Answered step by step

Verified Expert Solution

Question

1 Approved Answer

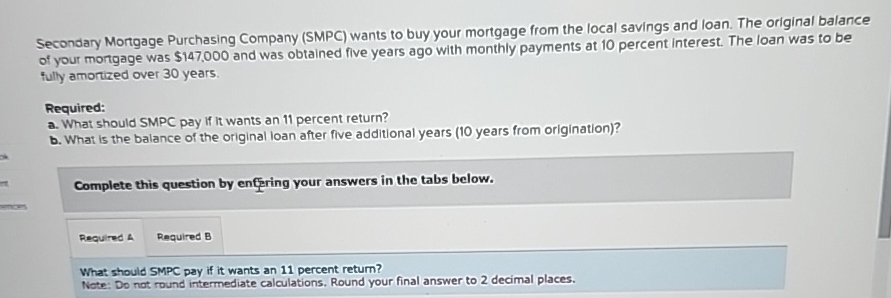

Secondary Mortgage Purchasing Company ( SMPC ) wants to buy your mortgage from the local savings and loan. The original balance of your mongage was

Secondary Mortgage Purchasing Company SMPC wants to buy your mortgage from the local savings and loan. The original balance of your mongage was $ and was obtained five years ago with monthly payments at percent interest. The loan was to be fully amontized over years.

Required:

a What should SMPC pay if it wants an percent return?

b What is the balance of the original loan after five additional years years from origination

Complete this question by enfyring your answers in the tabs below.

What should SMPC pay if it wants an percent retum?

Note: Do nat round intermediate calculations. Round your final answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started