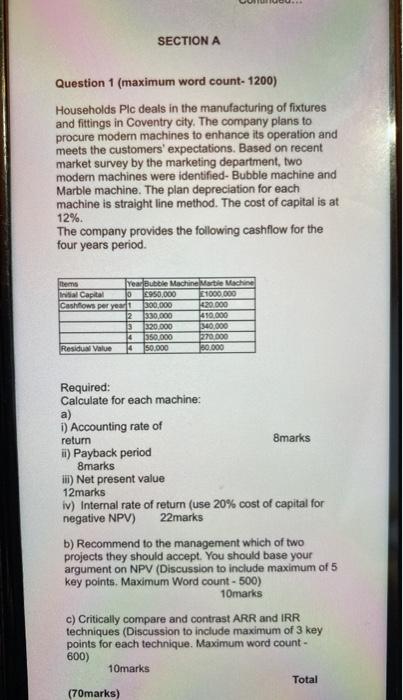

SECTION A Question 1 (maximum word count- 1200) Households Plc deals in the manufacturing of fixtures and fittings in Coventry city. The company plans to procure modern machines to enhance its operation and meets the customers' expectations. Based on recent market survey by the marketing department, two modern machines were identified- Bubble machine and Marble machine. The plan depreciation for each machine is straight line method. The cost of capital is at 12%. The company provides the following cashflow for the four years period nem Year Bubble Machine Marble Machine Inicial Capital 10 8950,000 1000.000 Cashflows per year 300,000 120.000 12 330.000 410.000 3 320.000 300.000 14 350.000 170 000 Residus Value 14 50.000 180.000 Required: Calculate for each machine: a) 1) Accounting rate of return Bmarks ) Payback period 8marks ill) Net present value 12marks iv) Internal rate of return (use 20% cost of capital for negative NPV) 22 marks b) Recommend to the management which of two projects they should accept. You should base your argument on NPV (Discussion to include maximum of 5 key points. Maximum Word count - 500) 10marks c) Critically compare and contrast ARR and IRR techniques (Discussion to include maximum of 3 key points for each technique. Maximum word count - 600) 10marks Total (70marks) SECTION A Question 1 (maximum word count- 1200) Households Plc deals in the manufacturing of fixtures and fittings in Coventry city. The company plans to procure modern machines to enhance its operation and meets the customers' expectations. Based on recent market survey by the marketing department, two modern machines were identified- Bubble machine and Marble machine. The plan depreciation for each machine is straight line method. The cost of capital is at 12%. The company provides the following cashflow for the four years period nem Year Bubble Machine Marble Machine Inicial Capital 10 8950,000 1000.000 Cashflows per year 300,000 120.000 12 330.000 410.000 3 320.000 300.000 14 350.000 170 000 Residus Value 14 50.000 180.000 Required: Calculate for each machine: a) 1) Accounting rate of return Bmarks ) Payback period 8marks ill) Net present value 12marks iv) Internal rate of return (use 20% cost of capital for negative NPV) 22 marks b) Recommend to the management which of two projects they should accept. You should base your argument on NPV (Discussion to include maximum of 5 key points. Maximum Word count - 500) 10marks c) Critically compare and contrast ARR and IRR techniques (Discussion to include maximum of 3 key points for each technique. Maximum word count - 600) 10marks Total (70marks)