SECTION B: ANALYSIS OF FINANCIAL STATEMENT (USING INTEL CORP STATEMENTS ABOVE ANSWER QUESTIONS BELOW) 1. Compute the major ratios related to the firms liquidity situation

SECTION B:

ANALYSIS OF FINANCIAL STATEMENT (USING INTEL CORP STATEMENTS ABOVE ANSWER QUESTIONS BELOW)

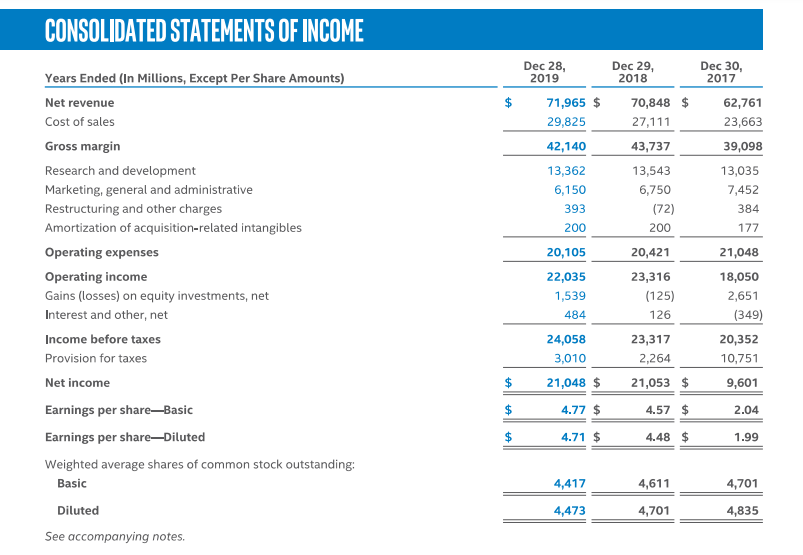

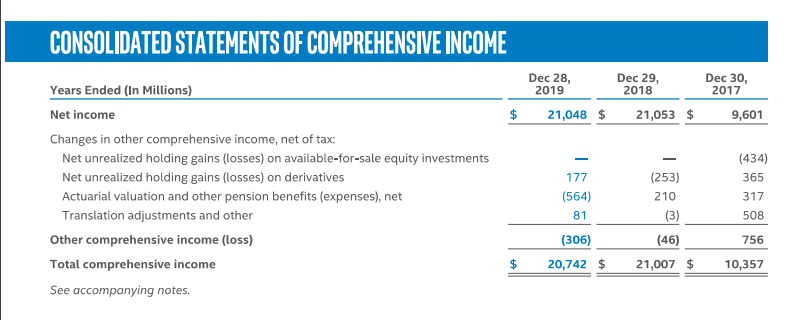

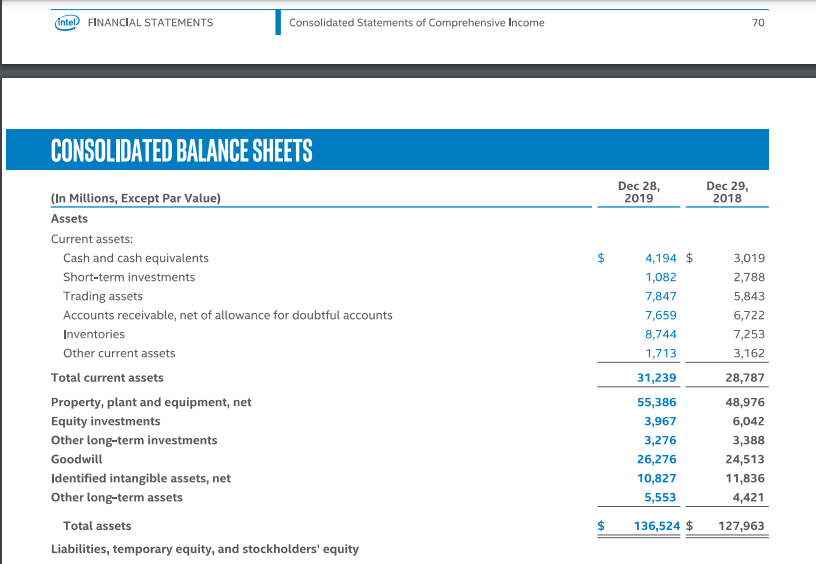

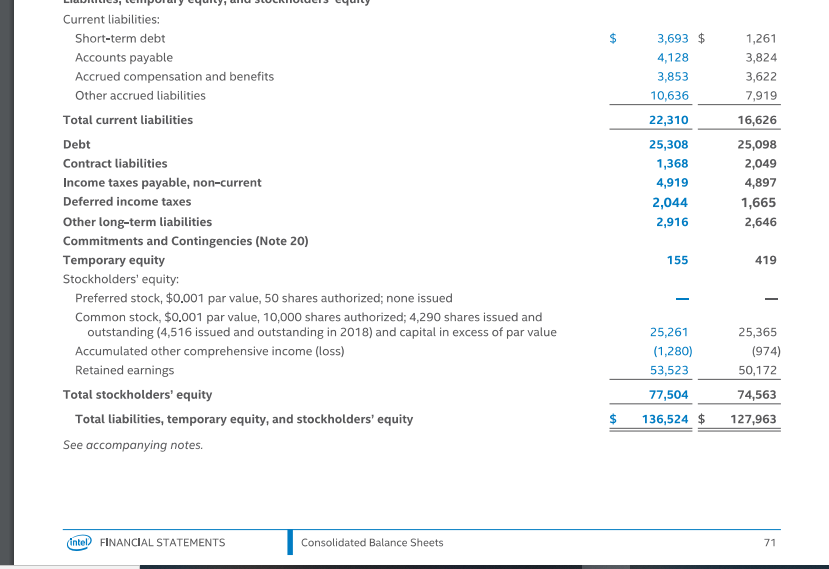

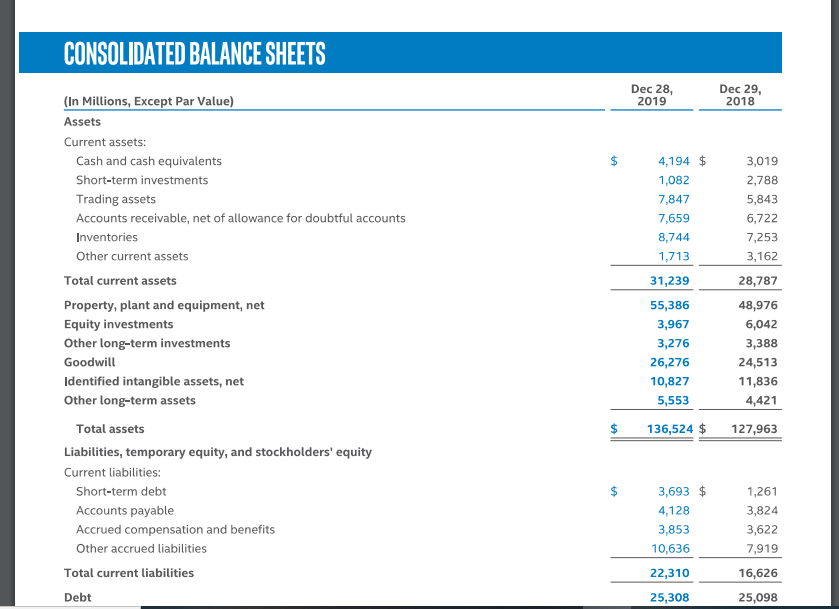

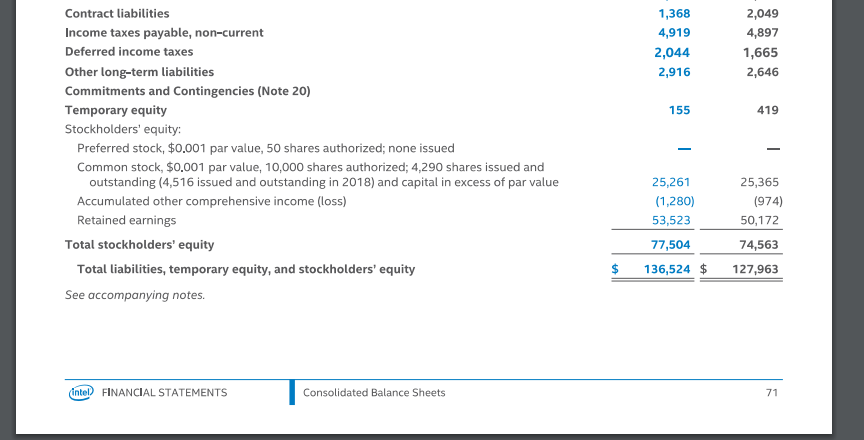

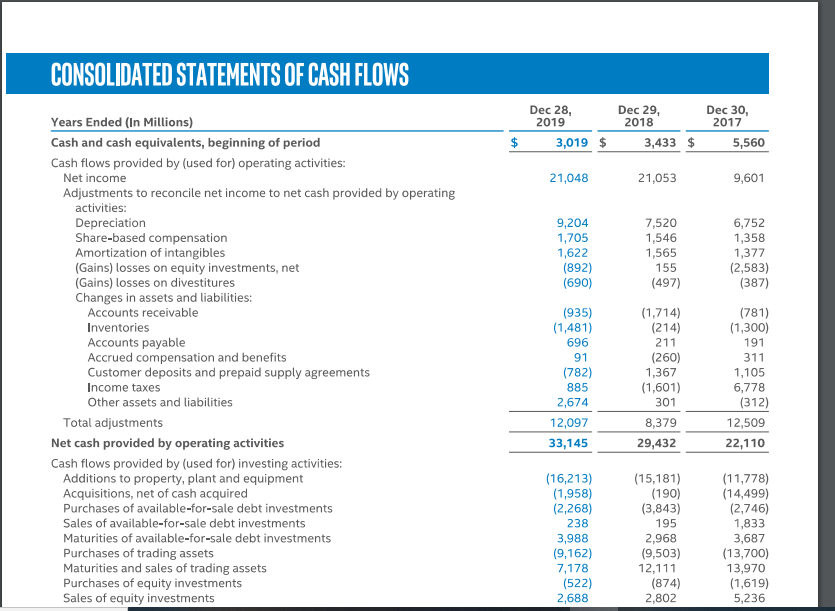

1. Compute the major ratios related to the firms liquidity situation and comment on the firms liquidity situation.

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

2. Compute the major ratios related to the firms solvency situation and comment on the firms solvency situation.

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

3. Compute the major ratios related to the firms profitability and comment on the firms profitability situation.

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

4. Compute the major ratios related to the firms market performance situation and comment on the firms market performance situation.

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

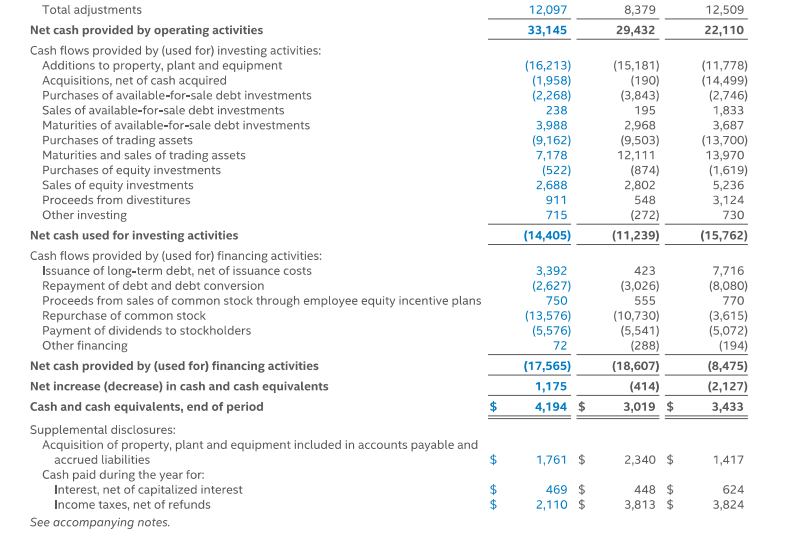

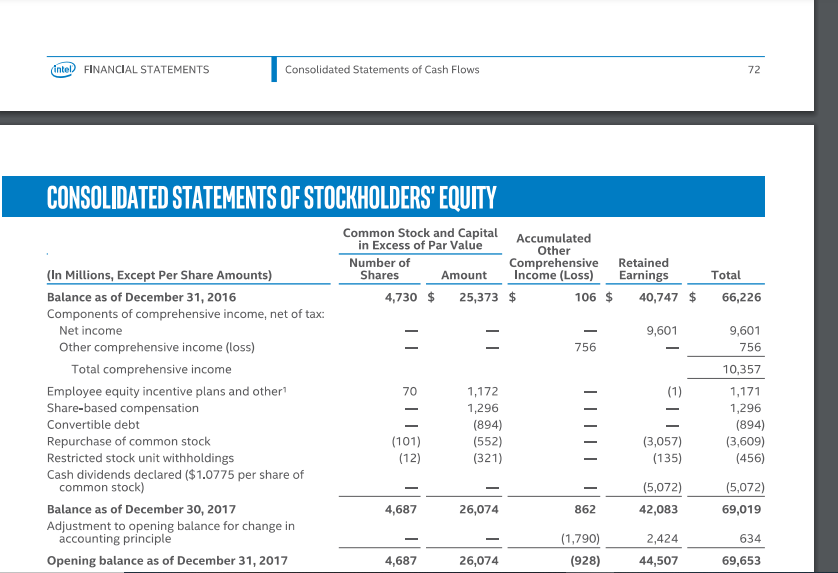

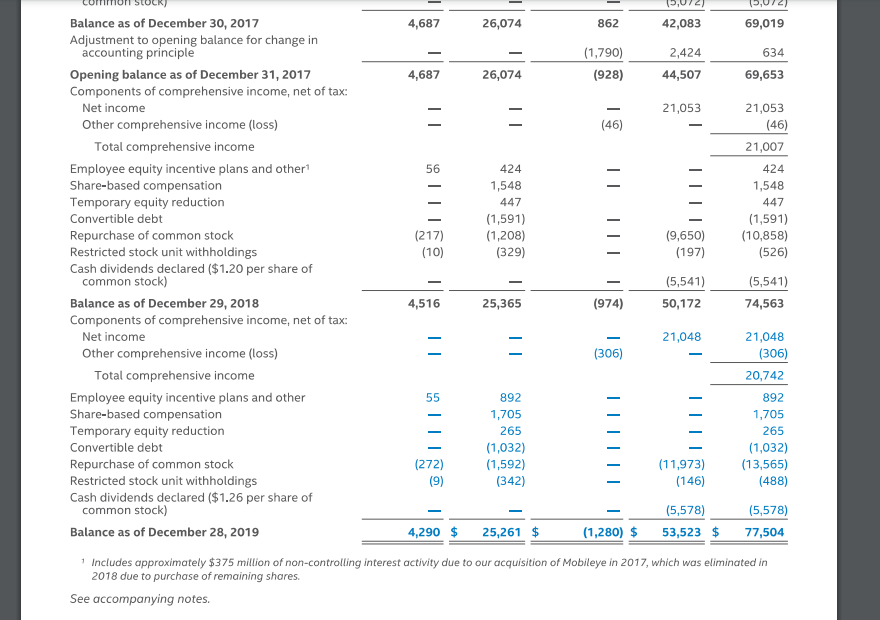

CONSOLIDATED STATEMENTS OF INCOME Dec 28, 2019 Dec 29, 2018 Dec 30, 2017 $ 71,965 $ 29,825 70,848 $ 27,111 62,761 23,663 39,098 42,140 13,362 6,150 393 200 20,105 22,035 1,539 484 43,737 13,543 6,750 (72) 200 13,035 7,452 384 177 Years Ended (In Millions, Except Per Share Amounts) Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and other charges Amortization of acquisition-related intangibles Operating expenses Operating income Gains (losses) on equity investments, net Interest and other, net Income before taxes Provision for taxes Net income Earnings per shareBasic Earnings per share-Diluted Weighted average shares of common stock outstanding: Basic Diluted See accompanying notes 21,048 20,421 23,316 (125) 126 18,050 2,651 (349) 20,352 10,751 24,058 3,010 21,048 $ 23,317 2,264 21,053 $ $ 9,601 $ 4.77 $ 4.57 $ 2.04 4.71 $ 4.48 $ 1.99 4,417 4,611 4,701 4,473 4,701 4,835 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Dec 30, 2017 Dec 28, Dec 29, 2019 2018 21,048 $ 21,053 $ 9,601 Years Ended (in Millions) Net income Changes in other comprehensive income, net of tax: Net unrealized holding gains (losses) on available-for-sale equity investments Net unrealized holding gains (losses) on derivatives Actuarial valuation and other pension benefits (expenses), net Translation adjustments and other Other comprehensive income (loss) Total comprehensive income See accompanying notes. 177 (564) 81 (253) 210 (3) (434) 365 317 508 (306) 756 (46) 21,007 $ $ 20,742 $ 10,357 (intel) FINANCIAL STATEMENTS Consolidated Statements of Comprehensive Income 70 CONSOLIDATED BALANCE SHEETS Dec 28, 2019 Dec 29, 2018 $ (In Millions, Except Par Value) Assets Current assets: Cash and cash equivalents Short-term investments Trading assets Accounts receivable, net of allowance for doubtful accounts Inventories Other current assets Total current assets Property, plant and equipment, net Equity investments Other long-term investments Goodwill Identified intangible assets, net Other long-term assets 4,194 $ 1,082 7,847 7,659 8,744 1,713 3,019 2,788 5,843 6,722 7,253 3,162 31,239 55,386 3,967 3,276 26,276 10,827 5,553 28,787 48,976 6,042 3,388 24,513 11,836 4,421 Total assets $ 136,524 $ 127,963 Liabilities, temporary equity, and stockholders' equity $ 1,261 3,824 3,622 7,919 3,693 $ 4,128 3,853 10,636 22,310 25,308 1,368 4,919 2,044 2,916 16,626 25,098 2,049 4,897 1,665 2,646 Current liabilities: Short-term debt Accounts payable Accrued compensation and benefits Other accrued liabilities Total current liabilities Debt Contract liabilities Income taxes payable, non-current Deferred income taxes Other long-term liabilities Commitments and Contingencies (Note 20) Temporary equity Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 4,290 shares issued and outstanding (4,516 issued and outstanding in 2018) and capital in excess of par value Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities, temporary equity, and stockholders' equity See accompanying notes. 155 419 25,261 (1,280) 53,523 25,365 (974) 50,172 74,563 77,504 $ 136,524 $ 127,963 (Intel) FINANCIAL STATEMENTS Consolidated Balance Sheets 71 CONSOLIDATED BALANCE SHEETS Dec 28, 2019 Dec 29, 2018 4,194 $ 1,082 7,847 7,659 8,744 1,713 3,019 2,788 5,843 6,722 7,253 3,162 28,787 31,239 (In Millions, Except Par Value) Assets Current assets: Cash and cash equivalents Short-term investments Trading assets Accounts receivable, net of allowance for doubtful accounts Inventories Other current assets Total current assets Property, plant and equipment, net Equity investments Other long-term investments Goodwill Identified intangible assets, net Other long-term assets Total assets Liabilities, temporary equity, and stockholders' equity Current liabilities: Short-term debt Accounts payable Accrued compensation and benefits Other accrued liabilities Total current liabilities 55,386 3,967 3,276 26,276 10,827 5,553 48,976 6,042 3,388 24,513 11,836 4,421 $ 136,524 $ 127,963 $ 3,693 $ 4,128 3,853 10,636 1,261 3,824 3,622 7,919 22,310 16,626 Debt 25,308 25,098 1,368 4,919 2,044 2,916 2,049 4,897 1,665 2,646 155 419 Contract liabilities Income taxes payable, non-current Deferred income taxes Other long-term liabilities Commitments and Contingencies (Note 20) Temporary equity Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 4,290 shares issued and outstanding (4,516 issued and outstanding in 2018) and capital in excess of par value Accumulated other comprehensive income (Loss) Retained earnings Total stockholders' equity Total liabilities, temporary equity, and stockholders' equity See accompanying notes 25,261 (1,280) 53,523 25,365 (974) 50,172 74,563 77,504 136,524 $ $ 127,963 intel? FINANCIAL STATEMENTS Consolidated Balance Sheets 71 CONSOLIDATED STATEMENTS OF CASH FLOWS Dec 28, 2019 3,019 $ Dec 29, 2018 3,433 $ Dec 30, 2017 5,560 $ 21,048 21,053 9,601 9,204 1,705 1,622 (892) (690) 7,520 1,546 1,565 155 (497) 6,752 1,358 1,377 (2,583) (387) Years Ended (In Millions) Cash and cash equivalents, beginning of period Cash flows provided by (used for) operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Share-based compensation Amortization of intangibles (Gains) losses on equity investments, net (Gains) losses on divestitures Changes in assets and liabilities: Accounts receivable Inventories Accounts payable Accrued compensation and benefits Customer deposits and prepaid supply agreements Income taxes Other assets and liabilities Total adjustments Net cash provided by operating activities Cash flows provided by (used for) investing activities: Additions to property, plant and equipment Acquisitions, net of cash acquired Purchases of available-for-sale debt investments Sales of available-for-sale debt investments Maturities of available-for-sale debt investments Purchases of trading assets Maturities and sales of trading assets Purchases of equity investments Sales of equity investments (935) (1,481) 696 91 (782) 885 2,674 12,097 33,145 (1,714) (214) 211 (260) 1,367 (1,601) 301 (781) (1,300) 191 311 1,105 6,778 (312) 12,509 22,110 8,379 29,432 (16,213) (1,958) (2,268) 238 3,988 (9,162) 7,178 (522) 2,688 (15,181) (190) (3,843) 195 2,968 (9,503) 12,111 (874) 2,802 (11,778) (14,499) (2,746) 1,833 3,687 (13,700) 13,970 (1,619) 5,236 12,097 33,145 8,379 29,432 12,509 22,110 (15,181) (190) (3,843) 195 (16,213) (1,958) (2,268) 238 3,988 (9,162) 7,178 (522) 2,688 911 715 (14,405) 2,968 (9,503) 12,111 (874) 2,802 548 (11,778) (14,499) (2,746) 1,833 3,687 (13,700) 13,970 (1,619) 5,236 3,124 730 (15,762) (272) (11,239) Total adjustments Net cash provided by operating activities Cash flows provided by (used for) investing activities: Additions to property, plant and equipment Acquisitions, net of cash acquired Purchases of available-for-sale debt investments Sales of available-for-sale debt investments Maturities of available-for-sale debt investments Purchases of trading assets Maturities and sales of trading assets Purchases of equity investments Sales of equity investments Proceeds from divestitures Other investing Net cash used for investing activities Cash flows provided by (used for) financing activities: Issuance of long-term debt, net of issuance costs Repayment of debt and debt conversion Proceeds from sales of common stock through employee equity incentive plans Repurchase of common stock Payment of dividends to stockholders Other financing Net cash provided by (used for) financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, end of period Supplemental disclosures: Acquisition of property, plant and equipment included in accounts payable and accrued liabilities Cash paid during the year for: Interest, net of capitalized interest Income taxes, net of refunds See accompanying notes. 3,392 (2,627) 750 (13,576) (5,576) 72 (17,565) 1,175 4,194 $ 423 (3,026) 555 (10,730) (5,541) (288) (18,607) (414) 3,019 $ 7,716 (8,080) 770 (3,615) (5,072) (194) (8,475) (2,127) 3,433 $ $ 1,761 $ 2,340 $ 1,417 469 $ 2,110 $ 448 $ 3,813 $ 624 3,824 A (intelFINANCIAL STATEMENTS Consolidated Statements of Cash Flows 72 CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Common Stock and Capital Accumulated in Excess of Par Value Other Number of Comprehensive Retained Shares Amount Income (Loss) Earnings 4,730 $ 25,373 $ 106 $ 40,747 $ Total 66,226 9,601 756 9,601 756 | 70 (1) (In Millions, Except Per Share Amounts) Balance as of December 31, 2016 Components of comprehensive income, net of tax: Net income Other comprehensive income (loss) Total comprehensive income Employee equity incentive plans and other Share-based compensation Convertible debt Repurchase of common stock Restricted stock unit withholdings Cash dividends declared ($1.0775 per share of common stock) Balance as of December 30, 2017 Adjustment to opening balance for change in accounting principle Opening balance as of December 31, 2017 1,172 1,296 (894) (552) (321) III 10,357 1,171 1,296 (894) (3,609) (456) (101) (12) (3,057) (135) (5,072) 42,083 (5,072) 69,019 4,687 26,074 862 634 (1,790) (928) 2,424 44,507 4,687 26,074 69,653 1,0741 11 56 Balance as of December 30, 2017 4,687 26,074 862 42,083 69,019 Adjustment to opening balance for change in accounting principle (1,790) 2,424 634 Opening balance as of December 31, 2017 4,687 26,074 (928) 44,507 69,653 Components of comprehensive income, net of tax: Net income 21,053 21,053 Other comprehensive income (loss) (46) (46) Total comprehensive income 21,007 Employee equity incentive plans and other 424 424 Share-based compensation 1,548 1,548 Temporary equity reduction 447 447 Convertible debt (1,591) (1,591) Repurchase of common stock (217) (1,208) (9,650) (10,858) Restricted stock unit withholdings (10) (329) (197) (526) Cash dividends declared ($1.20 per share of common stock) (5,541) (5,541) Balance as of December 29, 2018 4,516 25,365 (974) 50,172 74,563 Components of comprehensive income, net of tax: Net income 21,048 21,048 Other comprehensive income (loss) (306) (306) Total comprehensive income 20,742 Employee equity incentive plans and other 55 892 892 Share-based compensation 1,705 1,705 Temporary equity reduction 265 265 Convertible debt (1,032) (1,032) Repurchase of common stock (272) (1,592) (11,973) (13,565) Restricted stock unit withholdings (9) (342) (146) (488) Cash dividends declared ($1.26 per share of common stock) (5,578) (5,578) Balance as of December 28, 2019 4,290 $ 25,261 $ (1,280) $ 53,523 $ 77,504 Includes approximately $375 million of non-controlling interest activity due to our acquisition of Mobileye in 2017, which was eliminated in 2018 due to purchase of remaining shares. See accompanying notes. 11 CONSOLIDATED STATEMENTS OF INCOME Dec 28, 2019 Dec 29, 2018 Dec 30, 2017 $ 71,965 $ 29,825 70,848 $ 27,111 62,761 23,663 39,098 42,140 13,362 6,150 393 200 20,105 22,035 1,539 484 43,737 13,543 6,750 (72) 200 13,035 7,452 384 177 Years Ended (In Millions, Except Per Share Amounts) Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and other charges Amortization of acquisition-related intangibles Operating expenses Operating income Gains (losses) on equity investments, net Interest and other, net Income before taxes Provision for taxes Net income Earnings per shareBasic Earnings per share-Diluted Weighted average shares of common stock outstanding: Basic Diluted See accompanying notes 21,048 20,421 23,316 (125) 126 18,050 2,651 (349) 20,352 10,751 24,058 3,010 21,048 $ 23,317 2,264 21,053 $ $ 9,601 $ 4.77 $ 4.57 $ 2.04 4.71 $ 4.48 $ 1.99 4,417 4,611 4,701 4,473 4,701 4,835 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Dec 30, 2017 Dec 28, Dec 29, 2019 2018 21,048 $ 21,053 $ 9,601 Years Ended (in Millions) Net income Changes in other comprehensive income, net of tax: Net unrealized holding gains (losses) on available-for-sale equity investments Net unrealized holding gains (losses) on derivatives Actuarial valuation and other pension benefits (expenses), net Translation adjustments and other Other comprehensive income (loss) Total comprehensive income See accompanying notes. 177 (564) 81 (253) 210 (3) (434) 365 317 508 (306) 756 (46) 21,007 $ $ 20,742 $ 10,357 (intel) FINANCIAL STATEMENTS Consolidated Statements of Comprehensive Income 70 CONSOLIDATED BALANCE SHEETS Dec 28, 2019 Dec 29, 2018 $ (In Millions, Except Par Value) Assets Current assets: Cash and cash equivalents Short-term investments Trading assets Accounts receivable, net of allowance for doubtful accounts Inventories Other current assets Total current assets Property, plant and equipment, net Equity investments Other long-term investments Goodwill Identified intangible assets, net Other long-term assets 4,194 $ 1,082 7,847 7,659 8,744 1,713 3,019 2,788 5,843 6,722 7,253 3,162 31,239 55,386 3,967 3,276 26,276 10,827 5,553 28,787 48,976 6,042 3,388 24,513 11,836 4,421 Total assets $ 136,524 $ 127,963 Liabilities, temporary equity, and stockholders' equity $ 1,261 3,824 3,622 7,919 3,693 $ 4,128 3,853 10,636 22,310 25,308 1,368 4,919 2,044 2,916 16,626 25,098 2,049 4,897 1,665 2,646 Current liabilities: Short-term debt Accounts payable Accrued compensation and benefits Other accrued liabilities Total current liabilities Debt Contract liabilities Income taxes payable, non-current Deferred income taxes Other long-term liabilities Commitments and Contingencies (Note 20) Temporary equity Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 4,290 shares issued and outstanding (4,516 issued and outstanding in 2018) and capital in excess of par value Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities, temporary equity, and stockholders' equity See accompanying notes. 155 419 25,261 (1,280) 53,523 25,365 (974) 50,172 74,563 77,504 $ 136,524 $ 127,963 (Intel) FINANCIAL STATEMENTS Consolidated Balance Sheets 71 CONSOLIDATED BALANCE SHEETS Dec 28, 2019 Dec 29, 2018 4,194 $ 1,082 7,847 7,659 8,744 1,713 3,019 2,788 5,843 6,722 7,253 3,162 28,787 31,239 (In Millions, Except Par Value) Assets Current assets: Cash and cash equivalents Short-term investments Trading assets Accounts receivable, net of allowance for doubtful accounts Inventories Other current assets Total current assets Property, plant and equipment, net Equity investments Other long-term investments Goodwill Identified intangible assets, net Other long-term assets Total assets Liabilities, temporary equity, and stockholders' equity Current liabilities: Short-term debt Accounts payable Accrued compensation and benefits Other accrued liabilities Total current liabilities 55,386 3,967 3,276 26,276 10,827 5,553 48,976 6,042 3,388 24,513 11,836 4,421 $ 136,524 $ 127,963 $ 3,693 $ 4,128 3,853 10,636 1,261 3,824 3,622 7,919 22,310 16,626 Debt 25,308 25,098 1,368 4,919 2,044 2,916 2,049 4,897 1,665 2,646 155 419 Contract liabilities Income taxes payable, non-current Deferred income taxes Other long-term liabilities Commitments and Contingencies (Note 20) Temporary equity Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 4,290 shares issued and outstanding (4,516 issued and outstanding in 2018) and capital in excess of par value Accumulated other comprehensive income (Loss) Retained earnings Total stockholders' equity Total liabilities, temporary equity, and stockholders' equity See accompanying notes 25,261 (1,280) 53,523 25,365 (974) 50,172 74,563 77,504 136,524 $ $ 127,963 intel? FINANCIAL STATEMENTS Consolidated Balance Sheets 71 CONSOLIDATED STATEMENTS OF CASH FLOWS Dec 28, 2019 3,019 $ Dec 29, 2018 3,433 $ Dec 30, 2017 5,560 $ 21,048 21,053 9,601 9,204 1,705 1,622 (892) (690) 7,520 1,546 1,565 155 (497) 6,752 1,358 1,377 (2,583) (387) Years Ended (In Millions) Cash and cash equivalents, beginning of period Cash flows provided by (used for) operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Share-based compensation Amortization of intangibles (Gains) losses on equity investments, net (Gains) losses on divestitures Changes in assets and liabilities: Accounts receivable Inventories Accounts payable Accrued compensation and benefits Customer deposits and prepaid supply agreements Income taxes Other assets and liabilities Total adjustments Net cash provided by operating activities Cash flows provided by (used for) investing activities: Additions to property, plant and equipment Acquisitions, net of cash acquired Purchases of available-for-sale debt investments Sales of available-for-sale debt investments Maturities of available-for-sale debt investments Purchases of trading assets Maturities and sales of trading assets Purchases of equity investments Sales of equity investments (935) (1,481) 696 91 (782) 885 2,674 12,097 33,145 (1,714) (214) 211 (260) 1,367 (1,601) 301 (781) (1,300) 191 311 1,105 6,778 (312) 12,509 22,110 8,379 29,432 (16,213) (1,958) (2,268) 238 3,988 (9,162) 7,178 (522) 2,688 (15,181) (190) (3,843) 195 2,968 (9,503) 12,111 (874) 2,802 (11,778) (14,499) (2,746) 1,833 3,687 (13,700) 13,970 (1,619) 5,236 12,097 33,145 8,379 29,432 12,509 22,110 (15,181) (190) (3,843) 195 (16,213) (1,958) (2,268) 238 3,988 (9,162) 7,178 (522) 2,688 911 715 (14,405) 2,968 (9,503) 12,111 (874) 2,802 548 (11,778) (14,499) (2,746) 1,833 3,687 (13,700) 13,970 (1,619) 5,236 3,124 730 (15,762) (272) (11,239) Total adjustments Net cash provided by operating activities Cash flows provided by (used for) investing activities: Additions to property, plant and equipment Acquisitions, net of cash acquired Purchases of available-for-sale debt investments Sales of available-for-sale debt investments Maturities of available-for-sale debt investments Purchases of trading assets Maturities and sales of trading assets Purchases of equity investments Sales of equity investments Proceeds from divestitures Other investing Net cash used for investing activities Cash flows provided by (used for) financing activities: Issuance of long-term debt, net of issuance costs Repayment of debt and debt conversion Proceeds from sales of common stock through employee equity incentive plans Repurchase of common stock Payment of dividends to stockholders Other financing Net cash provided by (used for) financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, end of period Supplemental disclosures: Acquisition of property, plant and equipment included in accounts payable and accrued liabilities Cash paid during the year for: Interest, net of capitalized interest Income taxes, net of refunds See accompanying notes. 3,392 (2,627) 750 (13,576) (5,576) 72 (17,565) 1,175 4,194 $ 423 (3,026) 555 (10,730) (5,541) (288) (18,607) (414) 3,019 $ 7,716 (8,080) 770 (3,615) (5,072) (194) (8,475) (2,127) 3,433 $ $ 1,761 $ 2,340 $ 1,417 469 $ 2,110 $ 448 $ 3,813 $ 624 3,824 A (intelFINANCIAL STATEMENTS Consolidated Statements of Cash Flows 72 CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Common Stock and Capital Accumulated in Excess of Par Value Other Number of Comprehensive Retained Shares Amount Income (Loss) Earnings 4,730 $ 25,373 $ 106 $ 40,747 $ Total 66,226 9,601 756 9,601 756 | 70 (1) (In Millions, Except Per Share Amounts) Balance as of December 31, 2016 Components of comprehensive income, net of tax: Net income Other comprehensive income (loss) Total comprehensive income Employee equity incentive plans and other Share-based compensation Convertible debt Repurchase of common stock Restricted stock unit withholdings Cash dividends declared ($1.0775 per share of common stock) Balance as of December 30, 2017 Adjustment to opening balance for change in accounting principle Opening balance as of December 31, 2017 1,172 1,296 (894) (552) (321) III 10,357 1,171 1,296 (894) (3,609) (456) (101) (12) (3,057) (135) (5,072) 42,083 (5,072) 69,019 4,687 26,074 862 634 (1,790) (928) 2,424 44,507 4,687 26,074 69,653 1,0741 11 56 Balance as of December 30, 2017 4,687 26,074 862 42,083 69,019 Adjustment to opening balance for change in accounting principle (1,790) 2,424 634 Opening balance as of December 31, 2017 4,687 26,074 (928) 44,507 69,653 Components of comprehensive income, net of tax: Net income 21,053 21,053 Other comprehensive income (loss) (46) (46) Total comprehensive income 21,007 Employee equity incentive plans and other 424 424 Share-based compensation 1,548 1,548 Temporary equity reduction 447 447 Convertible debt (1,591) (1,591) Repurchase of common stock (217) (1,208) (9,650) (10,858) Restricted stock unit withholdings (10) (329) (197) (526) Cash dividends declared ($1.20 per share of common stock) (5,541) (5,541) Balance as of December 29, 2018 4,516 25,365 (974) 50,172 74,563 Components of comprehensive income, net of tax: Net income 21,048 21,048 Other comprehensive income (loss) (306) (306) Total comprehensive income 20,742 Employee equity incentive plans and other 55 892 892 Share-based compensation 1,705 1,705 Temporary equity reduction 265 265 Convertible debt (1,032) (1,032) Repurchase of common stock (272) (1,592) (11,973) (13,565) Restricted stock unit withholdings (9) (342) (146) (488) Cash dividends declared ($1.26 per share of common stock) (5,578) (5,578) Balance as of December 28, 2019 4,290 $ 25,261 $ (1,280) $ 53,523 $ 77,504 Includes approximately $375 million of non-controlling interest activity due to our acquisition of Mobileye in 2017, which was eliminated in 2018 due to purchase of remaining shares. See accompanying notes. 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started