Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION A COMPULSORY QUESTION 1 [50 MARKS] The statements of financial position of Jonjo Co and its investee companies, Phil Co and Sterling Co, at

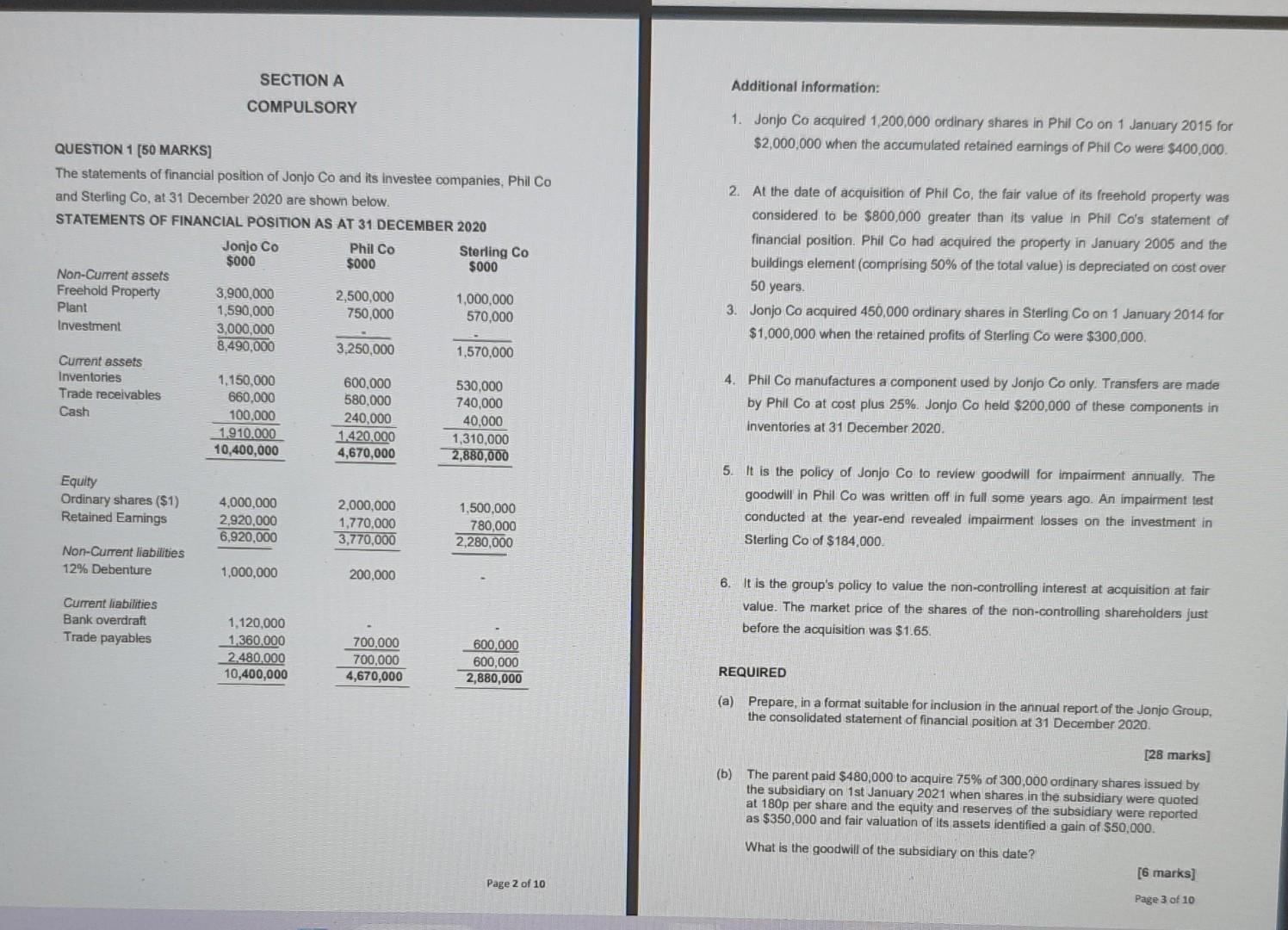

SECTION A COMPULSORY QUESTION 1 [50 MARKS] The statements of financial position of Jonjo Co and its investee companies, Phil Co and Sterling Co, at 31 December 2020 are shown below. STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 Additional information: 1. Jonjo Co acquired 1,200,000 ordinary shares in Phil Co on 1 January 2015 for $2,000,000 when the accumulated retained earnings of Phil Co were $400,000. 2. At the date of acquisition of Phil Co, the fair value of its freehold property was considered to be $800,000 greater than its value in Phil Co's statement of financial position. Phil Co had acquired the property in January 2005 and the buildings element (comprising 50% of the total value) is depreciated on cost over 50 years. 3. Jonjo Co acquired 450,000 ordinary shares in Sterling Co on 1 January 2014 for $1,000,000 when the retained profits of Sterling Co were $300,000. 4. Phil Co manufactures a component used by Jonjo Co only. Transfers are made by Phil Co at cost plus 25%. Jonjo Co held $200,000 of these components in inventories at 31 December 2020. 5. It is the policy of Jonjo Co to review goodwill for impaiment annually. The goodwill in Phil Co was written off in full some years ago. An impairment test conducted at the year-end revealed impairment losses on the investment in Sterling Co of $184,000. 6. It is the group's policy to value the non-controlling interest at acquisition at fair value. The market price of the shares of the non-controlling shareholders just before the acquisition was $1.65. REQUIRED (a) Prepare, in a format suitable for inclusion in the annual report of the Jonjo Group, the consolidated statement of financial position at 31 December 2020 . [28 marks] (b) The parent paid $480,000 to acquire 75% of 300,000 ordinary shares issued by the subsidiary on 1 st January 2021 when shares in the subsidiary were quoted at 180p per share and the equity and reserves of the subsidiary were reported as $350,000 and fair valuation of its assets identified a gain of $50,000. What is the goodwill of the subsidiary on this date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started