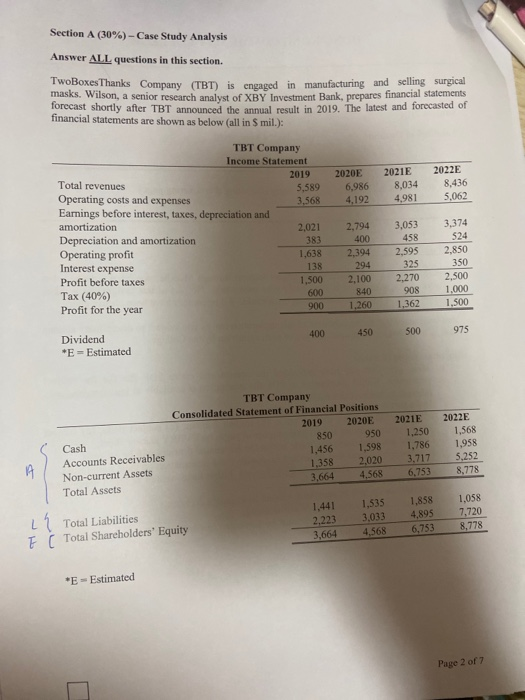

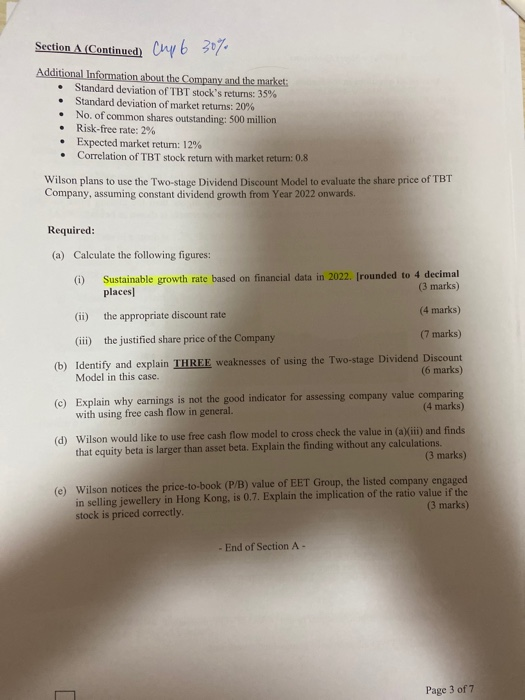

Section A (Continued) Chyb 30% Additional Information about the Company and the market: Standard deviation of TBT stock's returns: 35% Standard deviation of market returns: 20% No. of common shares outstanding: 500 million Risk-free rate: 2% Expected market return: 12% Correlation of TBT stock return with market return: 0.8 Wilson plans to use the Two-stage Dividend Discount Model to evaluate the share price of TBT Company, assuming constant dividend growth from Year 2022 onwards. Required: (a) Calculate the following figures: (1) Sustainable growth rate based on financial data in 2022. [rounded to 4 decimal places (3 marks) (ii) the appropriate discount rate (4 marks) (iii) the justified share price of the Company (7 marks) (b) Identify and explain THREE weaknesses of using the Two-stage Dividend Discount Model in this case. (6 marks) (c) Explain why earnings is not the good indicator for assessing company value comparing with using free cash flow in general. (4 marks) (d) Wilson would like to use free cash flow model to cross check the value in (aXiii) and finds that equity beta is larger than asset beta. Explain the finding without any calculations (3 marks) (e) Wilson notices the price-to-book (P/B) value of EET Group, the listed company engaged in selling jewellery in Hong Kong, is 0.7. Explain the implication of the ratio value if the stock is priced correctly. (3 marks) - End of Section A- Page 3 of 7 Section A (Continued) Chyb 30% Additional Information about the Company and the market: Standard deviation of TBT stock's returns: 35% Standard deviation of market returns: 20% No. of common shares outstanding: 500 million Risk-free rate: 2% Expected market return: 12% Correlation of TBT stock return with market return: 0.8 Wilson plans to use the Two-stage Dividend Discount Model to evaluate the share price of TBT Company, assuming constant dividend growth from Year 2022 onwards. Required: (a) Calculate the following figures: (1) Sustainable growth rate based on financial data in 2022. [rounded to 4 decimal places (3 marks) (ii) the appropriate discount rate (4 marks) (iii) the justified share price of the Company (7 marks) (b) Identify and explain THREE weaknesses of using the Two-stage Dividend Discount Model in this case. (6 marks) (c) Explain why earnings is not the good indicator for assessing company value comparing with using free cash flow in general. (4 marks) (d) Wilson would like to use free cash flow model to cross check the value in (aXiii) and finds that equity beta is larger than asset beta. Explain the finding without any calculations (3 marks) (e) Wilson notices the price-to-book (P/B) value of EET Group, the listed company engaged in selling jewellery in Hong Kong, is 0.7. Explain the implication of the ratio value if the stock is priced correctly. (3 marks) - End of Section A- Page 3 of 7