Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You sell cash grain at $11.75 and buy MAR futures at $11.50. Later you buy cash grain at $11.30 and sell MAR futures at

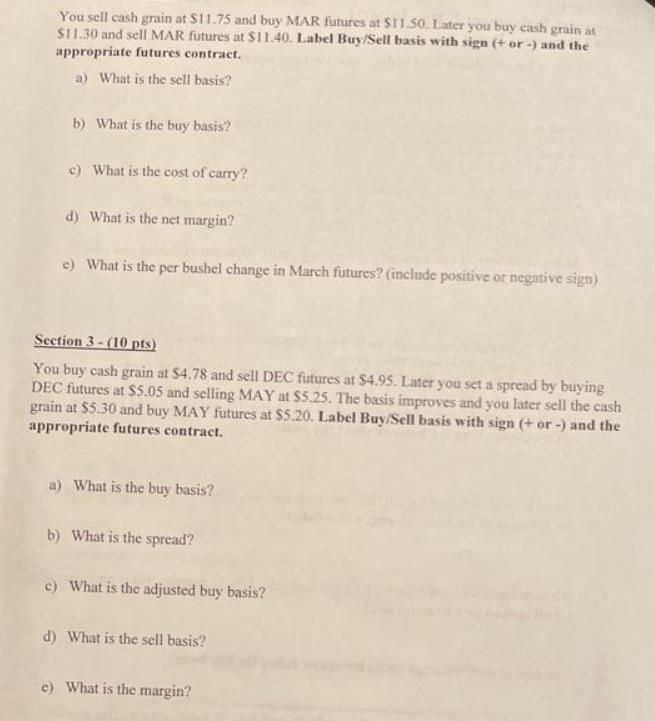

You sell cash grain at $11.75 and buy MAR futures at $11.50. Later you buy cash grain at $11.30 and sell MAR futures at $11.40. Label Buy/Sell basis with sign (+ or -) and the appropriate futures contract. a) What is the sell basis? b) What is the buy basis? c) What is the cost of carry? d) What is the net margin? e) What is the per bushel change in March futures? (include positive or negative sign) Section 3-(10 pts) You buy cash grain at $4.78 and sell DEC futures at $4.95. Later you set a spread by buying DEC futures at $5.05 and selling MAY at $5.25. The basis improves and you later sell the cash grain at $5.30 and buy MAY futures at $5.20. Label Buy/Sell basis with sign (+ or -) and the appropriate futures contract. a) What is the buy basis? b) What is the spread? c) What is the adjusted buy basis? d) What is the sell basis? e) What is the margin?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Section 2 a Sell basis Cash grain selling price MAR futures selling price Sell basis 1175 1140 035 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started