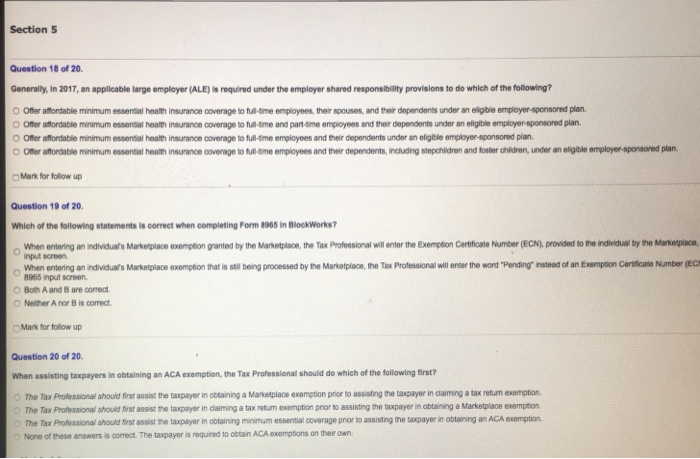

Section 5 Question 18 of 20. Generally, In 2017, an applicable large employer (ALE) is required under the employer shared responsibilty provisions to do which of the following? O Offer affordable minimum essential health insuranoe coverage to full-time employees, their spouses, and their dependents under an eligible empioyer-sponsored plan OOffer atfordable minimum essential health insurance coverage to full-time and part-tme employees and their dependents under an eligible employer-sponsored plan O Offer affordable minimum essential health insurance coverage to full-time employees and their dependents under an eligible employer-sponsored plarn oner a o a te min mum esse al haan insurance cove ago to ta e empo ees and rer de er tents na ang ste chi en and fost anion, un r ane ble amplo e spo send plan Mark for blow up Question 19 of 20 Which of the following statements is correct when completing Form 8965 in BlockWorks? o Whan entering an indvidua's Marketplace exetion pranted by the Marketplace, the Tax Professional will enter the Exemption Cartificate Niumber (ECNI provided to the individual by the Marketplace, input screen When entering an individuars Marketplace exemption that is stil being processed by the Marketplace, the Tax Professional will enter the word "Pending" instead of an Exemption Certificate Number (EC 8965 input screen O Both A and B are correct O Nelher A nor B is correct Mark fortaow up Question 20 of 20 When assisting taxpayers in obtaining an ACA exemption, the Tax Professional should do which of the following first? The Tax Professional should first assist the taxpayer in obtaining a Maketplace exemption prior to assisting the taxpayer in claiming a tax retum exemption The Tax Professional should first assist the taxpayer in daiming a tax return exemption prior to assisting the taxpayer in obtaining a Marketplace exemption The Tax Professional shouid first assist the taxpayer in obtaining minimum essential coverage prior to assisting the taxpayer in obtaining an ACA exemption Nore of these answers is correct. The ta payer is requred to attan ACA exemptions on ther own