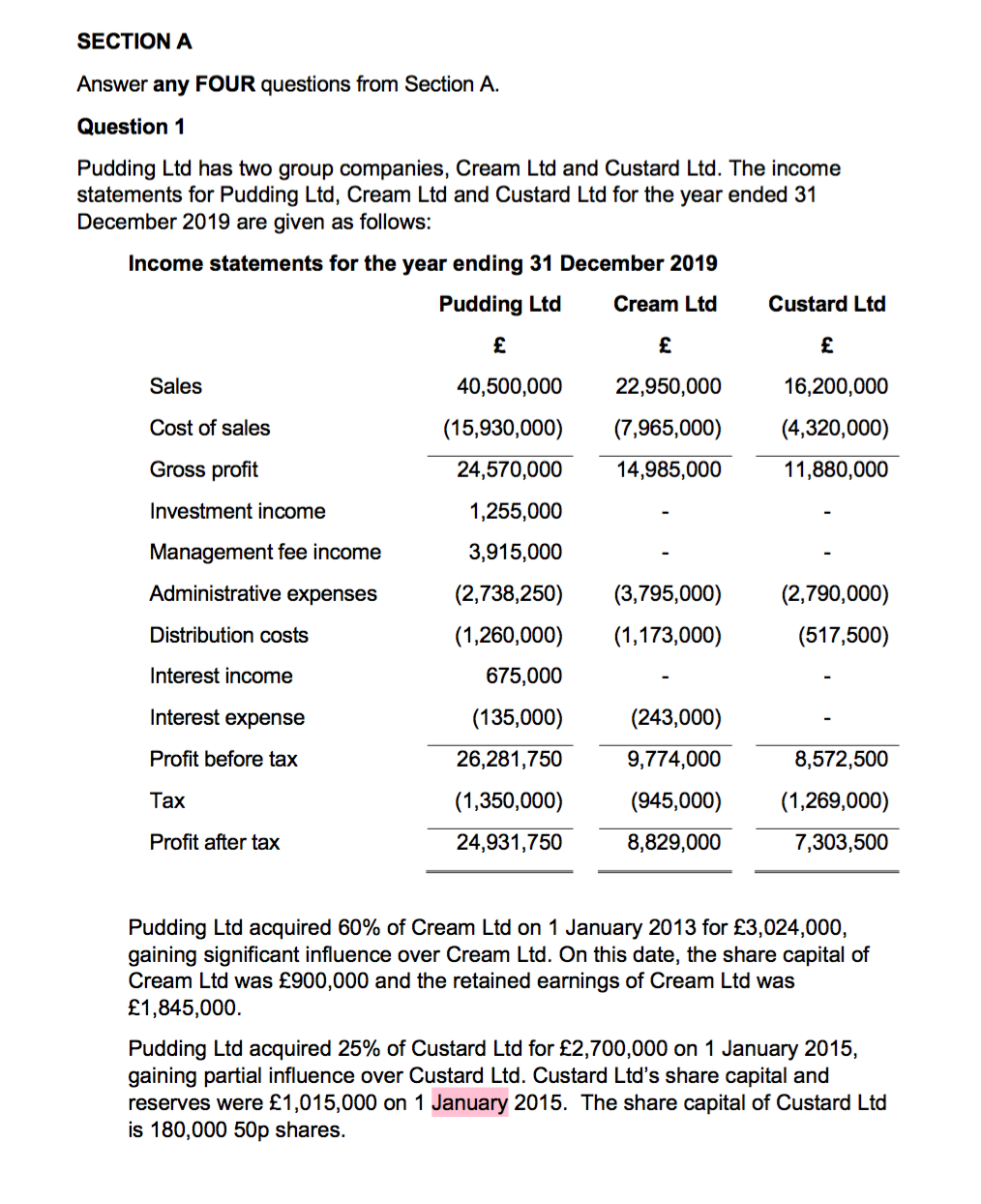

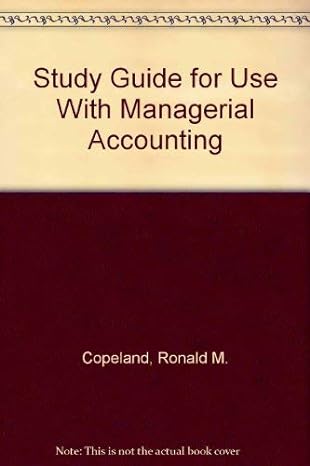

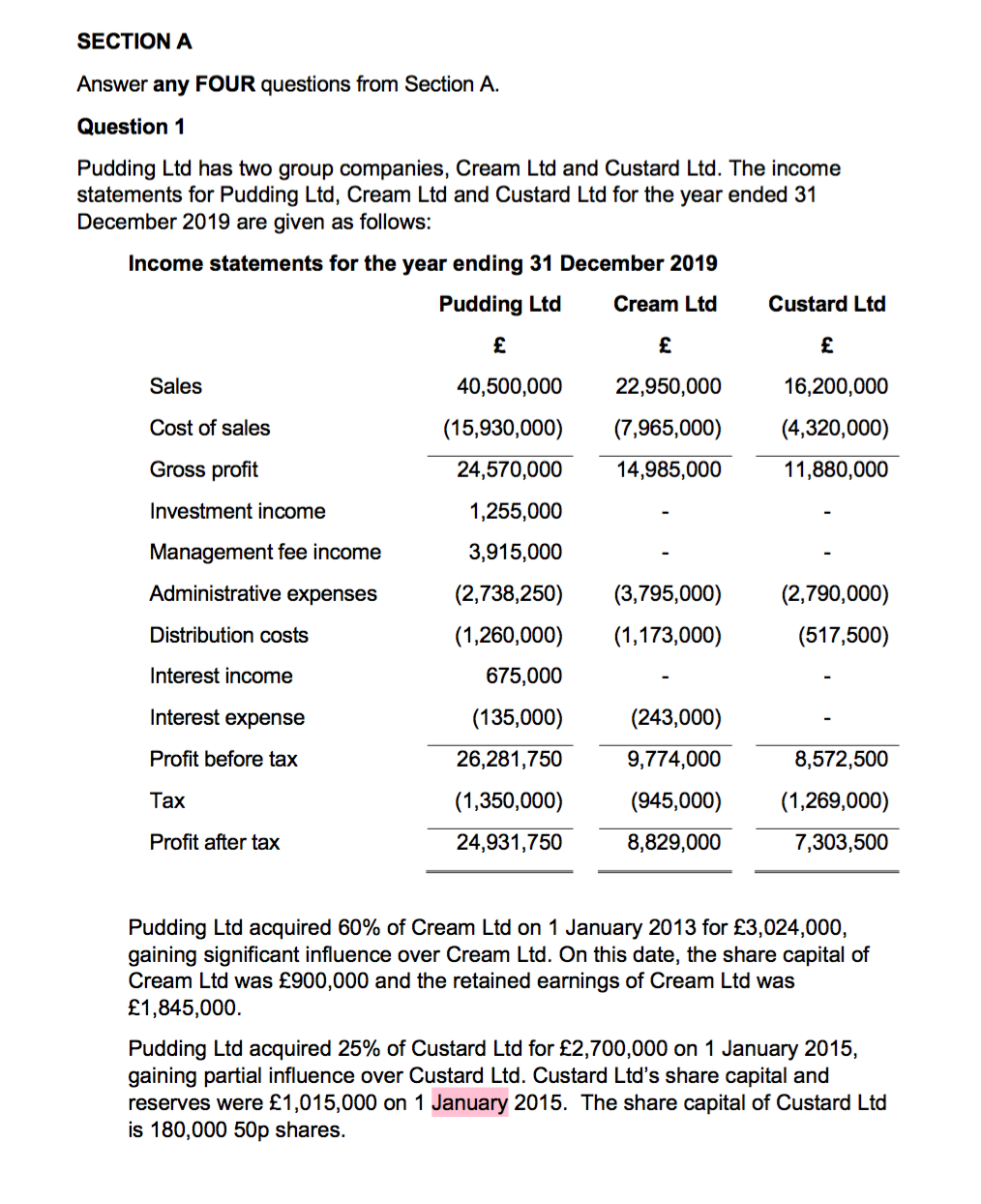

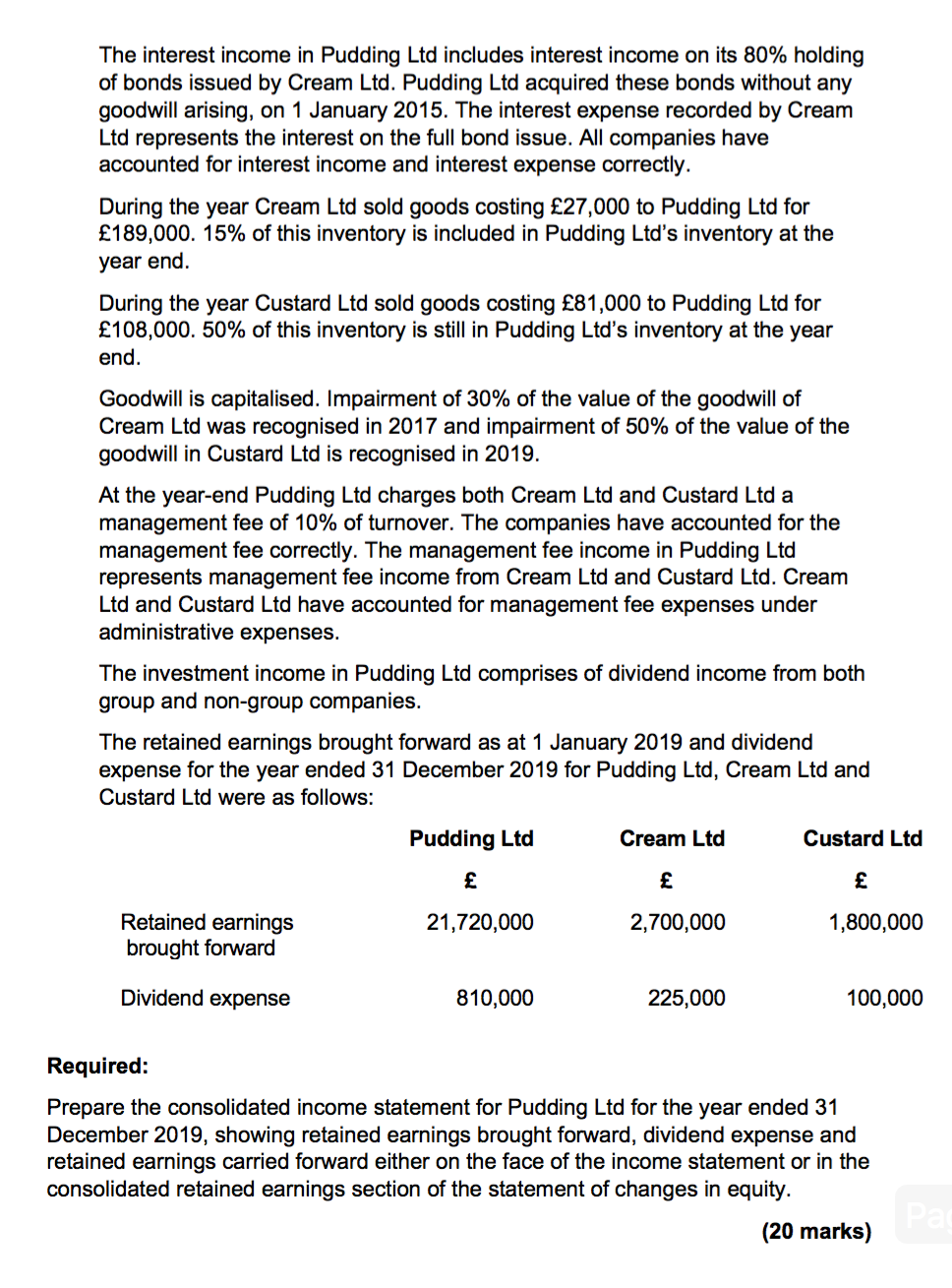

SECTION A Answer any FOUR questions from Section A. Question 1 Pudding Ltd has two group companies, Cream Ltd and Custard Ltd. The income statements for Pudding Ltd, Cream Ltd and Custard Ltd for the year ended 31 December 2019 are given as follows: Income statements for the year ending 31 December 2019 Pudding Ltd Cream Ltd Custard Ltd Sales 22,950,000 Cost of sales 40,500,000 (15,930,000) 24,570,000 (7,965,000) 14,985,000 16,200,000 (4,320,000) 11,880,000 Gross profit Investment income 1,255,000 Management fee income 3,915,000 Administrative expenses (2,738,250) (1,260,000) 675,000 (3,795,000) (1,173,000) (2,790,000) (517,500) Distribution costs Interest income Interest expense (135,000) (243,000) Profit before tax 26,281,750 9,774,000 8,572,500 (1,269,000) Tax (1,350,000) 24,931,750 (945,000) 8,829,000 Profit after tax 7,303,500 Pudding Ltd acquired 60% of Cream Ltd on 1 January 2013 for 3,024,000, gaining significant influence over Cream Ltd. On this date, the share capital of Cream Ltd was 900,000 and the retained earnings of Cream Ltd was 1,845,000. Pudding Ltd acquired 25% of Custard Ltd for 2,700,000 on 1 January 2015, gaining partial influence over Custard Ltd. Custard Ltd's share capital and reserves were 1,015,000 on 1 January 2015. The share capital of Custard Ltd is 180,000 50p shares. The interest income in Pudding Ltd includes interest income on its 80% holding of bonds issued by Cream Ltd. Pudding Ltd acquired these bonds without any goodwill arising, on 1 January 2015. The interest expense recorded by Cream Ltd represents the interest on the full bond issue. All companies have accounted for interest income and interest expense correctly. During the year Cream Ltd sold goods costing 27,000 to Pudding Ltd for 189,000. 15% of this inventory is included in Pudding Ltd's inventory at the year end. During the year Custard Ltd sold goods costing 81,000 to Pudding Ltd for 108,000. 50% of this inventory is still in Pudding Ltd's inventory at the year end. Goodwill is capitalised. Impairment of 30% of the value of the goodwill of Cream Ltd was recognised in 2017 and impairment of 50% of the value of the goodwill in Custard Ltd is reco ised in 2019. At the year-end Pudding Ltd charges both Cream Ltd and Custard Ltd a management fee of 10% of turnover. The companies have accounted for the management fee correctly. The management fee income in Pudding Ltd represents management fee income from Cream Ltd and Custard Ltd. Cream Ltd and Custard Ltd have accounted for management fee expenses under administrative expenses. The investment income in Pudding Ltd comprises of dividend income from both group and non-group companies. The retained earnings brought forward as at 1 January 2019 and dividend expense for the year ended 31 December 2019 for Pudding Ltd, Cream Ltd and Custard Ltd were as follows: Pudding Ltd Cream Ltd Custard Ltd 21,720,000 2,700,000 1,800,000 Retained earnings brought forward Dividend expense 810,000 225,000 100,000 Required: Prepare the consolidated income statement for Pudding Ltd for the year ended 31 December 2019, showing retained earnings brought forward, dividend expense and retained earnings carried forward either on the face of the income statement or in the consolidated retained earnings section of the statement of changes in equity. (20 marks) Pa SECTION A Answer any FOUR questions from Section A. Question 1 Pudding Ltd has two group companies, Cream Ltd and Custard Ltd. The income statements for Pudding Ltd, Cream Ltd and Custard Ltd for the year ended 31 December 2019 are given as follows: Income statements for the year ending 31 December 2019 Pudding Ltd Cream Ltd Custard Ltd Sales 22,950,000 Cost of sales 40,500,000 (15,930,000) 24,570,000 (7,965,000) 14,985,000 16,200,000 (4,320,000) 11,880,000 Gross profit Investment income 1,255,000 Management fee income 3,915,000 Administrative expenses (2,738,250) (1,260,000) 675,000 (3,795,000) (1,173,000) (2,790,000) (517,500) Distribution costs Interest income Interest expense (135,000) (243,000) Profit before tax 26,281,750 9,774,000 8,572,500 (1,269,000) Tax (1,350,000) 24,931,750 (945,000) 8,829,000 Profit after tax 7,303,500 Pudding Ltd acquired 60% of Cream Ltd on 1 January 2013 for 3,024,000, gaining significant influence over Cream Ltd. On this date, the share capital of Cream Ltd was 900,000 and the retained earnings of Cream Ltd was 1,845,000. Pudding Ltd acquired 25% of Custard Ltd for 2,700,000 on 1 January 2015, gaining partial influence over Custard Ltd. Custard Ltd's share capital and reserves were 1,015,000 on 1 January 2015. The share capital of Custard Ltd is 180,000 50p shares. The interest income in Pudding Ltd includes interest income on its 80% holding of bonds issued by Cream Ltd. Pudding Ltd acquired these bonds without any goodwill arising, on 1 January 2015. The interest expense recorded by Cream Ltd represents the interest on the full bond issue. All companies have accounted for interest income and interest expense correctly. During the year Cream Ltd sold goods costing 27,000 to Pudding Ltd for 189,000. 15% of this inventory is included in Pudding Ltd's inventory at the year end. During the year Custard Ltd sold goods costing 81,000 to Pudding Ltd for 108,000. 50% of this inventory is still in Pudding Ltd's inventory at the year end. Goodwill is capitalised. Impairment of 30% of the value of the goodwill of Cream Ltd was recognised in 2017 and impairment of 50% of the value of the goodwill in Custard Ltd is reco ised in 2019. At the year-end Pudding Ltd charges both Cream Ltd and Custard Ltd a management fee of 10% of turnover. The companies have accounted for the management fee correctly. The management fee income in Pudding Ltd represents management fee income from Cream Ltd and Custard Ltd. Cream Ltd and Custard Ltd have accounted for management fee expenses under administrative expenses. The investment income in Pudding Ltd comprises of dividend income from both group and non-group companies. The retained earnings brought forward as at 1 January 2019 and dividend expense for the year ended 31 December 2019 for Pudding Ltd, Cream Ltd and Custard Ltd were as follows: Pudding Ltd Cream Ltd Custard Ltd 21,720,000 2,700,000 1,800,000 Retained earnings brought forward Dividend expense 810,000 225,000 100,000 Required: Prepare the consolidated income statement for Pudding Ltd for the year ended 31 December 2019, showing retained earnings brought forward, dividend expense and retained earnings carried forward either on the face of the income statement or in the consolidated retained earnings section of the statement of changes in equity. (20 marks) Pa