Answered step by step

Verified Expert Solution

Question

1 Approved Answer

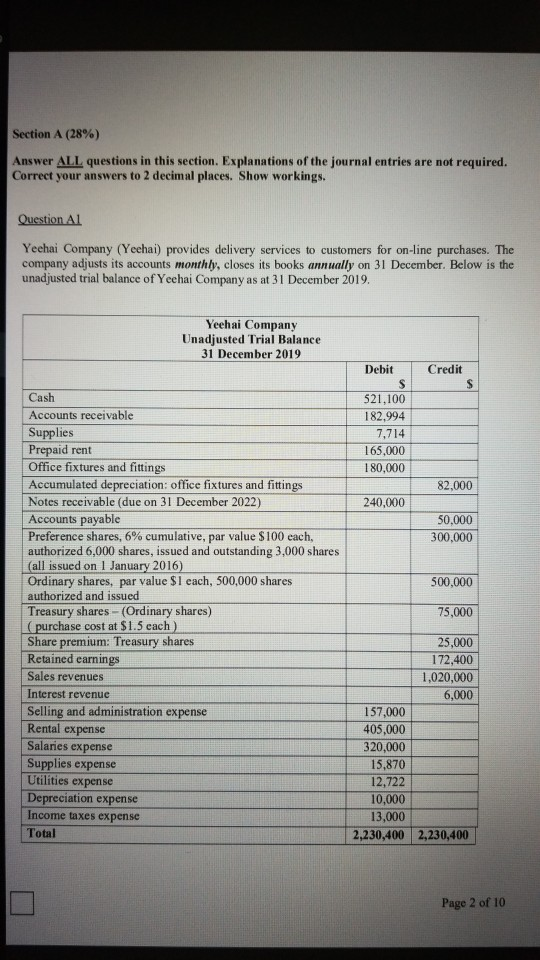

Section A (28%) Answer ALL questions in this section. Explanations of the journal entries are not required. Correct your answers to 2 decimal places. Show

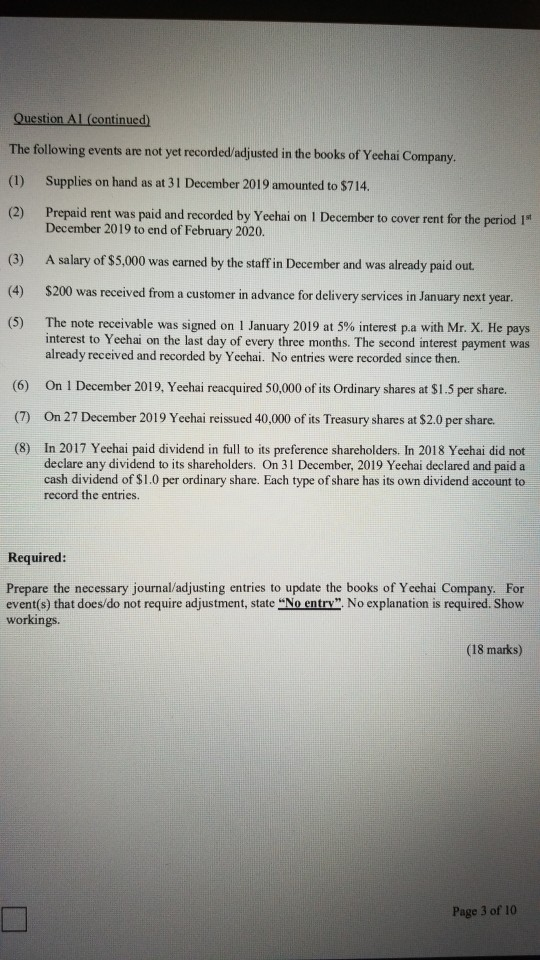

Section A (28%) Answer ALL questions in this section. Explanations of the journal entries are not required. Correct your answers to 2 decimal places. Show workings. Question Al Yeehai Company (Yeehai) provides delivery services to customers for on-line purchases. The company adjusts its accounts monthly, closes its books annually on 31 December. Below is the unadjusted trial balance of Yeehai Company as at 31 December 2019. Yeehai Company Unadjusted Trial Balance 31 December 2019 Credit S Debit S 521,100 182,994 7,714 165,000 180,000 82,000 240,000 50,000 300,000 500,000 Cash Accounts receivable Supplies Prepaid rent Office fixtures and fittings Accumulated depreciation: office fixtures and fittings Notes receivable (due on 31 December 2022) Accounts payable Preference shares, 6% cumulative, par value $100 each, authorized 6,000 shares, issued and outstanding 3,000 shares (all issued on 1 January 2016) Ordinary shares, par value $1 each, 500,000 shares authorized and issued Treasury shares - (Ordinary shares) (purchase cost at $1.5 each) Share premium: Treasury shares Retained earnings Sales revenues Interest revenue Selling and administration expense Rental expense Salaries expense Supplies expense Utilities expense Depreciation expense Income taxes expense Total 75,000 25,000 172,400 1,020,000 6,000 157,000 405,000 320,000 15,870 12,722 10,000 13,000 2,230,400 2,230,400 Page 2 of 10 Question Al (continued) The following events are not yet recorded/adjusted in the books of Yeehai Company (1) Supplies on hand as at 31 December 2019 amounted to $714. (2) Prepaid rent was paid and recorded by Yeehai on 1 December to cover rent for the period 1" December 2019 to end of February 2020. (3) A salary of $5,000 was earned by the staff in December and was already paid out. (4) $200 was received from a customer in advance for delivery services in January next year. (5) The note receivable was signed on 1 January 2019 at 5% interest p.a with Mr. X. He pays interest to Yeehai on the last day of every three months. The second interest payment was already received and recorded by Yechai. No entries were recorded since then. (6) On 1 December 2019, Yeehai reacquired 50,000 of its Ordinary shares at $1.5 per share. (7) On 27 December 2019 Yeehai reissued 40,000 of its Treasury shares at $2.0 per share. (8) In 2017 Yechai paid dividend in full to its preference shareholders. In 2018 Yeehai did not declare any dividend to its shareholders. On 31 December, 2019 Yeehai declared and paid a cash dividend of $1.0 per ordinary share. Each type of share has its own dividend account to record the entries. Required: Prepare the necessary journal/adjusting entries to update the books of Yeehai Company. For event(s) that does/do not require adjustment, state "No entry". No explanation is required. Show workings. (18 marks) Page 3 of 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started