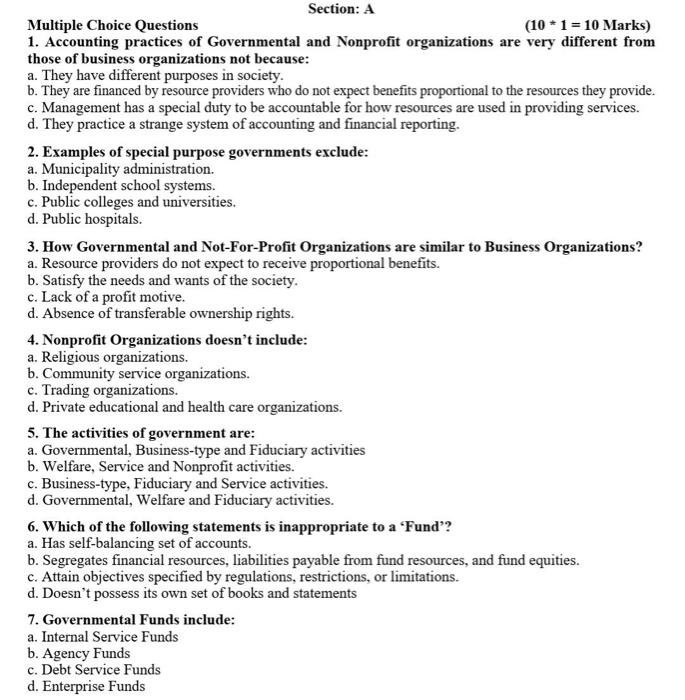

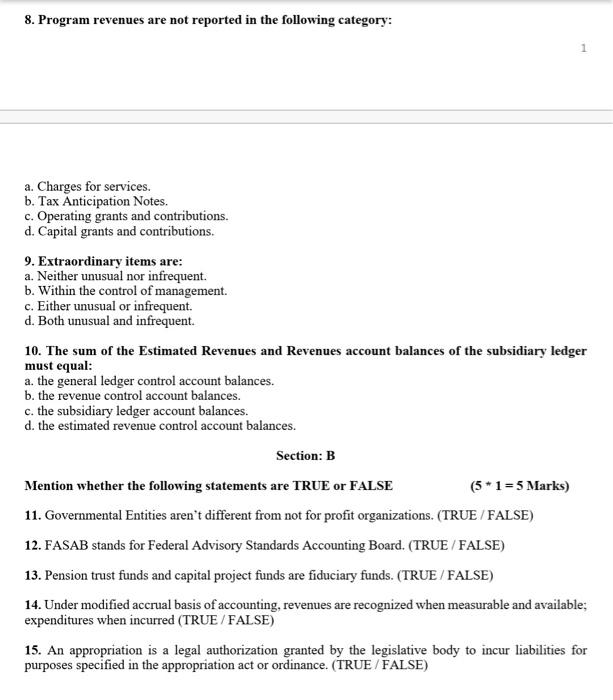

Section: A Multiple Choice Questions (10 + 1 = 10 Marks) 1. Accounting practices of Governmental and Nonprofit organizations are very different from those of business organizations not because: a. They have different purposes in society. b. They are financed by resource providers who do not expect benefits proportional to the resources they provide. c. Management has a special duty to be accountable for how resources are used in providing services. d. They practice a strange system of accounting and financial reporting. 2. Examples of special purpose governments exclude: a. Municipality administration. b. Independent school systems. c. Public colleges and universities. d. Public hospitals. 3. How Governmental and Not-For-Profit Organizations are similar to Business Organizations? a. Resource providers do not expect to receive proportional benefits. b. Satisfy the needs and wants of the society. c. Lack of a profit motive. d. Absence of transferable ownership rights. 4. Nonprofit Organizations doesn't include: a. Religious organizations. b. Community service organizations. c. Trading organizations. d. Private educational and health care organizations. 5. The activities of government are: a. Governmental, Business-type and Fiduciary activities b. Welfare, Service and Nonprofit activities. c. Business-type, Fiduciary and Service activities. d. Governmental, Welfare and Fiduciary activities. 6. Which of the following statements is inappropriate to a 'Fund? a. Has self-balancing set of accounts. b. Segregates financial resources, liabilities payable from fund resources, and fund equities. c. Attain objectives specified by regulations, restrictions, or limitations. d. Doesn't possess its own set of books and statements 7. Governmental Funds include: a. Internal Service Funds b. Agency Funds c. Debt Service Funds d. Enterprise Funds 8. Program revenues are not reported in the following category: 1 a. Charges for services. b. Tax Anticipation Notes. c. Operating grants and contributions. d. Capital grants and contributions. 9. Extraordinary items are: a. Neither unusual nor infrequent. b. Within the control of management. c. Either unusual or infrequent d. Both unusual and infrequent. 10. The sum of the Estimated Revenues and Revenues account balances of the subsidiary ledger must equal: a. the general ledger control account balances. b. the revenue control account balances. c. the subsidiary ledger account balances. d. the estimated revenue control account balances. Section: B Mention whether the following statements are TRUE or FALSE (5*1 = 5 Marks) 11. Governmental Entities aren't different from not for profit organizations. (TRUE / FALSE) 12. FASAB stands for Federal Advisory Standards Accounting Board. (TRUE / FALSE) 13. Pension trust funds and capital project funds are fiduciary funds. (TRUE / FALSE) 14. Under modified accrual basis of accounting, revenues are recognized when measurable and available: expenditures when incurred (TRUE / FALSE) 15. An appropriation is a legal authorization granted by the legislative body to incur liabilities for purposes specified in the appropriation act or ordinance. (TRUE / FALSE)