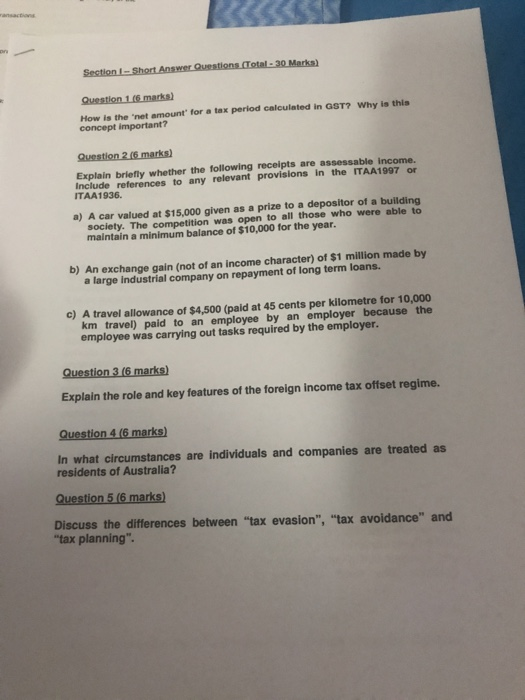

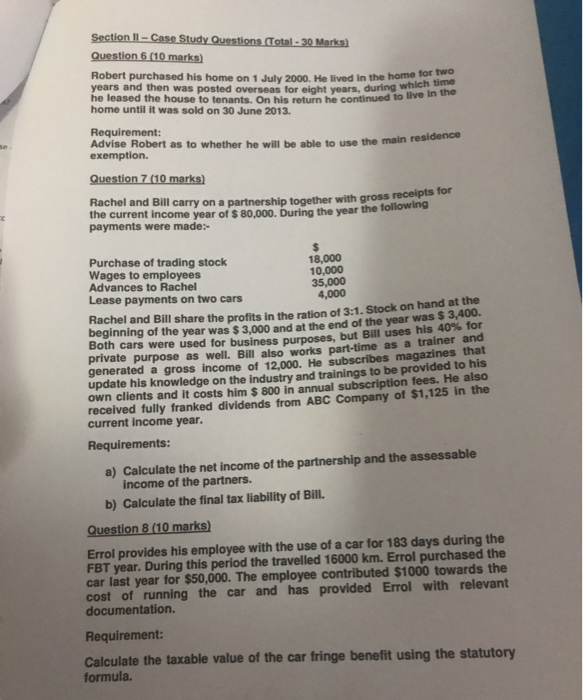

Section 1 - Short Answer Questions. (Total - 30 Marks) Question 1(6 marks) How is the 'net amount for a tax period calculated in GST? Why is this concept important? Question 2 (6 marks) Explain briefly whether the following receipts are assessable income. Include references to any relevant provisions in the ITAA1997 or ITAA1936. a) A car valued at $15,000 given as a prize to a depositor of a building society. The competition was open to all those who were able to maintain a minimum balance of $10,000 for the year. b) An exchange gain (not of an Income character) of $1 million made by a large industrial company on repayment of long term loans. c) A travel allowance of $4.500 (paid at 45 cents per kilometre for 10,000 km travel) pald to an employee by an employer because the employee was carrying out tasks required by the employer. Question 3 (6 marks) Explain the role and key features of the foreign income tax offset regime. Question 4 (6 marks) In what circumstances are individuals and companies are treated as residents of Australia? Question 5 (6 marks) Discuss the differences between "tax evasion", "tax avoidance" and "tax planning" Section II - Case Study Questions. Total - 30 Marks) Question 6 (10 marks) Robert purchased his home on 1 July 2000. He lived in the home years and then was posted overseas for acht wears during which tim he leased the house to tenants. On his return he continued to live home until it was sold on 30 June 2013. Requirement: Advise Robert as to whether he will be able to use the main reside exemption. Question 7 (10 marks) Rachel and Bill carry on a partnership together with gross receipts the current income year of $ 80,000. During the year the following payments were made:- Purchase of trading stock 18,000 Wages to employees 10,000 Advances to Rachel 35,000 Lease payments on two cars 4,000 Rachel and Bill share the profits in the ration of 3:1. Stock on hand beginning of the year was $3,000 and at the end of the year was $ 3,400- Both cars were used for business purposes, but Bill uses his 40% for private purpose as well. Bill also works part-time as a trainer and generated a gross income of 12,000. He subscribes magazines that update his knowledge on the industry and trainings to be provided to his own clients and it costs him $ 800 in annual subscription fees. He also received fully franked dividends from ABC Company of $1,125 in the current income year. Requirements: a) Calculate the net income of the partnership and the assessable income of the partners. b) Calculate the final tax liability of Bill Question 8 (10 marks) Errol provides his employee with the use of a car for 183 days during the FBT year. During this period the travelled 16000 km. Errol purchased the car last year for $50,000. The employee contributed $1000 towards the cost of running the car and has provided Errol with relevant documentation. Requirement: Calculate the taxable value of the car fringe benefit using the statutory formula. Section 1 - Short Answer Questions. (Total - 30 Marks) Question 1(6 marks) How is the 'net amount for a tax period calculated in GST? Why is this concept important? Question 2 (6 marks) Explain briefly whether the following receipts are assessable income. Include references to any relevant provisions in the ITAA1997 or ITAA1936. a) A car valued at $15,000 given as a prize to a depositor of a building society. The competition was open to all those who were able to maintain a minimum balance of $10,000 for the year. b) An exchange gain (not of an Income character) of $1 million made by a large industrial company on repayment of long term loans. c) A travel allowance of $4.500 (paid at 45 cents per kilometre for 10,000 km travel) pald to an employee by an employer because the employee was carrying out tasks required by the employer. Question 3 (6 marks) Explain the role and key features of the foreign income tax offset regime. Question 4 (6 marks) In what circumstances are individuals and companies are treated as residents of Australia? Question 5 (6 marks) Discuss the differences between "tax evasion", "tax avoidance" and "tax planning" Section II - Case Study Questions. Total - 30 Marks) Question 6 (10 marks) Robert purchased his home on 1 July 2000. He lived in the home years and then was posted overseas for acht wears during which tim he leased the house to tenants. On his return he continued to live home until it was sold on 30 June 2013. Requirement: Advise Robert as to whether he will be able to use the main reside exemption. Question 7 (10 marks) Rachel and Bill carry on a partnership together with gross receipts the current income year of $ 80,000. During the year the following payments were made:- Purchase of trading stock 18,000 Wages to employees 10,000 Advances to Rachel 35,000 Lease payments on two cars 4,000 Rachel and Bill share the profits in the ration of 3:1. Stock on hand beginning of the year was $3,000 and at the end of the year was $ 3,400- Both cars were used for business purposes, but Bill uses his 40% for private purpose as well. Bill also works part-time as a trainer and generated a gross income of 12,000. He subscribes magazines that update his knowledge on the industry and trainings to be provided to his own clients and it costs him $ 800 in annual subscription fees. He also received fully franked dividends from ABC Company of $1,125 in the current income year. Requirements: a) Calculate the net income of the partnership and the assessable income of the partners. b) Calculate the final tax liability of Bill Question 8 (10 marks) Errol provides his employee with the use of a car for 183 days during the FBT year. During this period the travelled 16000 km. Errol purchased the car last year for $50,000. The employee contributed $1000 towards the cost of running the car and has provided Errol with relevant documentation. Requirement: Calculate the taxable value of the car fringe benefit using the statutory formula