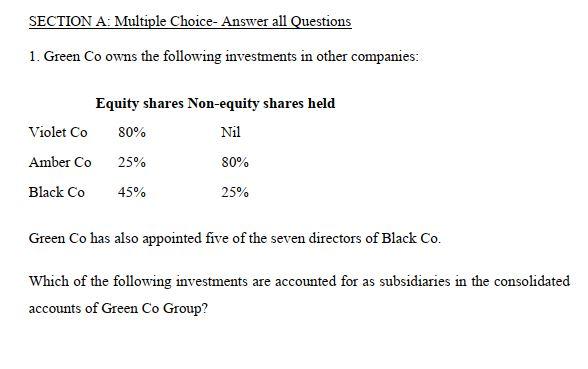

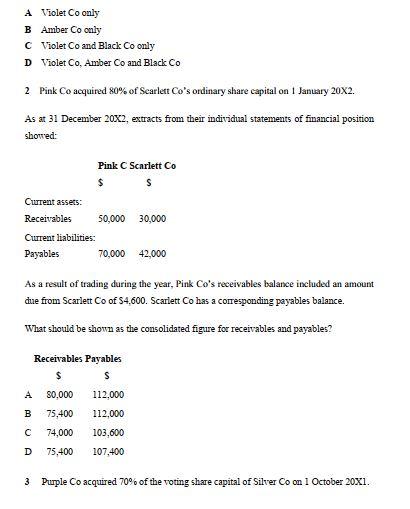

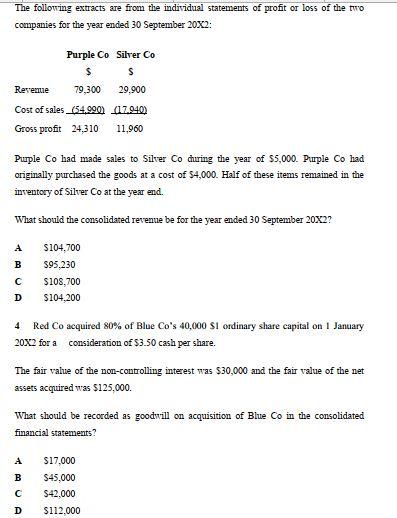

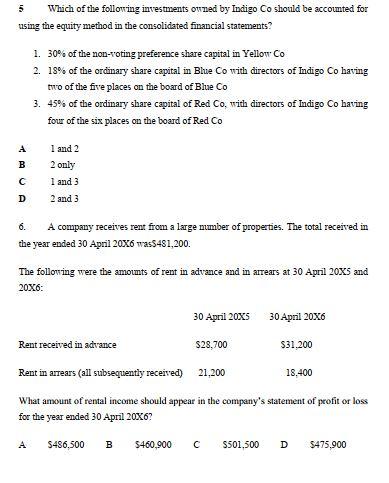

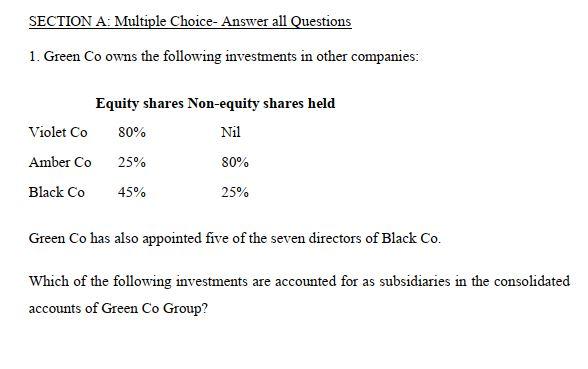

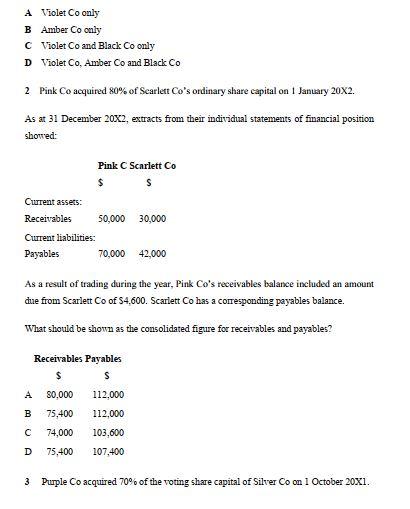

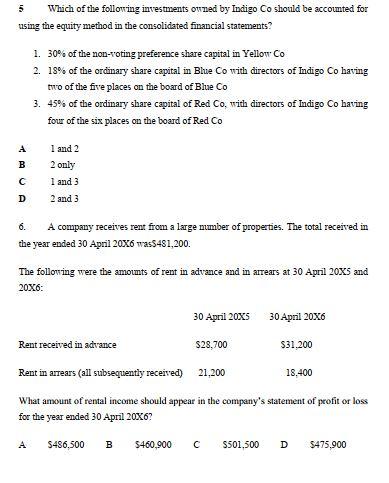

SECTION A: Multiple Choice- Answer all Questions 1. Green Co owns the following investments in other companies: Equity shares Non-equity shares held 80% Violet Co Nil Amber Co 25% 80% Black Co 45% 25% Green Co has also appointed five of the seven directors of Black Co. Which of the following investments are accounted for as subsidiaries in the consolidated accounts of Green Co Group? A Violet Co only B Amber Co only C Violet Co and Black Co only D Violet Co. Amber Co and Black Co 2. Pink Co acquired 80% of Searlett Co's ordinary share capital on 1 January 20x2. As at 31 December 20X2, extracts from their individual statements of financial position showed: Pink C Scarlett Co $ S 30,000 Cwrent assets: Receivables 50,000 Current liabilities: Payables 70,000 42.000 As a result of trading during the year, Pink Co's receivables balance included an amount due from Scarlett Co of 54.600. Scarlett Co has a corresponding payables balance. What should be shown as the consolidated figure for receivables and payables ? Receivables Payables $ S A 80.000 75,400 B 112.000 112,000 103,600 107,400 74,000 D 75.400 3 Purple Co acquired 70% of the voting share capital of Silver Co on 1 October 20X1. The following extracts are from the individual statements of profit or loss of the two companies for the year ended 30 September 20X2: Purple Co Silver Co $ S Revenue 79,300 29.900 Cost of sales_654.990) (17.940) Gross profit 24,310 11,960 Purple Co had made sales to Silver Co during the year of $5,000. Purple Co had originally purchased the goods at a cost of 54,000. Half of these items remained in the inventory of Silver Co at the year end. What should the consolidated revenue be for the year ended 30 September 20X2? A B $104,700 $95.230 $108,700 $104,200 D 4 Red Co acquired 80% of Blue Co's 40,000 SI ordinary share capital on 1 January 20x2 for a consideration of $3.50 cash per share. The fair value of the non-controlling interest was $30,000 and the fair value of the net assets acquired was $125,000. What should be recorded as goodwill on acquisition of Blue Co in the consolidated financial statements? B $17,000 $45,000 S42.000 $112.000 D Which of the following investments owned by Indigo Co should be accounted for using the equity method in the consolidated financial statements? 1. 30% of the non-roting preference share capital in Yellow Co 2. 18% of the ordinary share capital in Blue Co with directors of Indigo Co having two of the five places on the board of Blue Co 3. 45% of the ordinary share capital of Red Co. with directors of Indigo Co having four of the six places on the board of Red Co 29 1 and 2 2 only 1 and 3 2 and 3 D 6. A company receives rent from a large number of properties. The total received in the year ended 30 April 20X6 was 5481,200 The following were the amounts of rent in advance and in arrears at 30 April 20x5 and 20x6: 30 April 20x5 30 April 20X6 Rent received in advance $28,700 $31,200 Rent in artears (all subsequently received) 21,200 18.400 What amount of rental income should appear in the company's statement of profit or loss for the year ended 30 April 20X6? A $486,500 B 5460,900 S501,500 D $475,900