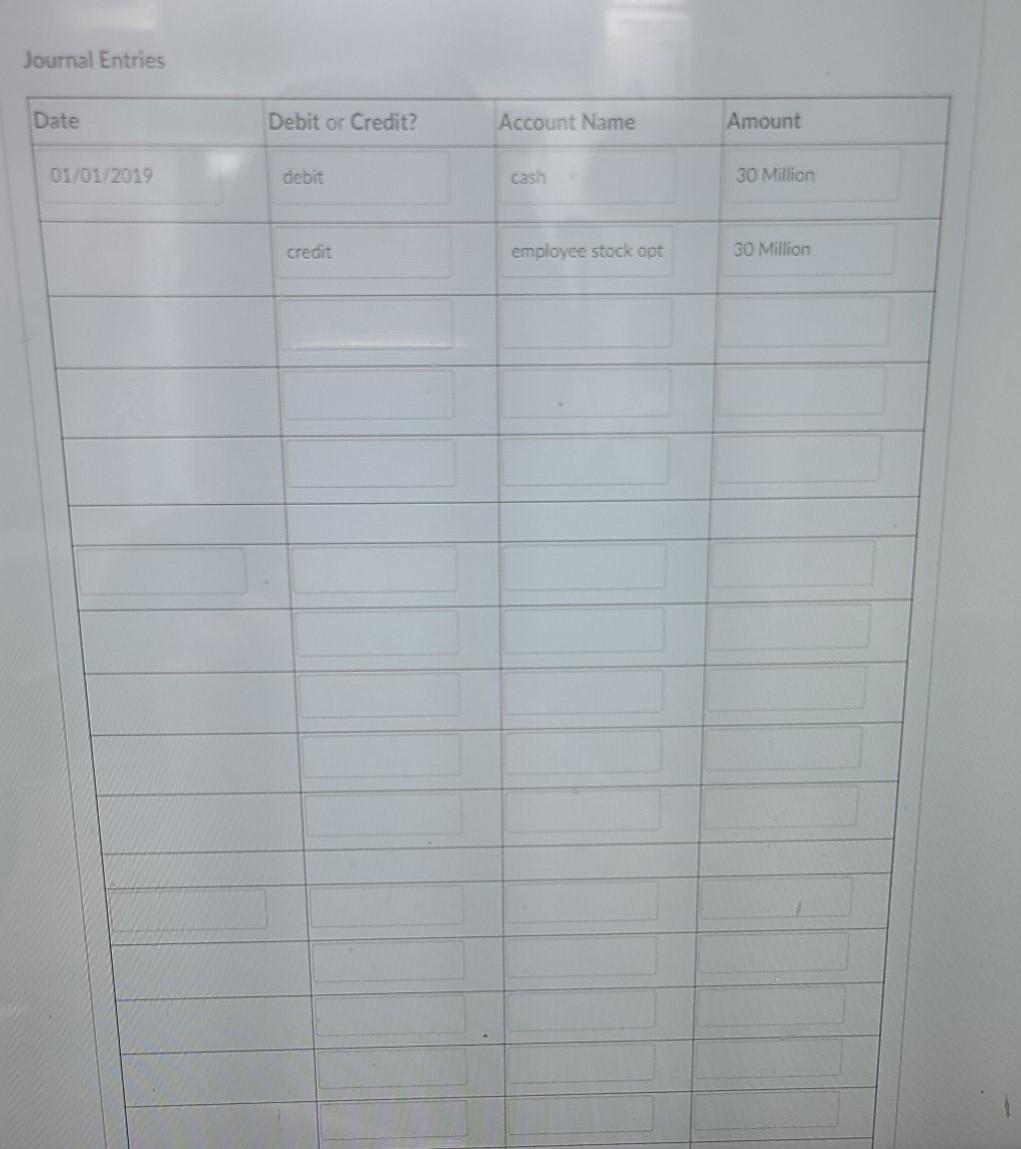

second is first portion of question just answer 2. Journal Entries Date Debit or Credit? Account Name Amount 01/01/2019 debit cash 30 Million credit employee

second is first portion of question just answer 2.

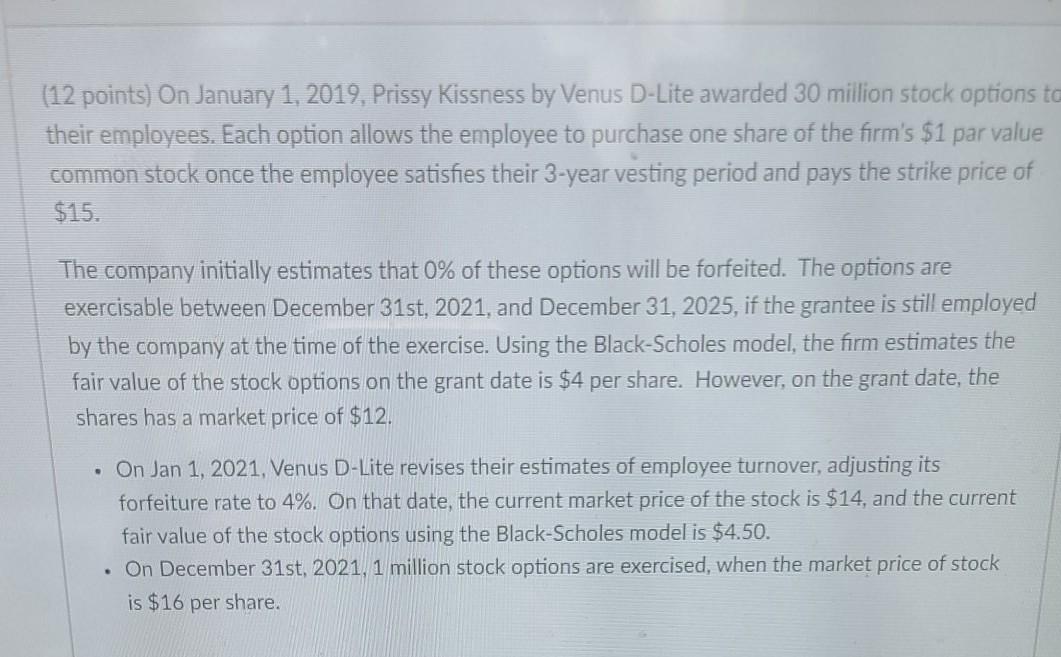

Journal Entries Date Debit or Credit? Account Name Amount 01/01/2019 debit cash 30 Million credit employee stock opt 30 Million (12 points) On January 1, 2019, Prissy Kissness by Venus D-Lite awarded 30 million stock options to their employees. Each option allows the employee to purchase one share of the firm's $1 par value common stock once the employee satisfies their 3-year vesting period and pays the strike price of $15. The company initially estimates that 0% of these options will be forfeited. The options are exercisable between December 31st, 2021, and December 31, 2025, if the grantee is still employed by the company at the time of the exercise. Using the Black-Scholes model, the firm estimates the fair value of the stock options on the grant date is $4 per share. However, on the grant date, the shares has a market price of $12. On Jan 1, 2021, Venus D-Lite revises their estimates of employee turnover, adjusting its forfeiture rate to 4%. On that date, the current market price of the stock is $14, and the current fair value of the stock options using the Black-Scholes model is $4.50. . On December 31st, 2021, 1 million stock options are exercised, when the market price of stock is $16 per share. Journal Entries Date Debit or Credit? Account Name Amount 01/01/2019 debit cash 30 Million credit employee stock opt 30 Million (12 points) On January 1, 2019, Prissy Kissness by Venus D-Lite awarded 30 million stock options to their employees. Each option allows the employee to purchase one share of the firm's $1 par value common stock once the employee satisfies their 3-year vesting period and pays the strike price of $15. The company initially estimates that 0% of these options will be forfeited. The options are exercisable between December 31st, 2021, and December 31, 2025, if the grantee is still employed by the company at the time of the exercise. Using the Black-Scholes model, the firm estimates the fair value of the stock options on the grant date is $4 per share. However, on the grant date, the shares has a market price of $12. On Jan 1, 2021, Venus D-Lite revises their estimates of employee turnover, adjusting its forfeiture rate to 4%. On that date, the current market price of the stock is $14, and the current fair value of the stock options using the Black-Scholes model is $4.50. . On December 31st, 2021, 1 million stock options are exercised, when the market price of stock is $16 per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started