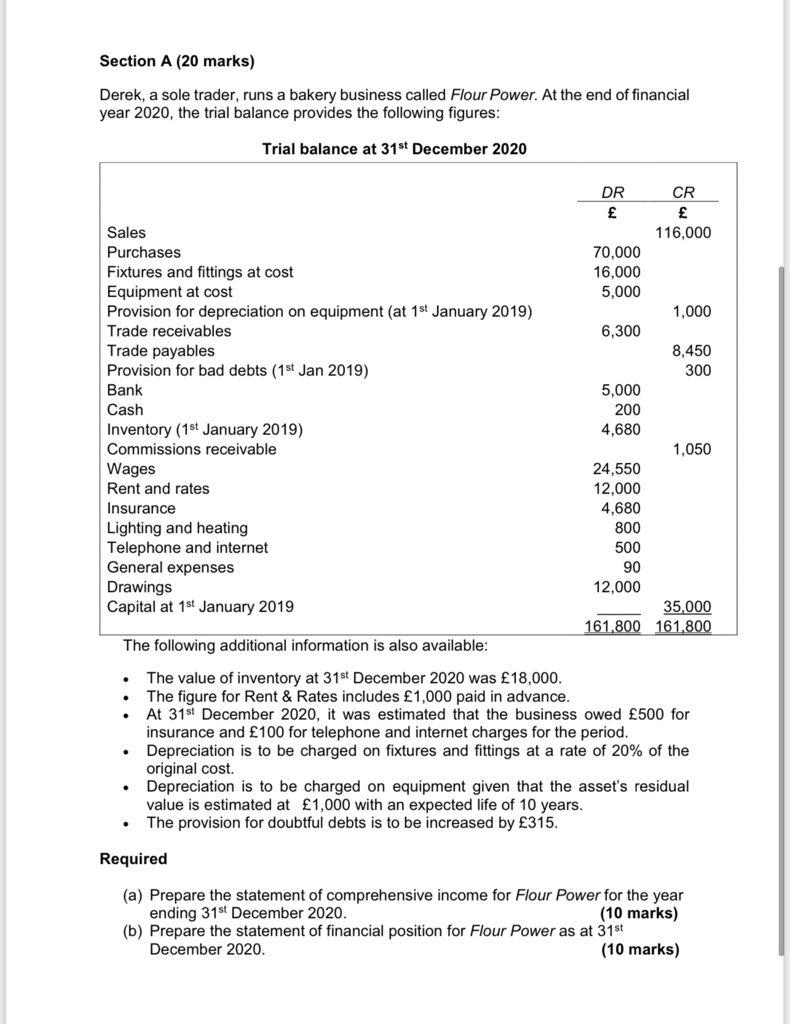

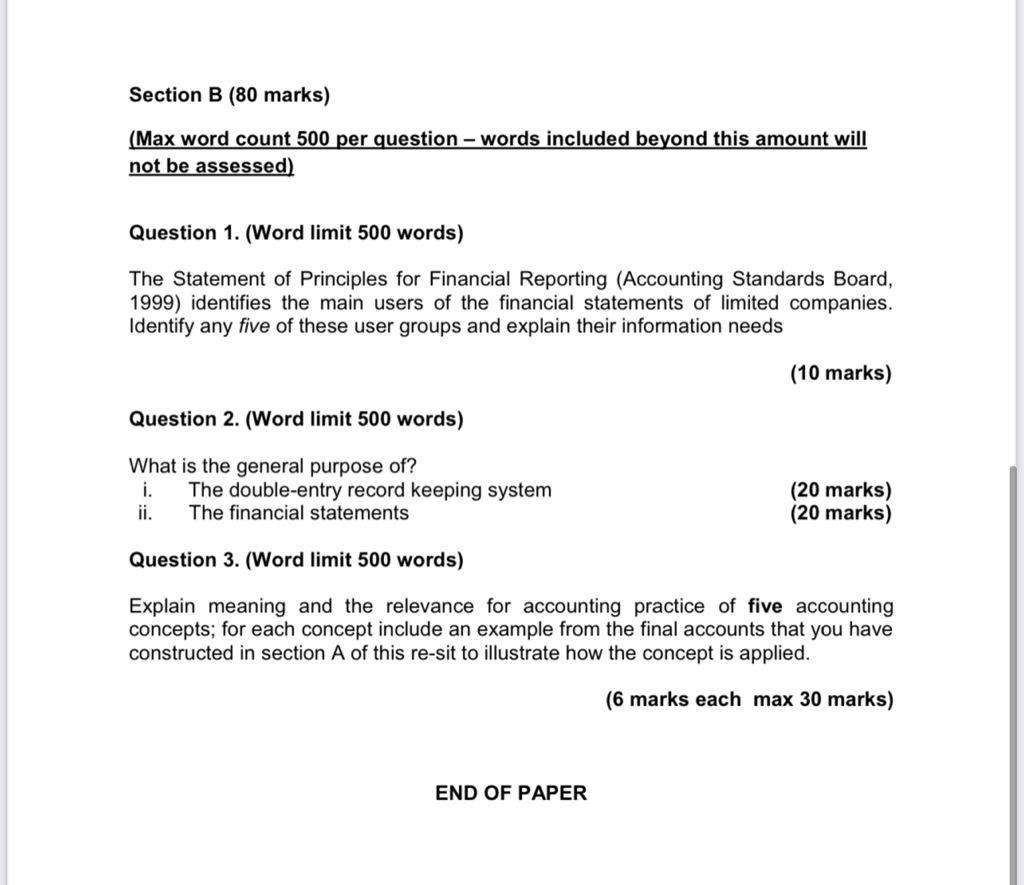

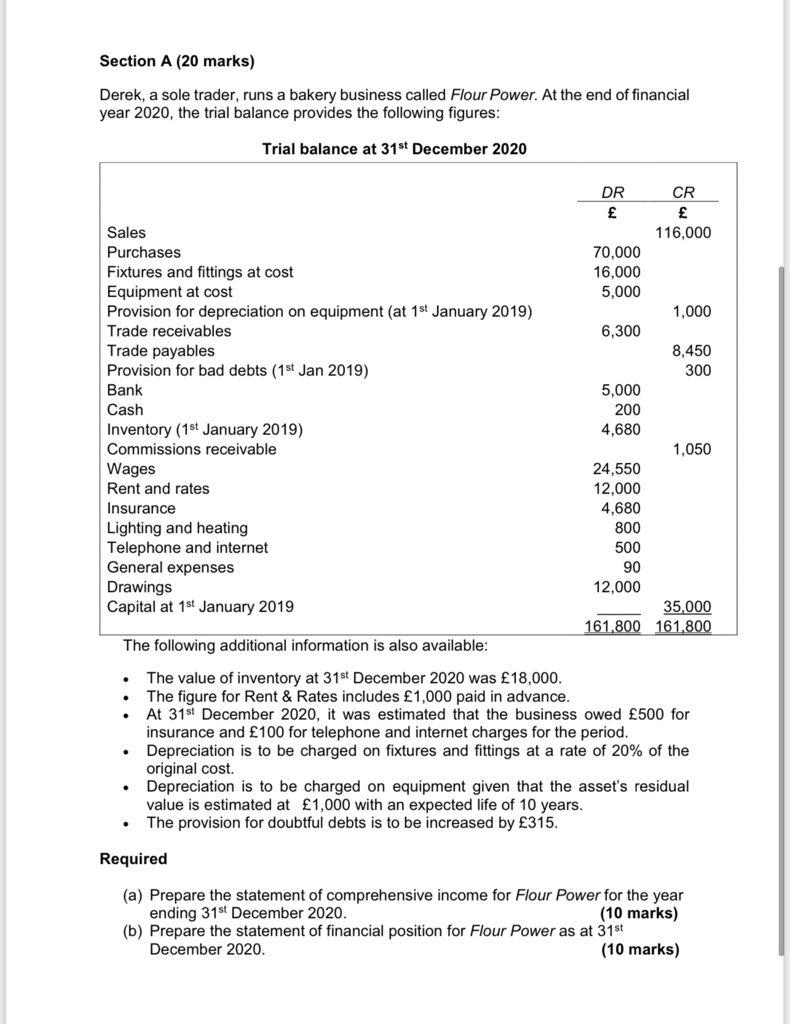

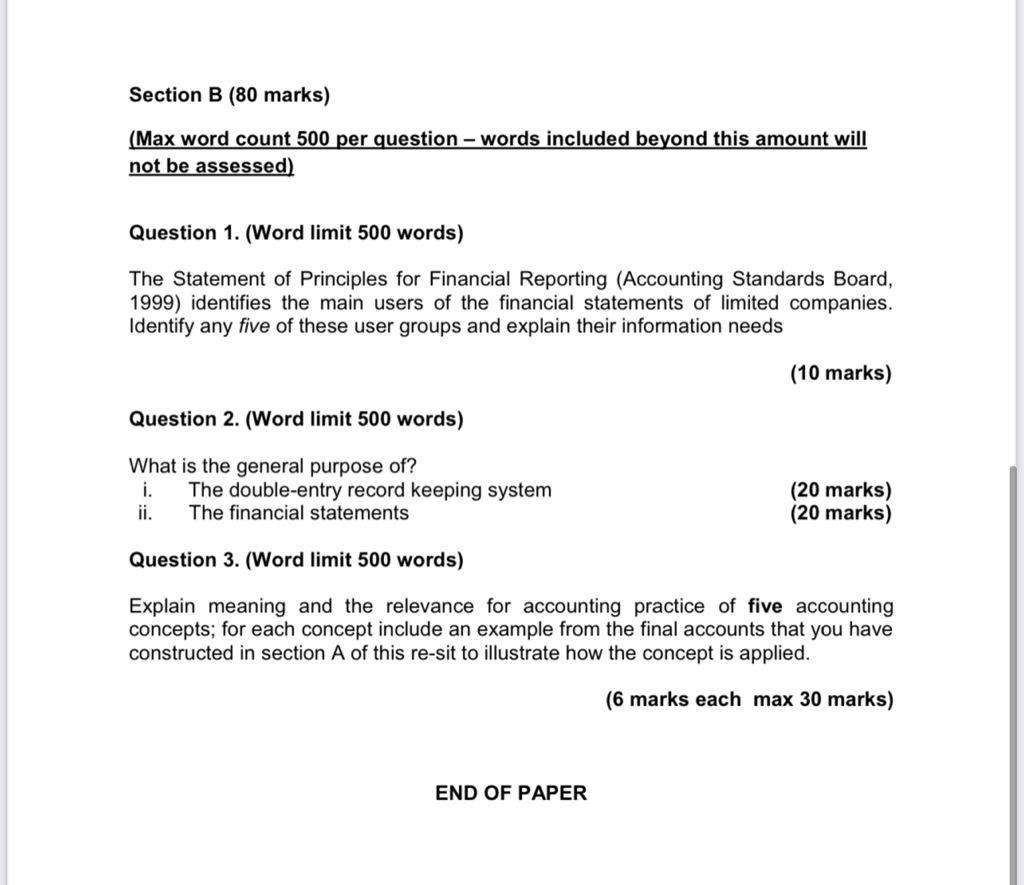

Section A (20 marks) Derek, a sole trader, runs a bakery business called Flour Power. At the end of financial year 2020, the trial balance provides the following figures: Trial balance at 31st December 2020 DR CR 116,000 70,000 16,000 5,000 1.000 6,300 8,450 300 Sales Purchases Fixtures and fittings at cost Equipment at cost Provision for depreciation on equipment (at 1st January 2019) Trade receivables Trade payables Provision for bad debts (1st Jan 2019) Bank Cash Inventory (1st January 2019) Commissions receivable Wages Rent and rates Insurance Lighting and heating Telephone and internet General expenses Drawings Capital at 1st January 2019 5,000 200 4,680 1,050 24,550 12.000 4,680 800 500 90 12,000 35,000 161.800 161,800 The following additional information is also available: The value of inventory at 31st December 2020 was 18,000. The figure for Rent & Rates includes 1,000 paid in advance. At 31st December 2020, it was estimated that the business owed 500 for insurance and 100 for telephone and internet charges for the period. Depreciation is to be charged on fixtures and fittings at a rate of 20% of the original cost. Depreciation is to be charged on equipment given that the asset's residual value is estimated at 1,000 with an expected life of 10 years. The provision for doubtful debts is to be increased by 315. Required (a) Prepare the statement of comprehensive income for Flour Power for the year ending 31st December 2020. (10 marks) (b) Prepare the statement of financial position for Flour Power as at 31st December 2020. (10 marks) Section B (80 marks) (Max word count 500 per question - words included beyond this amount will not be assessed) Question 1. (Word limit 500 words) The Statement of Principles for Financial Reporting (Accounting Standards Board, 1999) identifies the main users of the financial statements of limited companies. Identify any five of these user groups and explain their information needs (10 marks) Question 2. (Word limit 500 words) What is the general purpose of? The double-entry record keeping system ii. The financial statements (20 marks) (20 marks) Question 3. (Word limit 500 words) Explain meaning and the relevance for accounting practice of five accounting concepts; for each concept include an example from the final accounts that you have constructed in section A of this re-sit to illustrate how the concept is applied. (6 marks each max 30 marks) END OF PAPER