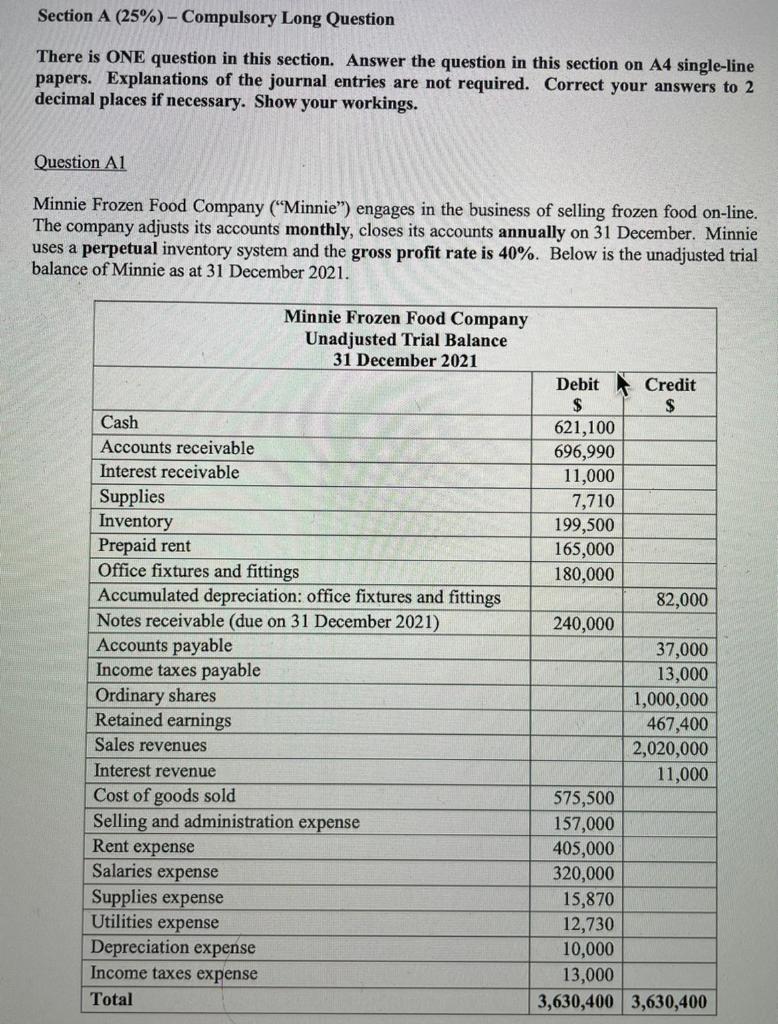

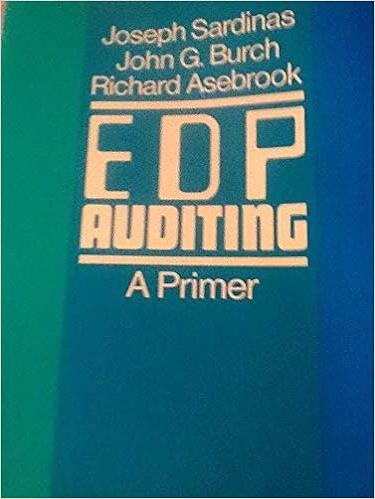

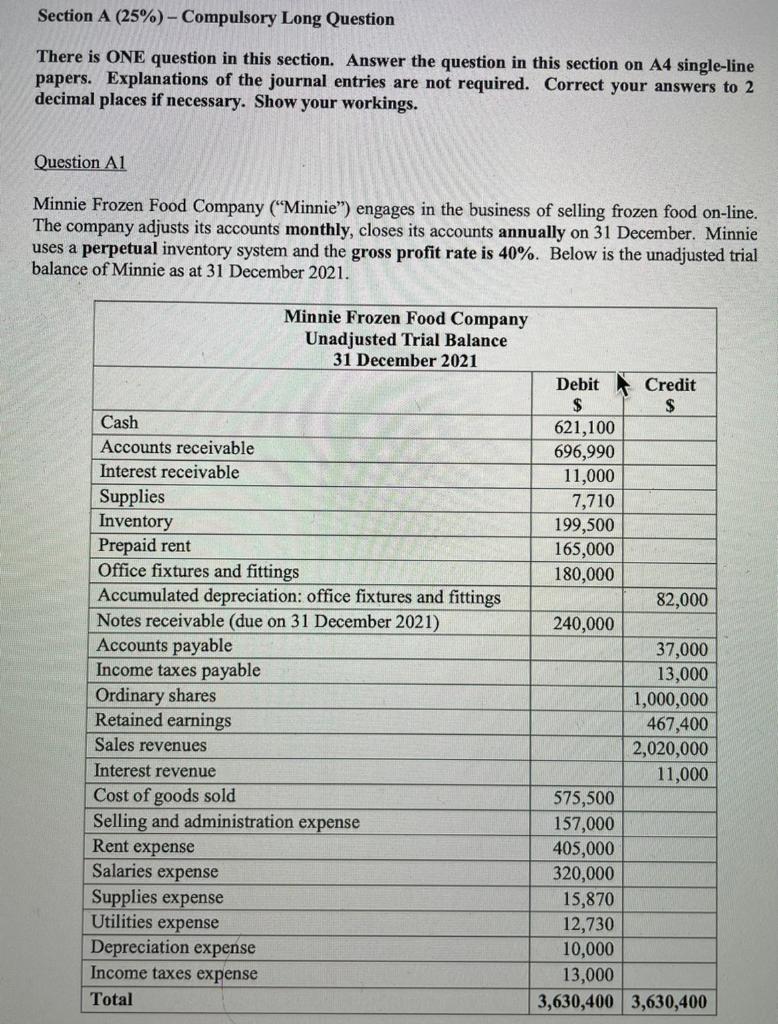

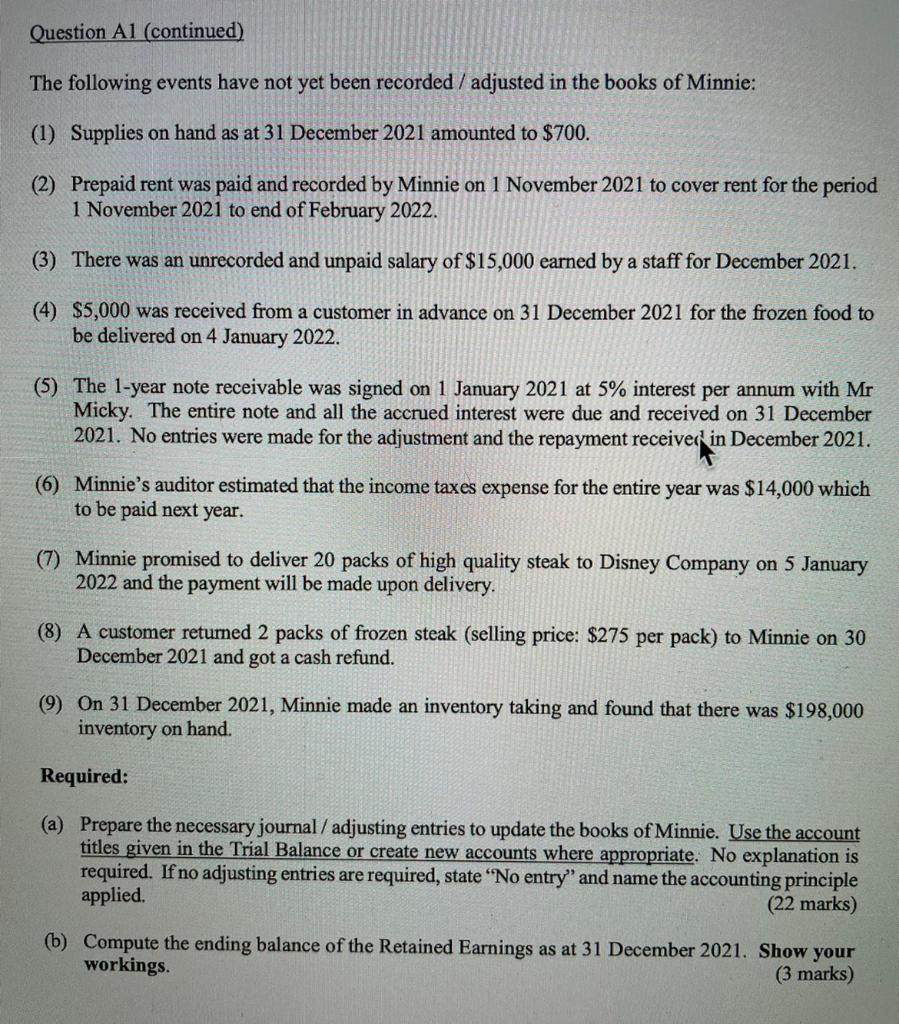

Section A (25%) - Compulsory Long Question There is ONE question in this section. Answer the question in this section on A4 single-line papers. Explanations of the journal entries are not required. Correct your answers to 2 decimal places if necessary. Show your workings. Question Al Minnie Frozen Food Company ("Minnie") engages in the business of selling frozen food on-line. The company adjusts its accounts monthly, closes its accounts annually on 31 December. Minnie uses a perpetual inventory system and the gross profit rate is 40%. Below is the unadjusted trial balance of Minnie as at 31 December 2021. Minnie Frozen Food Company Unadjusted Trial Balance 31 December 2021 Cash Accounts receivable Interest receivable Supplies Inventory Prepaid rent Office fixtures and fittings Accumulated depreciation: office fixtures and fittings Notes receivable (due on 31 December 2021) Accounts payable Income taxes payable Ordinary shares Retained earnings Sales revenues Interest revenue Cost of goods sold Selling and administration expense Rent expense Salaries expense Supplies expense Utilities expense Depreciation expense Income taxes expense Total Debit Credit $ $ 621,100 696,990 11,000 7,710 199,500 165,000 180,000 82,000 240,000 37,000 13,000 1,000,000 467,400 2,020,000 11,000 575,500 157,000 405,000 320,000 15,870 12,730 10,000 13,000 3,630,400 3,630,400 Question Al (continued) The following events have not yet been recorded / adjusted in the books of Minnie: (1) Supplies on hand as at 31 December 2021 amounted to $700. (2) Prepaid rent was paid and recorded by Minnie on 1 November 2021 to cover rent for the period 1 November 2021 to end of February 2022. (3) There was an unrecorded and unpaid salary of $15,000 earned by a staff for December 2021. (4) $5,000 was received from a customer in advance on 31 December 2021 for the frozen food to be delivered on 4 January 2022. (5) The 1-year note receivable was signed on 1 January 2021 at 5% interest per annum with Mr Micky. The entire note and all the accrued interest were due and received on 31 December 2021. No entries were made for the adjustment and the repayment receiver in December 2021. (6) Minnie's auditor estimated that the income taxes expense for the entire year was $14,000 which to be paid next year. (7) Minnie promised to deliver 20 packs of high quality steak to Disney Company on 5 January 2022 and the payment will be made upon delivery. (8) A customer returned 2 packs of frozen steak (selling price: $275 per pack) to Minnie on 30 December 2021 and got a cash refund. (9) On 31 December 2021, Minnie made an inventory taking and found that there was $198,000 inventory on hand. Required: (a) Prepare the necessary journal / adjusting entries to update the books of Minnie. Use the account titles given in the Trial Balance or create new accounts where appropriate. No explanation is required. If no adjusting entries are required, state "No entry" and name the accounting principle applied. (22 marks) (b) Compute the ending balance of the Retained Earnings as at 31 December 2021. Show your workings