Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Section A and B 1. Attempted: 0/1 Rebecca, a Singaporean, has just commenced employment as Managing Director with Pharma Sdn Bhd (a tax resident

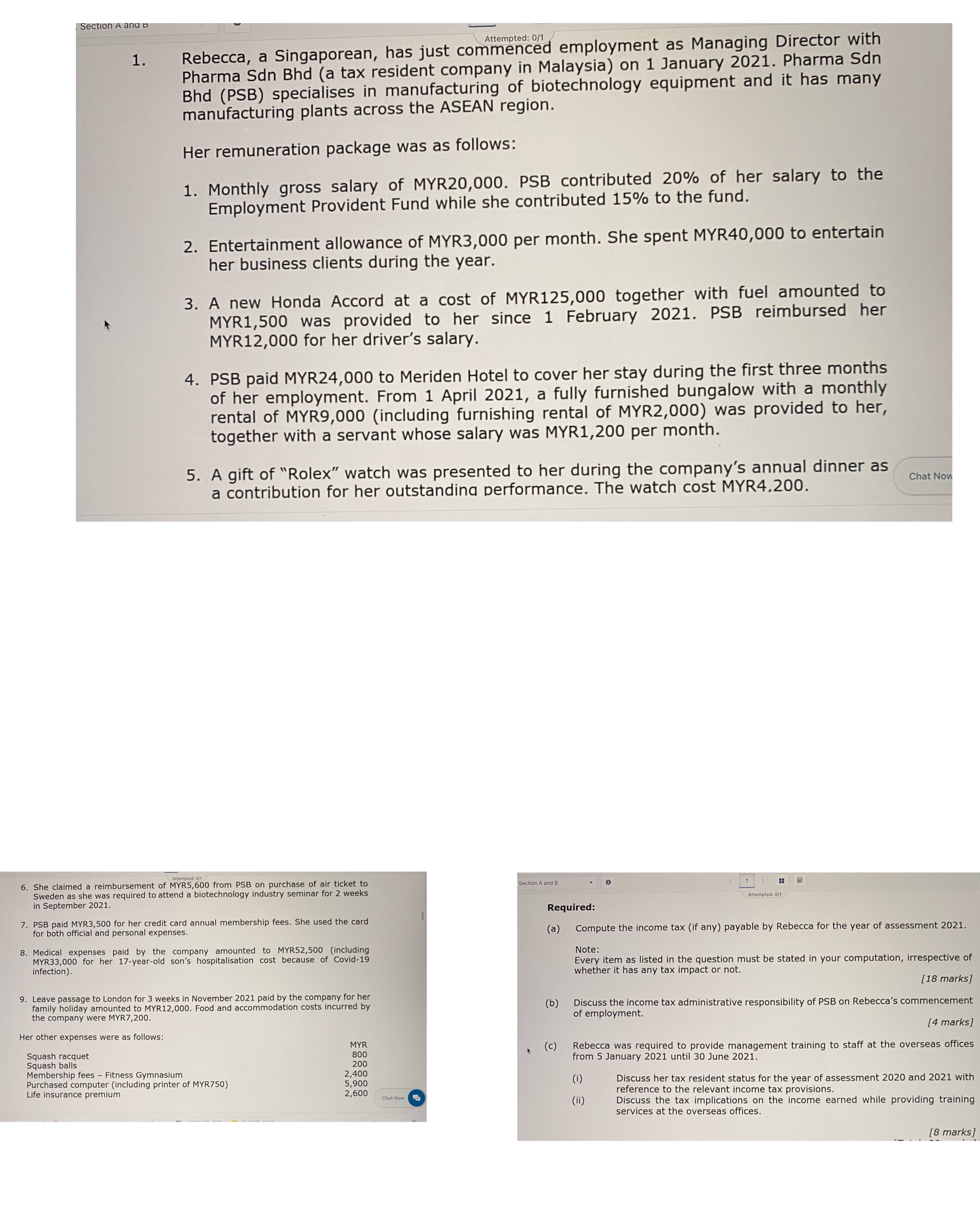

Section A and B 1. Attempted: 0/1 Rebecca, a Singaporean, has just commenced employment as Managing Director with Pharma Sdn Bhd (a tax resident company in Malaysia) on 1 January 2021. Pharma Sdn Bhd (PSB) specialises in manufacturing of biotechnology equipment and it has many manufacturing plants across the ASEAN region. Her remuneration package was as follows: 1. Monthly gross salary of MYR20,000. PSB contributed 20% of her salary to the Employment Provident Fund while she contributed 15% to the fund. 2. Entertainment allowance of MYR3,000 per month. She spent MYR40,000 to entertain her business clients during the year. 3. A new Honda Accord at a cost of MYR125,000 together with fuel amounted to MYR1,500 was provided to her since 1 February 2021. PSB reimbursed her MYR12,000 for her driver's salary. 4. PSB paid MYR24,000 to Meriden Hotel to cover her stay during the first three months of her employment. From 1 April 2021, a fully furnished bungalow with a monthly rental of MYR9,000 (including furnishing rental of MYR2,000) was provided to her, together with a servant whose salary was MYR1,200 per month. 5. A gift of "Rolex" watch was presented to her during the company's annual dinner as a contribution for her outstanding performance. The watch cost MYR4,200. Attempted: 0/1 6. She claimed a reimbursement of MYR5,600 from PSB on purchase of air ticket to Sweden as she was required to attend a biotechnology industry seminar for 2 weeks in September 2021. 7. PSB paid MYR3,500 for her credit card annual membership fees. She used the card for both official and personal expenses. 8. Medical expenses paid by the company amounted to MYR52,500 (including MYR33,000 for her 17-year-old son's hospitalisation cost because of Covid-19 infection). 9. Leave passage to London for 3 weeks in November 2021 paid by the company for her family holiday amounted to MYR12,000. Food and accommodation costs incurred by the company were MYR7,200. Her other expenses were as follows: Squash racquet Squash balls Membership fees - Fitness Gymnasium Purchased computer (including printer of MYR750) Life insurance premium MYR 800 200 2,400 5,900 2,600 Chat Now Section A and B + Required: (a) 1 (c) H Attempted: 0/1 F Chat Now Compute the income tax (if any) payable by Rebecca for the year of assessment 2021. Note: Every item as listed in the question must be stated in your computation, irrespective of whether it has any tax impact or not. [18 marks] (b) Discuss the income tax administrative responsibility of PSB on Rebecca's commencement of employment. [4 marks] Rebecca was required to provide management training to staff at the overseas offices from 5 January 2021 until 30 June 2021. (i) (ii) Discuss her tax resident status for the year of assessment 2020 and 2021 with reference to the relevant income tax provisions. Discuss the tax implications on the income earned while providing training services at the overseas offices. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets calculate the income tax payable by Rebecca for the year of assessment 2021 based on the provided information a Income Tax Computation for Rebecca for the Year of Assessment 2021 Monthly g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started