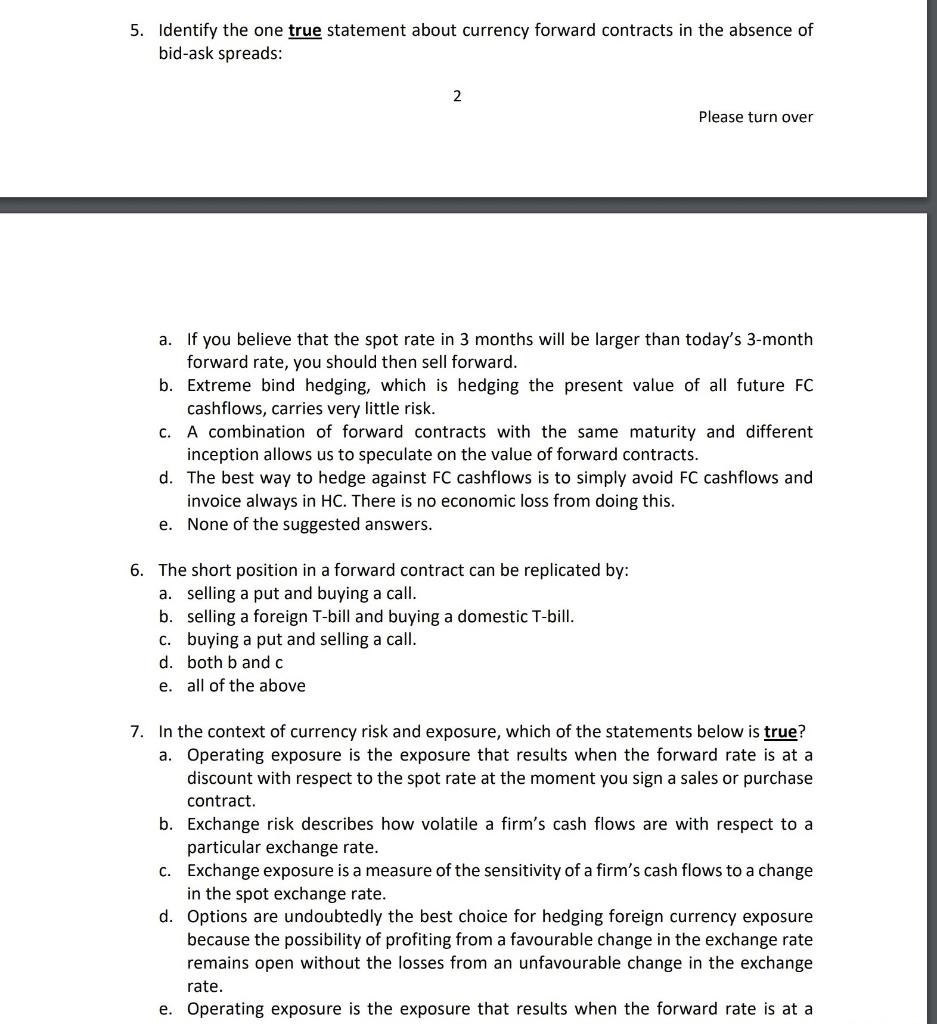

SECTION A SECTION A CONSISTS OF MULTIPLE CHOICE QUESTIONS (MCQs) 1 TO 10. ANSWER ALL QUESTIONS. EACH QUESTION IS WORTH 3 MARKS. THERE IS NO PENALTY FOR AN INCORRECT ANSWER. 1. Identify the one false statement about bid/ask spreads: a. The bid-ask spread increases in the liquidity of the currency that you transact in, i.e., the more liquid a foreign currency the higher the bid-ask spread. b. The terms "bid" and "ask" are from the perspective of the bank, i.e., the bank bids an amount of home currency for one unit of foreign currency and the bank asks an amount of home currency for one unit of foreign currency. c. The bid-ask spread increases in the time-to-maturity of a forward contract, i.e., the longer the time-to-delivery the higher the bid-ask spread. d. As the customer of a bank, you always transact at the less favourable rate, i.e., you buy at the ask rate and you sell at the bid rate. e. When the currency you transact in is in the denominator (as is always the case in our textbook), the bid rate is lower than the ask rate. 2. Identify the one false statement about the current banking system: a. In foreign exchange markets, a market maker in one currency pair is a commercial bank obliged to state a bid and an ask rate for this currency pair b. As foreign exchange markets are de-centralized, you can always buy or sell foreign currency during working days, even on, e.g., Thursday 1am. c. In foreign exchange markets, foreign exchange dealers always state the name instead of the dimension of the currency pair they want to trade in. d. The wholesale tier of the foreign exchange markets consists exclusively of a number of large commercial banks. e. At each point in time, the limit order book shows the best bid and ask quote. 3. Identify the one true statement about the covered interest parity (CIP) theory: a. CIP says that synthetic forward rates and direct forward rates should be equal. b. CIP is not reliable as it only takes into account the domestic interest rate. c. CIP always holds. d. CIP takes into account transaction costs. e. None of the suggested answers. 4. Identify the one false statement about futures: a. Futures are traded on organised markets. b. Futures are standardised contracts. C. Futures have zero initial value. d. Trading with futures will result in a margin call. e. Marking to market is a primitive version of daily re-contracting, where the discounting is omitted. 5. Identify the one true statement about currency forward contracts in the absence of bid-ask spreads: 2 Please turn over a. If you believe that the spot rate in 3 months will be larger than today's 3-month forward rate, you should then sell forward. b. Extreme bind hedging, which is hedging the present value of all future FC cashflows, carries very little risk. c. A combination of forward contracts with the same maturity and different inception allows us to speculate on the value of forward contracts. d. The best way to hedge against FC cashflows is to simply avoid FC cashflows and invoice always in HC. There is no economic loss from doing this. e. None of the suggested answers. 6. The short position in a forward contract can be replicated by: a. selling a put and buying a call. b. selling a foreign T-bill and buying a domestic T-bill. c. buying a put and selling a call. d. both b and c e. all of the above 7. In the context of currency risk and exposure, which of the statements below is true? a. Operating exposure is the exposure that results when the forward rate is at a discount with respect to the spot rate at the moment you sign a sales or purchase contract. b. Exchange risk describes how volatile a firm's cash flows are with respect to a particular exchange rate. c. Exchange exposure is a measure of the sensitivity of a firm's cash flows to a change in the spot exchange rate. d. Options are undoubtedly the best choice for hedging foreign currency exposure because the possibility of profiting from a favourable change in the exchange rate remains open without the losses from an unfavourable change in the exchange rate. e. Operating exposure is the exposure that results when the forward rate is at a