second picture is part 1, need help with part two please

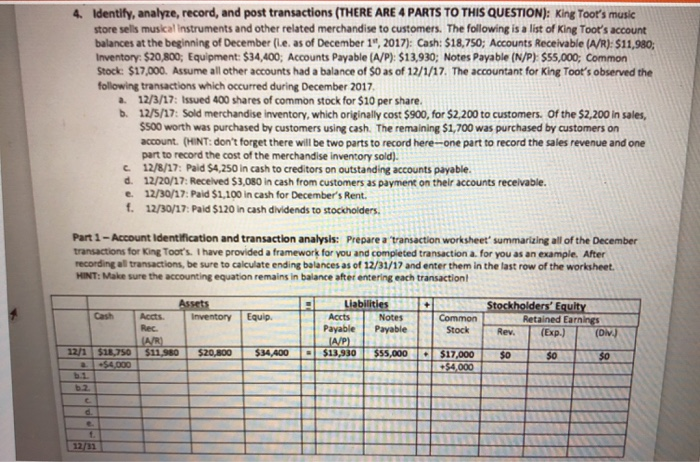

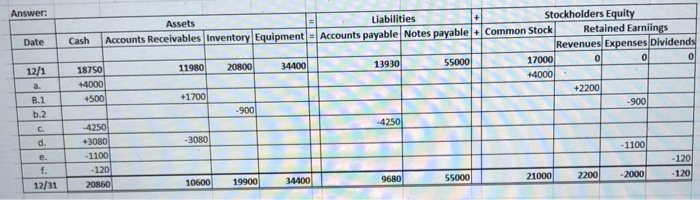

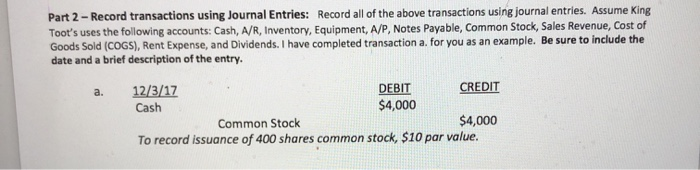

4. Identify, analyte, record, and post transactions (THERE ARE 4 PARTS TO THIS QUESTION): King Toot's music! store sels musical Instruments and other related merchandise to customers. The following is a list of King Toot's account balances at the beginning of December (le, as of December 14, 2017): Cash: $18.750; Accounts Receivable (A/R): $11,980, Inventory: $20,800, Equipment: $34,400; Accounts Payable (A/P): $13,930; Notes Payable (N/P) $55,000; Common Stock $17,000. Assume all other accounts had a balance of so as of 12/1/17. The accountant for King Toot's observed the following transactions which occurred during December 2017 a. 12/3/17: Issued 400 shares of common stock for $10 per share. 12/5/17: Sold merchandise inventory, which originally cost $900, for $2.200 to customers. Of the $2,200 in sales. $500 worth was purchased by customers using cash. The remaining $1,700 was purchased by customers on account. (HINT: don't forget there will be two parts to record here one part to record the sales revenue and one part to record the cost of the merchandise inventory sold). 12/8/17: Paid $4,250 in cash to creditors on outstanding accounts payable. 12/20/17. Received $3.00 in cash from customers as payment on their accounts receivable. e. 12/30/17: Paid $1,100 in cash for December's Rent. f. 12/30/17: Paid $120 in cash dividends to stocicholders. Part 1 - Account Identification and transaction analysis: Prepare a transaction worksheet' summarizing all of the December transactions for King Toor's. I have provided a framework for you and completed transaction a. for you as an example. After recording all transactions, be sure to calculate ending balances as of 12/31/17 and enter them in the last row of the worksheet. HINT: Make sure the accounting equation remains in balance after entering each transaction! A Assets Inventory Acct Equip. Liabilities Accts Notes Payable Payable IA/P) $13,930 $55,000 Rec Stockholders' Equity Retained Earnings Rev. (Exp.) (DV) Common Stock 12/1 ARI $11.95 $20.800 $34,400 O $ S O $11.750 -$4.000 $17,000 $4.000 Answer: Assets Accounts Receivables Inventory Equipment Date Cash 1211 18750 11980 2080034400 Liabilities + Stockholders Equity Accounts payable Notes payable. Common Stock Retained Earnings Revenues Expenses Dividends 1 3930 5 5000 17000000 +4000 +2200 T -900 +500 +1700 .1 b.2 .900 Apsol 3080 +3080 -1100 - 1100 12/31 20160 10600 19900 - 120 120 34400 9680 550.00 21000 2200 -2000 Part 2 - Record transactions using Journal Entries: Record all of the above transactions using journal entries. Assume King Toot's uses the following accounts: Cash, A/R, Inventory, Equipment, A/P, Notes Payable, Common Stock, Sales Revenue, Cost of Goods Sold (COGS), Rent Expense, and Dividends. I have completed transaction a. for you as an example. Be sure to include the date and a brief description of the entry. a. 12/3/17 DEBIT CREDIT Cash $4,000 Common Stock $4,000 To record issuance of 400 shares common stock, $10 par value