Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION B [60 MARKS] Answer ANY THREE questions in this section. QUESTION 3 (20 Marks REQUIRED Use the information provided below to answer the following

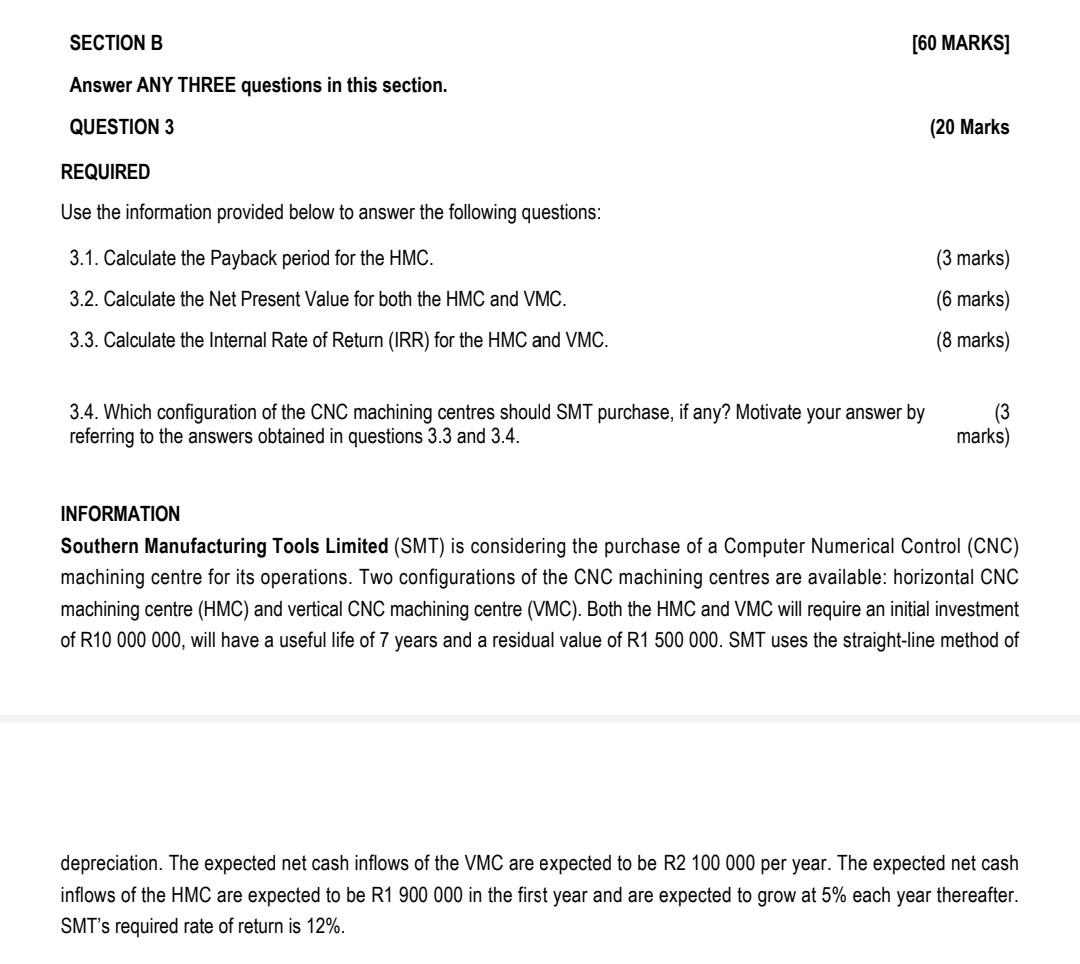

SECTION B [60 MARKS] Answer ANY THREE questions in this section. QUESTION 3 (20 Marks REQUIRED Use the information provided below to answer the following questions: 3.1. Calculate the Payback period for the HMC. (3 marks) 3.2. Calculate the Net Present Value for both the HMC and VMC. (6 marks) 3.3. Calculate the Internal Rate of Return (IRR) for the HMC and VMC. (8 marks) 3.4. Which configuration of the CNC machining centres should SMT purchase, if any? Motivate your answer by referring to the answers obtained in questions 3.3 and 3.4 . (3 marks) INFORMATION Southern Manufacturing Tools Limited (SMT) is considering the purchase of a Computer Numerical Control (CNC) machining centre for its operations. Two configurations of the CNC machining centres are available: horizontal CNC machining centre (HMC) and vertical CNC machining centre (VMC). Both the HMC and VMC will require an initial investment of R10 000000 , will have a useful life of 7 years and a residual value of R1 500000. SMT uses the straight-line method of depreciation. The expected net cash inflows of the VMC are expected to be R2 100000 per year. The expected net cash inflows of the HMC are expected to be R1 900000 in the first year and are expected to grow at 5% each year thereafter. SMT's required rate of return is 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started