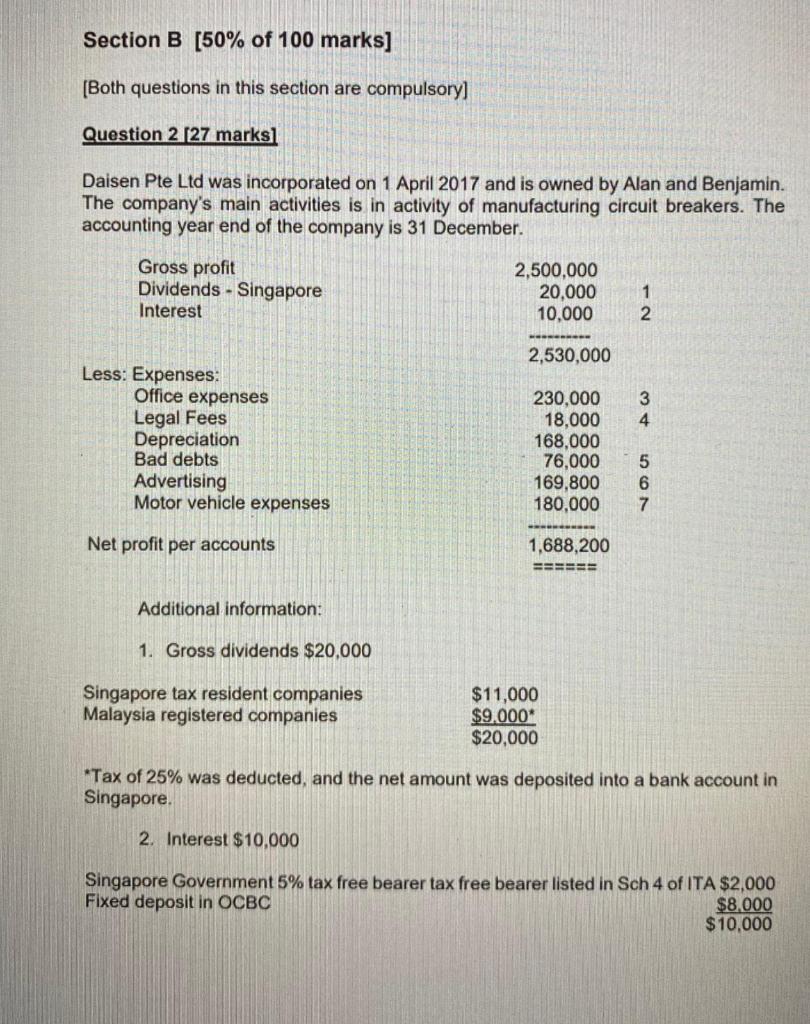

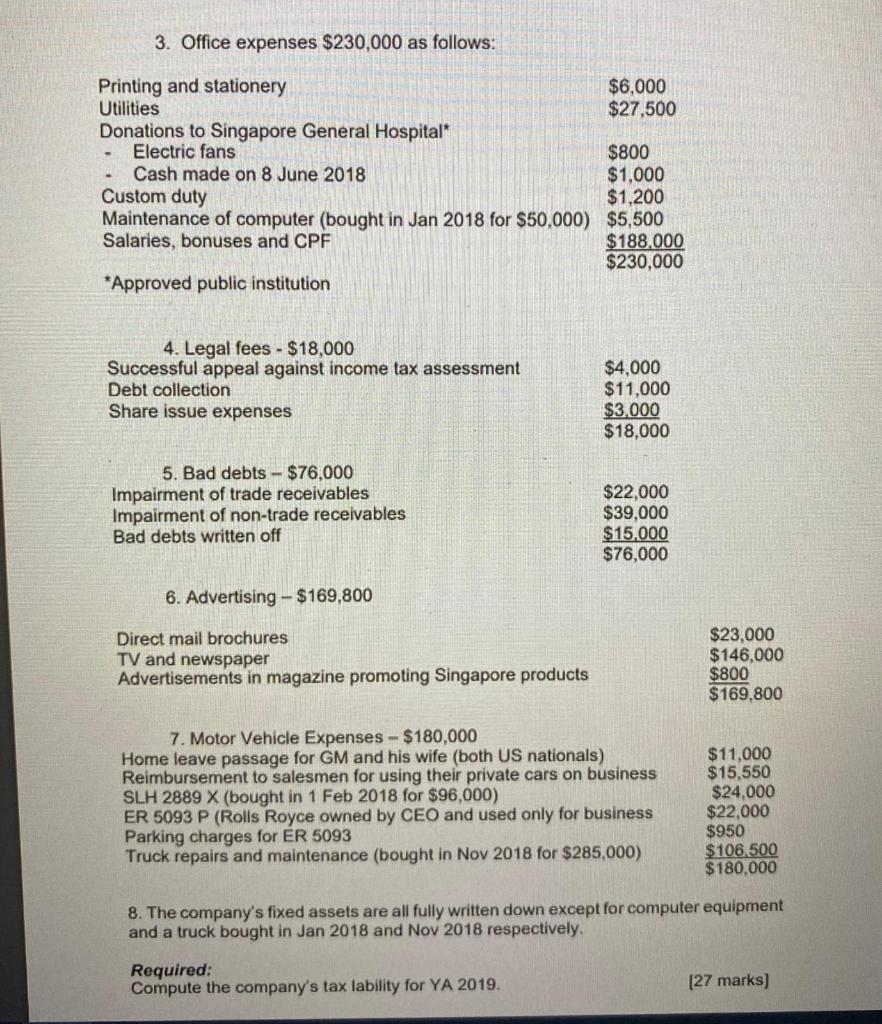

Section B (50% of 100 marks] [Both questions in this section are compulsory] Question 2 [27 marks) Daisen Pte Ltd was incorporated on 1 April 2017 and is owned by Alan and Benjamin. The company's main activities is in activity of manufacturing circuit breakers. The accounting year end of the company is 31 December. Gross profit Dividends - Singapore Interest 2,500,000 20,000 10,000 1 2 2,530,000 3 4 Less: Expenses Office expenses Legal Fees Depreciation Bad debts Advertising Motor vehicle expenses 230,000 18,000 168,000 76,000 169,800 180,000 5 6 7 Net profit per accounts 1,688,200 BEBE Additional information: 1. Gross dividends $20,000 Singapore tax resident companies Malaysia registered companies $11,000 $9,000 $20,000 *Tax of 25% was deducted, and the net amount was deposited into a bank account in Singapore. 2. Interest $10,000 Singapore Government 5% tax free bearer tax free bearer listed in Sch 4 of ITA $2,000 Fixed deposit in OCBC $8,000 $10.000 3. Office expenses $230,000 as follows: Printing and stationery $6,000 Utilities $27,500 Donations to Singapore General Hospital* Electric fans $800 Cash made on 8 June 2018 $1,000 Custom duty $1,200 Maintenance of computer (bought in Jan 2018 for $50,000) $5,500 Salaries, bonuses and CPF $188.000 $230,000 * Approved public institution 4. Legal fees - $18,000 Successful appeal against income tax assessment Debt collection Share issue expenses $4,000 $11,000 $3,000 $18,000 5. Bad debts - $76,000 Impairment of trade receivables Impairment of non-trade receivables Bad debts written off $22,000 $39,000 $15.000 $76,000 6. Advertising - $169,800 Direct mail brochures TV and newspaper Advertisements in magazine promoting Singapore products $23,000 $146,000 $800 $169,800 7. Motor Vehicle Expenses - $180,000 Home leave passage for GM and his wife (both US nationals) Reimbursement to salesmen for using their private cars on business SLH 2889 X (bought in 1 Feb 2018 for $96,000) ER 5093 P (Rolls Royce owned by CEO and used only for business Parking charges for ER 5093 Truck repairs and maintenance (bought in Nov 2018 for $285,000) $11,000 $15,550 $24,000 $22,000 $950 $106.500 $180,000 8. The company's fixed assets are all fully written down except for computer equipment and a truck bought in Jan 2018 and Nov 2018 respectively Required: Compute the company's tax lability for YA 2019. [27 marks) Section B (50% of 100 marks] [Both questions in this section are compulsory] Question 2 [27 marks) Daisen Pte Ltd was incorporated on 1 April 2017 and is owned by Alan and Benjamin. The company's main activities is in activity of manufacturing circuit breakers. The accounting year end of the company is 31 December. Gross profit Dividends - Singapore Interest 2,500,000 20,000 10,000 1 2 2,530,000 3 4 Less: Expenses Office expenses Legal Fees Depreciation Bad debts Advertising Motor vehicle expenses 230,000 18,000 168,000 76,000 169,800 180,000 5 6 7 Net profit per accounts 1,688,200 BEBE Additional information: 1. Gross dividends $20,000 Singapore tax resident companies Malaysia registered companies $11,000 $9,000 $20,000 *Tax of 25% was deducted, and the net amount was deposited into a bank account in Singapore. 2. Interest $10,000 Singapore Government 5% tax free bearer tax free bearer listed in Sch 4 of ITA $2,000 Fixed deposit in OCBC $8,000 $10.000 3. Office expenses $230,000 as follows: Printing and stationery $6,000 Utilities $27,500 Donations to Singapore General Hospital* Electric fans $800 Cash made on 8 June 2018 $1,000 Custom duty $1,200 Maintenance of computer (bought in Jan 2018 for $50,000) $5,500 Salaries, bonuses and CPF $188.000 $230,000 * Approved public institution 4. Legal fees - $18,000 Successful appeal against income tax assessment Debt collection Share issue expenses $4,000 $11,000 $3,000 $18,000 5. Bad debts - $76,000 Impairment of trade receivables Impairment of non-trade receivables Bad debts written off $22,000 $39,000 $15.000 $76,000 6. Advertising - $169,800 Direct mail brochures TV and newspaper Advertisements in magazine promoting Singapore products $23,000 $146,000 $800 $169,800 7. Motor Vehicle Expenses - $180,000 Home leave passage for GM and his wife (both US nationals) Reimbursement to salesmen for using their private cars on business SLH 2889 X (bought in 1 Feb 2018 for $96,000) ER 5093 P (Rolls Royce owned by CEO and used only for business Parking charges for ER 5093 Truck repairs and maintenance (bought in Nov 2018 for $285,000) $11,000 $15,550 $24,000 $22,000 $950 $106.500 $180,000 8. The company's fixed assets are all fully written down except for computer equipment and a truck bought in Jan 2018 and Nov 2018 respectively Required: Compute the company's tax lability for YA 2019. [27 marks)