Answered step by step

Verified Expert Solution

Question

1 Approved Answer

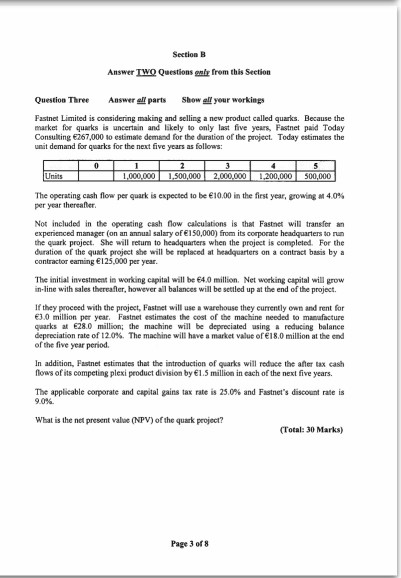

Sectia B Answer TWO Questions only from this section Questive Three Auswer all parts Show all yoer working Fastnet Limited is considering making and selling

Sectia B Answer TWO Questions only from this section Questive Three Auswer all parts Show all yoer working Fastnet Limited is considering making and selling a new product called gurks Because the market for gaarkes certain and likely to only last five years, Fastnet paid Today Consulting 267.000 estime demand for the duration of the project. Today estimates the unit demand for quals for the next five years as follows: 2 1.500.000 3 2.000.000 4 1.200.000 5 500.000 1.000.000 The operating cash flow per quark is expected to be 10.00 in the first year, growing per year thereafter 40% Not included in the operating cash flow calculations is that Fastnet will transfer an experienced manager (on an annual salary of 150,000) from its corporate headquarters to run the quark project. She will return to headquarters when the project is completed. For the duration of the quark project she will be replaced at headquarters on a contract basis by a contractor caming 125.000 per year. The initial investment in working capital will be 4,0 million Networking capital will grow in line with sales thereafter, however all balances will be settled up at the end of the project. If they proceed with the project, Fastne will use a warehouse they currently own and rent for 10 million per year. Fastnet estimates the cost of the machine needed to manfacture quarks 280 million; the machine will be depreciated using a reducing balance depreciation rate of 12.0%. The machine will have a market value of 18.0 million at the end of the five year period. In addition, Fastnet estimates that the introduction of quarks will reduce the after tax cash flows of its competing plexi product division by 1.5 million in each of the next five years The applicable corporate and capital gains tax rate is 25.0% and Fastnet's discount rate is 90% What is the nel present value (NPV) of the quark project? (Total: 30 Marks) Page 38 Sectia B Answer TWO Questions only from this section Questive Three Auswer all parts Show all yoer working Fastnet Limited is considering making and selling a new product called gurks Because the market for gaarkes certain and likely to only last five years, Fastnet paid Today Consulting 267.000 estime demand for the duration of the project. Today estimates the unit demand for quals for the next five years as follows: 2 1.500.000 3 2.000.000 4 1.200.000 5 500.000 1.000.000 The operating cash flow per quark is expected to be 10.00 in the first year, growing per year thereafter 40% Not included in the operating cash flow calculations is that Fastnet will transfer an experienced manager (on an annual salary of 150,000) from its corporate headquarters to run the quark project. She will return to headquarters when the project is completed. For the duration of the quark project she will be replaced at headquarters on a contract basis by a contractor caming 125.000 per year. The initial investment in working capital will be 4,0 million Networking capital will grow in line with sales thereafter, however all balances will be settled up at the end of the project. If they proceed with the project, Fastne will use a warehouse they currently own and rent for 10 million per year. Fastnet estimates the cost of the machine needed to manfacture quarks 280 million; the machine will be depreciated using a reducing balance depreciation rate of 12.0%. The machine will have a market value of 18.0 million at the end of the five year period. In addition, Fastnet estimates that the introduction of quarks will reduce the after tax cash flows of its competing plexi product division by 1.5 million in each of the next five years The applicable corporate and capital gains tax rate is 25.0% and Fastnet's discount rate is 90% What is the nel present value (NPV) of the quark project? (Total: 30 Marks) Page 38

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started