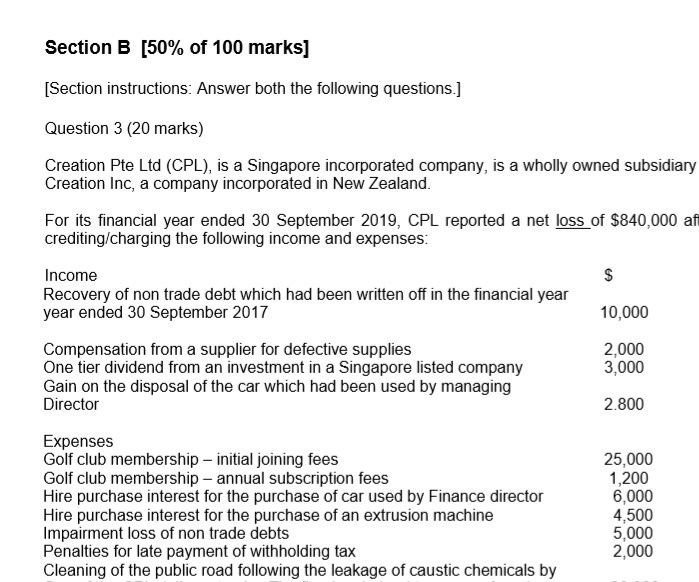

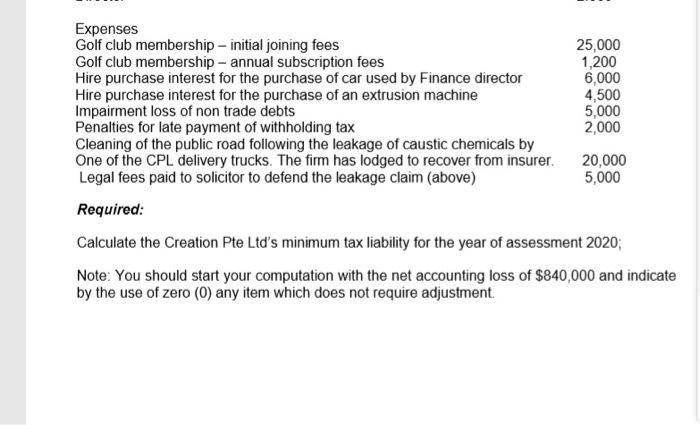

Section B [50% of 100 marks] [Section instructions: Answer both the following questions.] Question 3 (20 marks) Creation Pte Ltd (CPL), is a Singapore incorporated company, is a wholly owned subsidiary Creation Inc, a company incorporated in New Zealand. For its financial year ended 30 September 2019, CPL reported a net loss of $840,000 af crediting/charging the following income and expenses: Income $ Recovery of non trade debt which had been written off in the financial year year ended 30 September 2017 10,000 Compensation from a supplier for defective supplies 2,000 One tier dividend from an investment in a Singapore listed company 3,000 Gain on the disposal of the car which had been used by managing Director 2.800 Expenses Golf club membership - initial joining fees Golf club membership - annual subscription fees Hire purchase interest for the purchase of car used by Finance director Hire purchase interest for the purchase of an extrusion machine Impairment loss of non trade debts Penalties for late payment of withholding tax Cleaning of the public road following the leakage of caustic chemicals by 25,000 1,200 6,000 4,500 5,000 2,000 Expenses Golf club membership - initial joining fees 25,000 Golf club membership - annual subscription fees 1,200 Hire purchase interest for the purchase of car used by Finance director 6,000 Hire purchase interest for the purchase of an extrusion machine 4,500 Impairment loss of non trade debts 5,000 Penalties for late payment of withholding tax 2,000 Cleaning of the public road following the leakage of caustic chemicals by One of the CPL delivery trucks. The firm has lodged to recover from insurer. 20,000 Legal fees paid to solicitor to defend the leakage claim (above) 5,000 Required: Calculate the Creation Pte Ltd's minimum tax liability for the year of assessment 2020; Note: You should start your computation with the net accounting loss of $840,000 and indicate by the use of zero (0) any item which does not require adjustment. Section B [50% of 100 marks] [Section instructions: Answer both the following questions.] Question 3 (20 marks) Creation Pte Ltd (CPL), is a Singapore incorporated company, is a wholly owned subsidiary Creation Inc, a company incorporated in New Zealand. For its financial year ended 30 September 2019, CPL reported a net loss of $840,000 af crediting/charging the following income and expenses: Income $ Recovery of non trade debt which had been written off in the financial year year ended 30 September 2017 10,000 Compensation from a supplier for defective supplies 2,000 One tier dividend from an investment in a Singapore listed company 3,000 Gain on the disposal of the car which had been used by managing Director 2.800 Expenses Golf club membership - initial joining fees Golf club membership - annual subscription fees Hire purchase interest for the purchase of car used by Finance director Hire purchase interest for the purchase of an extrusion machine Impairment loss of non trade debts Penalties for late payment of withholding tax Cleaning of the public road following the leakage of caustic chemicals by 25,000 1,200 6,000 4,500 5,000 2,000 Expenses Golf club membership - initial joining fees 25,000 Golf club membership - annual subscription fees 1,200 Hire purchase interest for the purchase of car used by Finance director 6,000 Hire purchase interest for the purchase of an extrusion machine 4,500 Impairment loss of non trade debts 5,000 Penalties for late payment of withholding tax 2,000 Cleaning of the public road following the leakage of caustic chemicals by One of the CPL delivery trucks. The firm has lodged to recover from insurer. 20,000 Legal fees paid to solicitor to defend the leakage claim (above) 5,000 Required: Calculate the Creation Pte Ltd's minimum tax liability for the year of assessment 2020; Note: You should start your computation with the net accounting loss of $840,000 and indicate by the use of zero (0) any item which does not require adjustment