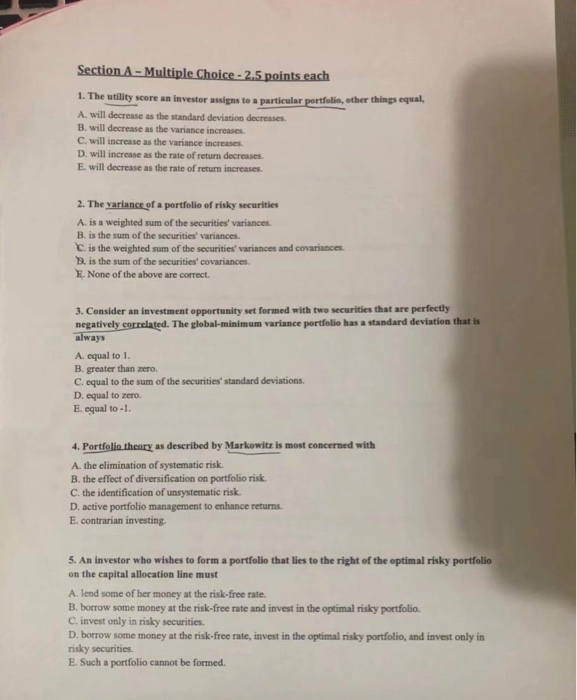

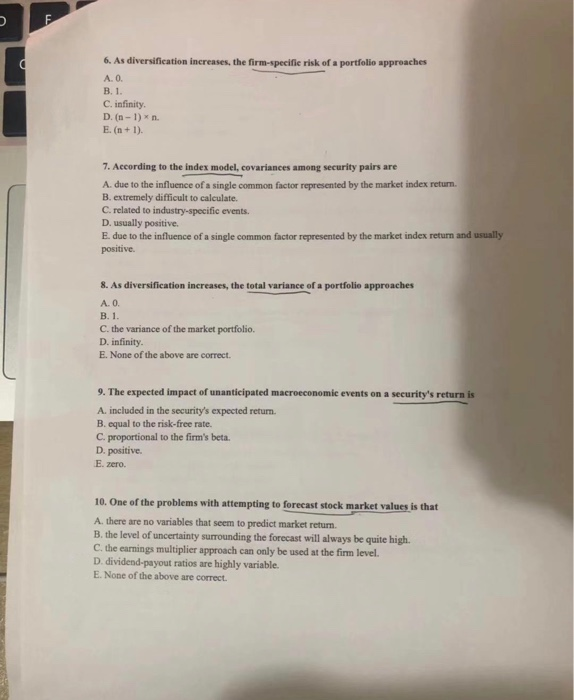

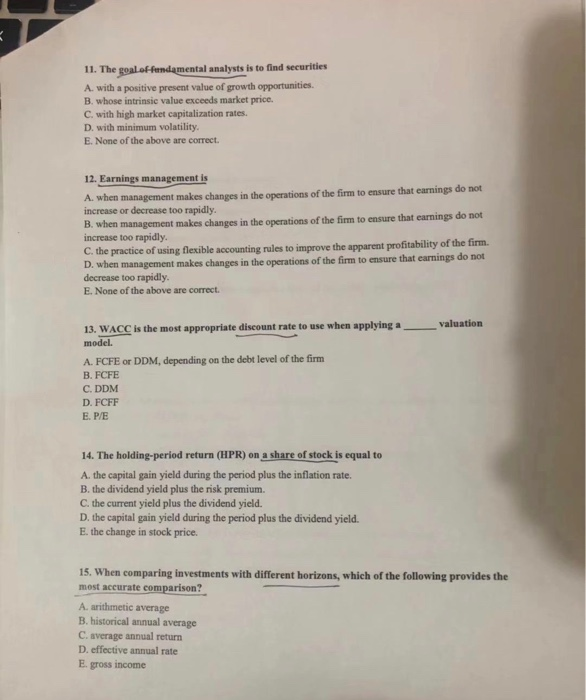

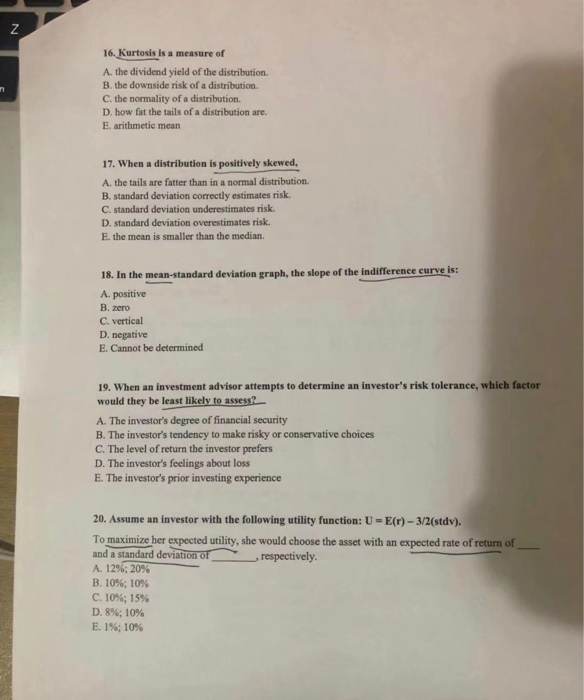

Section A - Multiple Choice - 2.5 points each 1. The utility score an investor assigns to a particular portfolio, other things equal, A. will decrease as the standard deviation decreases B. will decrease as the variance increases C. will increase as the variance increases D. will increase as the rate of return decreases E. will decrease as the rate of return increases 2. The variance of a portfolio of risky securities A. is a weighted sum of the securities' variances. B. is the sum of the securities' variances. C. is the weighted sum of the securities' variances and covariances B. is the sum of the securities' covariances. F. None of the above are correct. 3. Consider an investment opportunity set formed with two securities that are perfectly negatively correlated. The global-minimum variance portfolio has a standard deviation that is always A. equal to 1. B. greater than zero C. equal to the sum of the securities' standard deviations D. equal to zero. E. equal to -1. 4. Portfolio theory as described by Markowitz is most concerned with A. the elimination of systematic risk. B. the effect of diversification on portfolio risk. C. the identification of unsystematic risk. D. active portfolio management to enhance returns. E. contrarian investing. 5. An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the capital allocation line must A. lend some of her money at the risk-free rate. B. borrow some money at the risk-free rate and invest in the optimal risky portfolio C. invest only in risky securities. D. borrow some money at the risk-free rate, invest in the optimal risky portfolio, and invest only in risky securities E. Such a portfolio cannot be formed. 6. As diversification increases, the firm-specific risk of a portfolio approaches A. O B.1. C. infinity D. (n-1) n. E. (n + 1). 7. According to the index model, covariances among security pairs are A. due to the influence of a single common factor represented by the market index return B. extremely difficult to calculate. C. related to industry-specific events. D. usually positive. E. due to the influence of a single common factor represented by the market index return and usually positive 8. As diversification increases, the total variance of a portfolio approaches A. O B.1. C. the variance of the market portfolio. D. infinity E. None of the above are correct. 9. The expected impact of unanticipated macroeconomie events on a security's return is A. included in the security's expected return. B. equal to the risk-free rate. C. proportional to the firm's beta D. positive. Ezero. 10. One of the problems with attempting to forecast stock market values is that A. there are no variables that seem to predict market return. B. the level of uncertainty surrounding the forecast will always be quite high. C. the earnings multiplier approach can only be used at the firm level. D. dividend-payout ratios are highly variable. E. None of the above are correct. 11. The goal of fundamental analysts is to find securities A. with a positive present value of growth opportunities B. whose intrinsic value exceeds market price. C. with high market capitalization rates. D. with minimum volatility. E. None of the above are correct. 12. Earnings management is A. when management makes changes in the operations of the firm to ensure that earnings do not increase or decrease too rapidly. B. when management makes changes in the operations of the firm to ensure that earnings do not increase too rapidly. C. the practice of using flexible accounting rules to improve the apparent profitability of the firm D. when management makes changes in the operations of the firm to ensure that earnings do not decrease too rapidly. E. None of the above are correct. valuation 13. WACC is the most appropriate discount rate to use when applying a model. A. FCFE or DDM, depending on the debt level of the firm B. FCFE C. DDM D. FCFF E.P/E 14. The holding-period return (HPR) on a share of stock is equal to A. the capital gain yield during the period plus the inflation rate. B. the dividend yield plus the risk premium C. the current yield plus the dividend yield. D. the capital gain yield during the period plus the dividend yield. E. the change in stock price. 15. When comparing investments with different horizons, which of the following provides the most accurate comparison? A. arithmetic average B. historical annual average C. average annual return D. effective annual rate E gross income 16. Kurtosis is a measure of A. the dividend yield of the distribution B. the downside risk of a distribution C. the normality of a distribution. D. how fat the tails of a distribution are. E. arithmetic mean 17. When a distribution is positively skewed, A. the tails are fatter than in a normal distribution. B. standard deviation correctly estimates risk. C. standard deviation underestimates risk. D. standard deviation overestimates risk. E. the mean is smaller than the median. 18. In the mean-standard deviation graph, the slope of the indifference curve is: A. positive B. zero C. vertical D. negative E. Cannot be determined 19. When an investment advisor attempts to determine an investor's risk tolerance, which factor would they be least likely to assess? A. The investor's degree of financial security B. The investor's tendency to make risky or conservative choices C. The level of return the investor prefers D. The investor's feelings about loss E. The investor's prior investing experience 20. Assume an investor with the following utility function: U - E(r) - 3/2(stdv). To maximize her expected utility, she would choose the asset with an expected rate of return of and a standard deviation of respectively. A. 12920% B. 10%; 10% C. 10%; 15% D. 8%; 10% E.1%; 10%