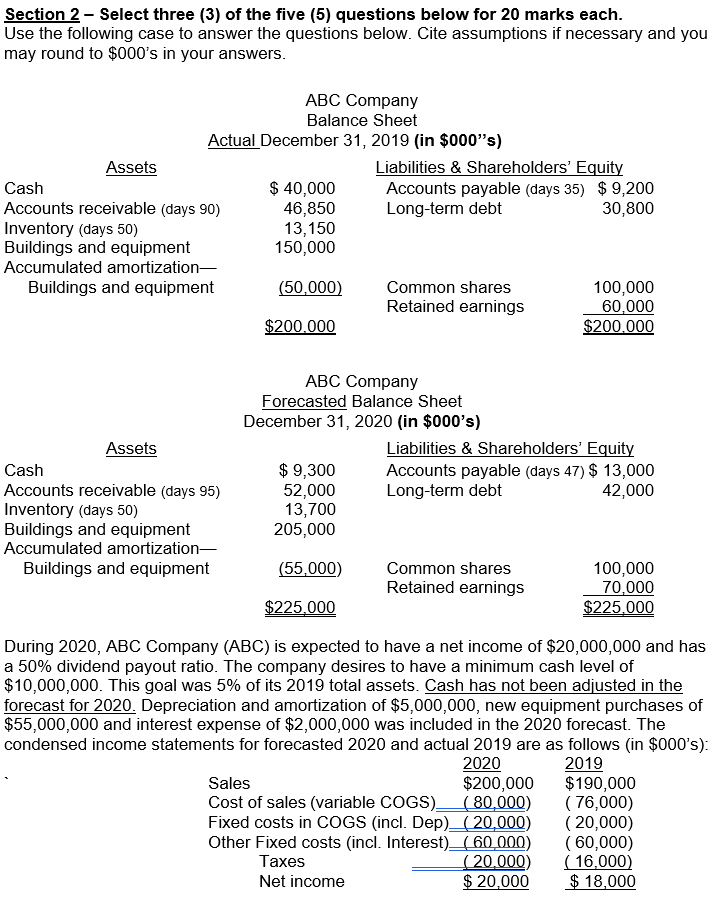

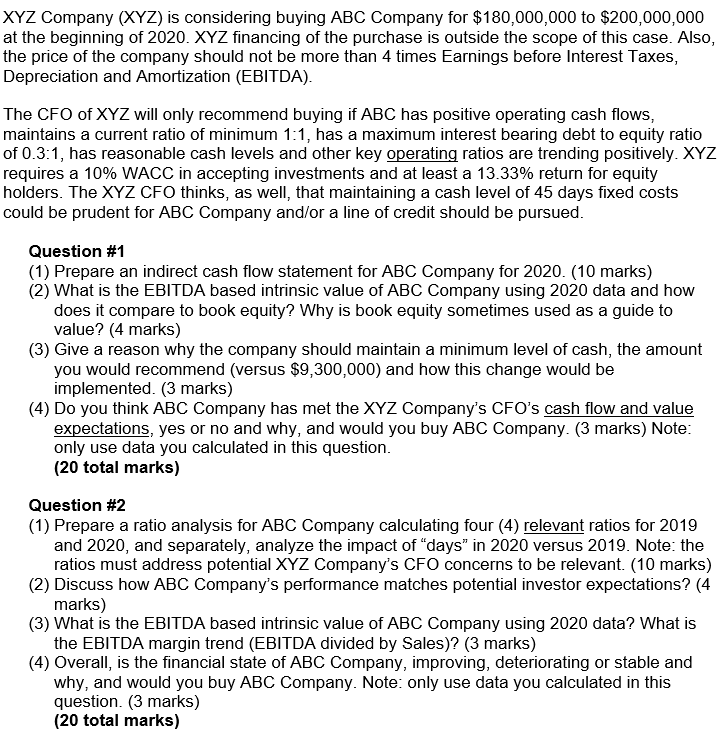

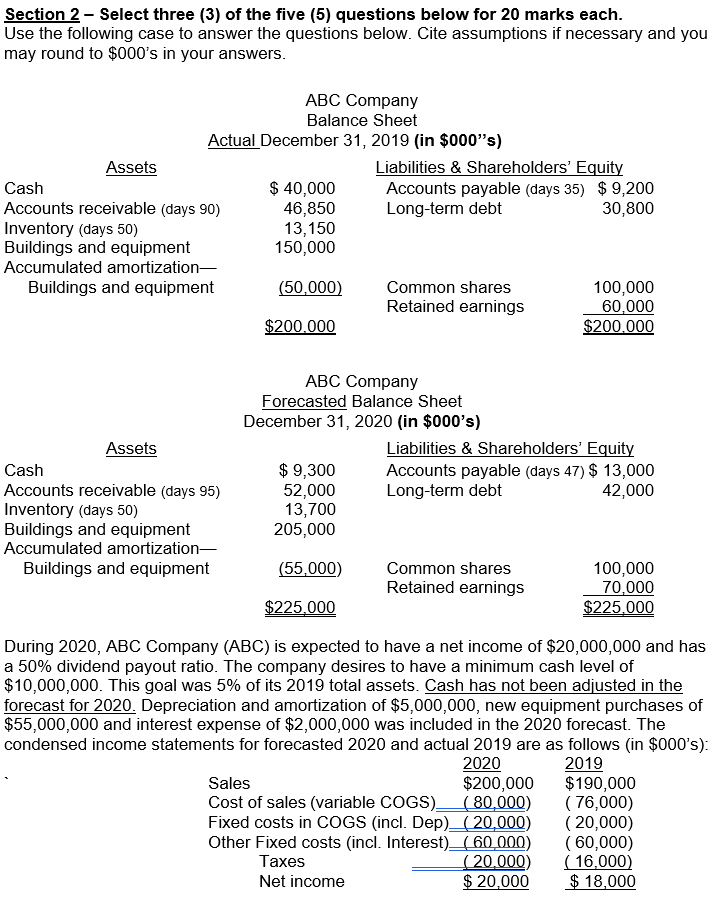

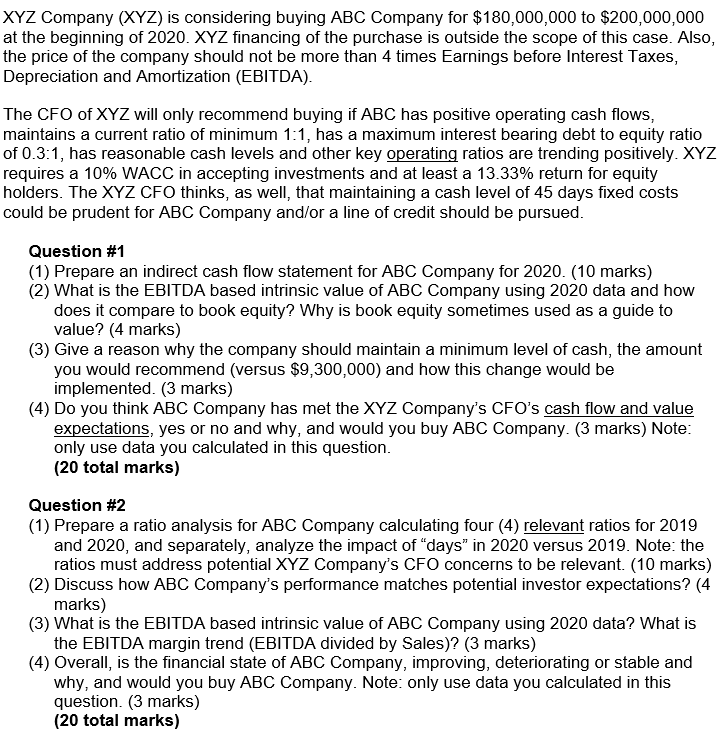

Section 2 - Select three (3) of the five (5) questions below for 20 marks each. Use the following case to answer the questions below. Cite assumptions if necessary and you may round to $000's in your answers. ABC Company Balance Sheet Actual December 31, 2019 (in $000's) Assets Liabilities & Shareholders' Equity Cash $ 40,000 Accounts payable (days 35) $ 9,200 Accounts receivable (days 90) 46,850 Long-term debt 30,800 Inventory (days 50) 13,150 Buildings and equipment 150,000 Accumulated amortization- Buildings and equipment (50,000) Common shares 100,000 Retained earnings 60,000 $200.000 $200.000 ABC Company Forecasted Balance Sheet December 31, 2020 (in $000's) Assets Liabilities & Shareholders' Equity Cash $ 9,300 Accounts payable (days 47) $ 13,000 Accounts receivable (days 95) 52,000 Long-term debt 42,000 Inventory (days 50) 13,700 Buildings and equipment 205,000 Accumulated amortization- Buildings and equipment (55,000) Common shares 100,000 Retained earnings 70,000 $225,000 $225,000 During 2020, ABC Company (ABC) is expected to have a net income of $20,000,000 and has a 50% dividend payout ratio. The company desires to have a minimum cash level of $10,000,000. This goal was 5% of its 2019 total assets. Cash has not been adjusted in the forecast for 2020. Depreciation and amortization of $5,000,000, new equipment purchases of $55,000,000 and interest expense of $2,000,000 was included in the 2020 forecast. The condensed income statements for forecasted 2020 and actual 2019 are as follows (in $000's): 2020 2019 Sales $200,000 $190,000 Cost of sales (variable COGS) ( 80,000) ( 76,000) Fixed costs in COGS (incl. Dep)_(20,000) (20,000) Other Fixed costs (incl. Interest)_( 60.000) ( 60,000) Taxes ( 20.000) ( 16,000) Net income $ 20,000 $ 18,000 XYZ Company (XYZ) is considering buying ABC Company for $180,000,000 to $200,000,000 at the beginning of 2020. XYZ financing of the purchase is outside the scope of this case. Also, the price of the company should not be more than 4 times Earnings before Interest Taxes, Depreciation and Amortization (EBITDA). The CFO of XYZ will only recommend buying if ABC has positive operating cash flows, maintains a current ratio of minimum 1:1, has a maximum interest bearing debt to equity ratio of 0.3:1, has reasonable cash levels and other key operating ratios are trending positively.XYZ requires a 10% WACC in accepting investments and at least a 13.33% return for equity holders. The XYZ CFO thinks, as well, that maintaining a cash level of 45 days fixed costs could be prudent for ABC Company and/or a line of credit should be pursued. Question #1 (1) Prepare an indirect cash flow statement for ABC Company for 2020. (10 marks) (2) What is the EBITDA based intrinsic value of ABC Company using 2020 data and how does it compare to book equity? Why is book equity sometimes used as a guide to value? (4 marks) (3) Give a reason why the company should maintain a minimum level of cash, the amount you would recommend (versus $9,300,000) and how this change would be implemented. (3 marks) (4) Do you think ABC Company has met the XYZ Company's CFO's cash flow and value expectations, yes or no and why, and would you buy ABC Company. (3 marks) Note: only use data you calculated in this question. (20 total marks) Question #2 (1) Prepare a ratio analysis for ABC Company calculating four (4) relevant ratios for 2019 and 2020, and separately, analyze the impact of "days in 2020 versus 2019. Note: the ratios must address potential XYZ Company's CFO concerns to be relevant. (10 marks) (2) Discuss how ABC Company's performance matches potential investor expectations? (4 marks) (3) What is the EBITDA based intrinsic value of ABC Company using 2020 data? What is the EBITDA margin trend (EBITDA divided by Sales)? (3 marks) (4) Overall, is the financial state of ABC Company, improving, deteriorating or stable and why, and would you buy ABC Company. Note: only use data you calculated in this question. (3 marks) (20 total marks) Section 2 - Select three (3) of the five (5) questions below for 20 marks each. Use the following case to answer the questions below. Cite assumptions if necessary and you may round to $000's in your answers. ABC Company Balance Sheet Actual December 31, 2019 (in $000's) Assets Liabilities & Shareholders' Equity Cash $ 40,000 Accounts payable (days 35) $ 9,200 Accounts receivable (days 90) 46,850 Long-term debt 30,800 Inventory (days 50) 13,150 Buildings and equipment 150,000 Accumulated amortization- Buildings and equipment (50,000) Common shares 100,000 Retained earnings 60,000 $200.000 $200.000 ABC Company Forecasted Balance Sheet December 31, 2020 (in $000's) Assets Liabilities & Shareholders' Equity Cash $ 9,300 Accounts payable (days 47) $ 13,000 Accounts receivable (days 95) 52,000 Long-term debt 42,000 Inventory (days 50) 13,700 Buildings and equipment 205,000 Accumulated amortization- Buildings and equipment (55,000) Common shares 100,000 Retained earnings 70,000 $225,000 $225,000 During 2020, ABC Company (ABC) is expected to have a net income of $20,000,000 and has a 50% dividend payout ratio. The company desires to have a minimum cash level of $10,000,000. This goal was 5% of its 2019 total assets. Cash has not been adjusted in the forecast for 2020. Depreciation and amortization of $5,000,000, new equipment purchases of $55,000,000 and interest expense of $2,000,000 was included in the 2020 forecast. The condensed income statements for forecasted 2020 and actual 2019 are as follows (in $000's): 2020 2019 Sales $200,000 $190,000 Cost of sales (variable COGS) ( 80,000) ( 76,000) Fixed costs in COGS (incl. Dep)_(20,000) (20,000) Other Fixed costs (incl. Interest)_( 60.000) ( 60,000) Taxes ( 20.000) ( 16,000) Net income $ 20,000 $ 18,000 XYZ Company (XYZ) is considering buying ABC Company for $180,000,000 to $200,000,000 at the beginning of 2020. XYZ financing of the purchase is outside the scope of this case. Also, the price of the company should not be more than 4 times Earnings before Interest Taxes, Depreciation and Amortization (EBITDA). The CFO of XYZ will only recommend buying if ABC has positive operating cash flows, maintains a current ratio of minimum 1:1, has a maximum interest bearing debt to equity ratio of 0.3:1, has reasonable cash levels and other key operating ratios are trending positively.XYZ requires a 10% WACC in accepting investments and at least a 13.33% return for equity holders. The XYZ CFO thinks, as well, that maintaining a cash level of 45 days fixed costs could be prudent for ABC Company and/or a line of credit should be pursued. Question #1 (1) Prepare an indirect cash flow statement for ABC Company for 2020. (10 marks) (2) What is the EBITDA based intrinsic value of ABC Company using 2020 data and how does it compare to book equity? Why is book equity sometimes used as a guide to value? (4 marks) (3) Give a reason why the company should maintain a minimum level of cash, the amount you would recommend (versus $9,300,000) and how this change would be implemented. (3 marks) (4) Do you think ABC Company has met the XYZ Company's CFO's cash flow and value expectations, yes or no and why, and would you buy ABC Company. (3 marks) Note: only use data you calculated in this question. (20 total marks) Question #2 (1) Prepare a ratio analysis for ABC Company calculating four (4) relevant ratios for 2019 and 2020, and separately, analyze the impact of "days in 2020 versus 2019. Note: the ratios must address potential XYZ Company's CFO concerns to be relevant. (10 marks) (2) Discuss how ABC Company's performance matches potential investor expectations? (4 marks) (3) What is the EBITDA based intrinsic value of ABC Company using 2020 data? What is the EBITDA margin trend (EBITDA divided by Sales)? (3 marks) (4) Overall, is the financial state of ABC Company, improving, deteriorating or stable and why, and would you buy ABC Company. Note: only use data you calculated in this question. (3 marks) (20 total marks)