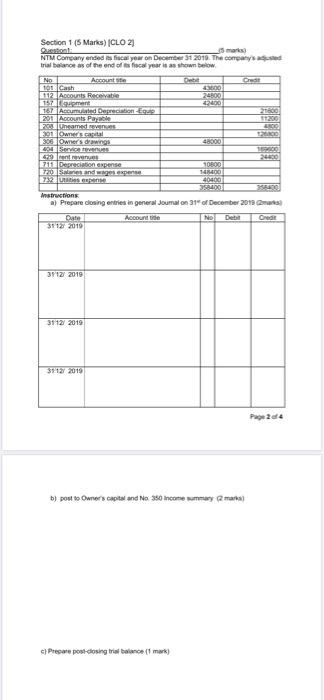

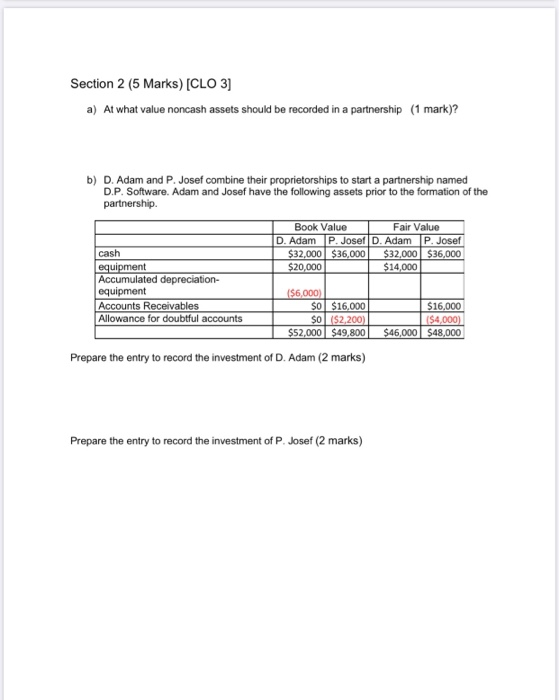

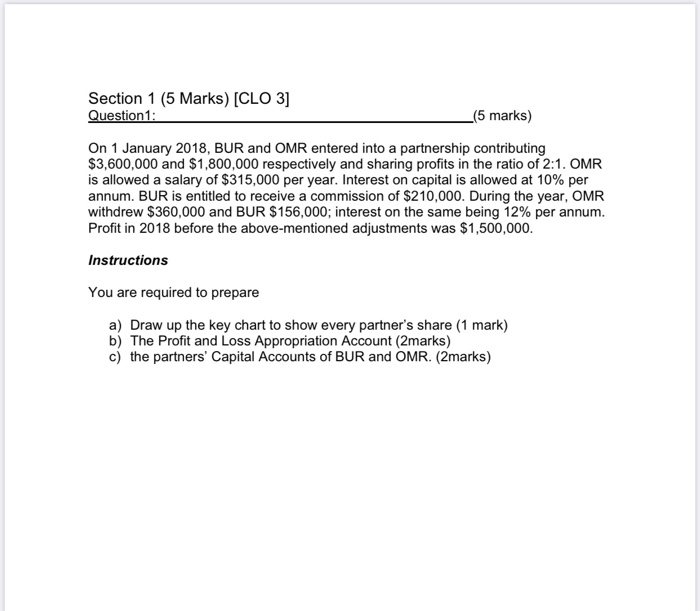

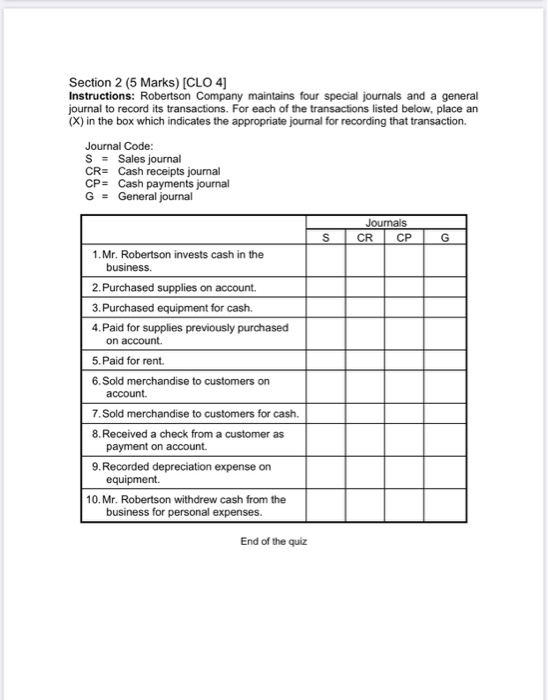

Section 1 (5 Marks) CLO 2] sta NTM Company ended its fiscal year on December 31 2019. The companys trial s of the end of fiscal years as shown below Account Cash ET Accounts Receivable 2 gaman Accumulated Depreciation 2011 A Poble Owner's capital Owners wings Account de 11 2010 post O n com a c) Prepare poslosing tribalance mark) Section 2 (5 Marks) [CLO 3] a) At what value noncash assets should be recorded in a partnership (1 mark)? b) D. Adam and P. Josef combine their proprietorships to start a partnership named D.P. Software. Adam and Josef have the following assets prior to the formation of the partnership Book Value Fair Value D. Adam P. Josef D. Adam P. Josef $32,000 $36,000 $32,000 $36,000 $20,000 $14,000 cash equipment Accumulated depreciation- equipment Accounts Receivables Allowance for doubtful accounts ($6,000) counts $0 $16,000 $0 $52,000 $2,200) $49,800 $16,000 $4.000) $48,000 $46,000 Prepare the entry to record the investment of D. Adam (2 marks) Prepare the entry to record the investment of P. Josef (2 marks) Section 1 (5 Marks) (CLO 3] Question 1: _(5 marks) On 1 January 2018, BUR and OMR entered into a partnership contributing $3,600,000 and $1,800,000 respectively and sharing profits in the ratio of 2:1. OMR is allowed a salary of $315,000 per year. Interest on capital is allowed at 10% per annum. BUR is entitled to receive a commission of $210,000. During the year, OMR withdrew $360,000 and BUR $156,000; interest on the same being 12% per annum. Profit in 2018 before the above-mentioned adjustments was $1,500,000 Instructions You are required to prepare a) Draw up the key chart to show every partner's share (1 mark) b) The Profit and Loss Appropriation Account (2marks) c) the partners' Capital Accounts of BUR and OMR. (2marks) Section 2 (5 Marks) [CLO 4] Instructions: Robertson Company maintains four special journals and a general journal to record its transactions. For each of the transactions listed below, place an (X) in the box which indicates the appropriate journal for recording that transaction. Journal Code: S = Sales journal CR= Cash receipts journal CP= Cash payments journal G = General journal Journals CRCPG S 1. Mr. Robertson invests cash in the business 2.Purchased supplies on account. 3. Purchased equipment for cash 4. Paid for supplies previously purchased on account. 5. Paid for rent 6. Sold merchandise to customers on account. 7. Sold merchandise to customers for cash. 8.Received a check from a customer as payment on account. 9. Recorded depreciation expense on equipment. 10. Mr. Robertson withdrew cash from the business for personal expenses. End of the quiz Section 1 (5 Marks) CLO 2] sta NTM Company ended its fiscal year on December 31 2019. The companys trial s of the end of fiscal years as shown below Account Cash ET Accounts Receivable 2 gaman Accumulated Depreciation 2011 A Poble Owner's capital Owners wings Account de 11 2010 post O n com a c) Prepare poslosing tribalance mark) Section 2 (5 Marks) [CLO 3] a) At what value noncash assets should be recorded in a partnership (1 mark)? b) D. Adam and P. Josef combine their proprietorships to start a partnership named D.P. Software. Adam and Josef have the following assets prior to the formation of the partnership Book Value Fair Value D. Adam P. Josef D. Adam P. Josef $32,000 $36,000 $32,000 $36,000 $20,000 $14,000 cash equipment Accumulated depreciation- equipment Accounts Receivables Allowance for doubtful accounts ($6,000) counts $0 $16,000 $0 $52,000 $2,200) $49,800 $16,000 $4.000) $48,000 $46,000 Prepare the entry to record the investment of D. Adam (2 marks) Prepare the entry to record the investment of P. Josef (2 marks) Section 1 (5 Marks) (CLO 3] Question 1: _(5 marks) On 1 January 2018, BUR and OMR entered into a partnership contributing $3,600,000 and $1,800,000 respectively and sharing profits in the ratio of 2:1. OMR is allowed a salary of $315,000 per year. Interest on capital is allowed at 10% per annum. BUR is entitled to receive a commission of $210,000. During the year, OMR withdrew $360,000 and BUR $156,000; interest on the same being 12% per annum. Profit in 2018 before the above-mentioned adjustments was $1,500,000 Instructions You are required to prepare a) Draw up the key chart to show every partner's share (1 mark) b) The Profit and Loss Appropriation Account (2marks) c) the partners' Capital Accounts of BUR and OMR. (2marks) Section 2 (5 Marks) [CLO 4] Instructions: Robertson Company maintains four special journals and a general journal to record its transactions. For each of the transactions listed below, place an (X) in the box which indicates the appropriate journal for recording that transaction. Journal Code: S = Sales journal CR= Cash receipts journal CP= Cash payments journal G = General journal Journals CRCPG S 1. Mr. Robertson invests cash in the business 2.Purchased supplies on account. 3. Purchased equipment for cash 4. Paid for supplies previously purchased on account. 5. Paid for rent 6. Sold merchandise to customers on account. 7. Sold merchandise to customers for cash. 8.Received a check from a customer as payment on account. 9. Recorded depreciation expense on equipment. 10. Mr. Robertson withdrew cash from the business for personal expenses. End of the quiz