Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION B: ANSWER ANY THREE QUESTIONS QUESTION TWO Wila owns 5 0 0 shares of Deli stock, which is listed on LuSE. Today is April

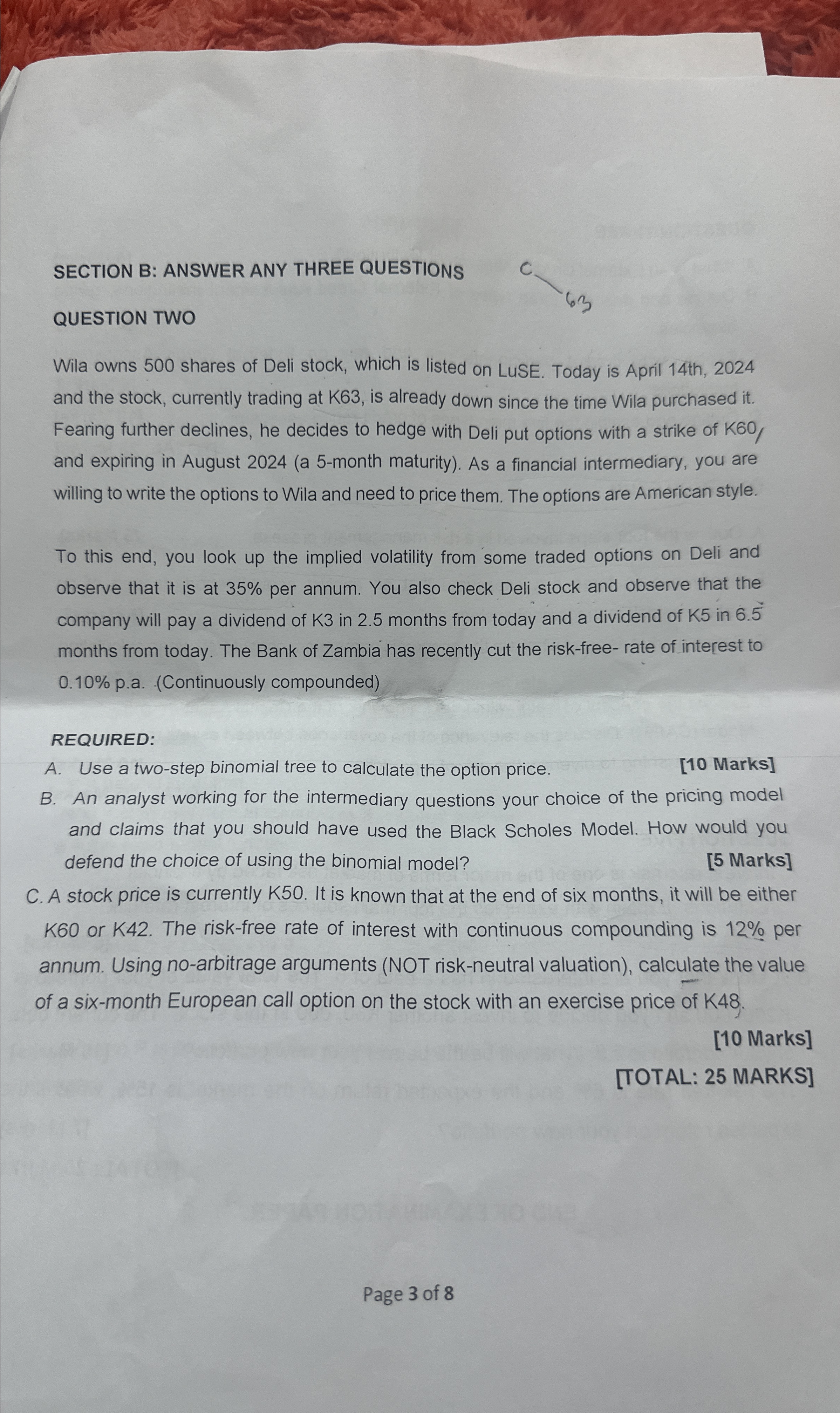

SECTION B: ANSWER ANY THREE QUESTIONS

QUESTION TWO

Wila owns shares of Deli stock, which is listed on LuSE. Today is April th and the stock, currently trading at K is already down since the time Wila purchased it Fearing further declines, he decides to hedge with Deli put options with a strike of K and expiring in August a month maturity As a financial intermediary, you are willing to write the options to Wila and need to price them. The options are American style.

To this end, you look up the implied volatility from some traded options on Deli and observe that it is at per annum. You also check Deli stock and observe that the company will pay a dividend of in months from today and a dividend of in months from today. The Bank of Zambia has recently cut the riskfree rate of interest to paContinuously compounded

REQUIRED:

A Use a twostep binomial tree to calculate the option price.

Marks

B An analyst working for the intermediary questions your choice of the pricing model and claims that you should have used the Black Scholes Model. How would you defend the choice of using the binomial model?

Marks

C A stock price is currently K It is known that at the end of six months, it will be either K or K The riskfree rate of interest with continuous compounding is per annum. Using noarbitrage arguments NOT riskneutral valuation calculate the value of a sixmonth European call option on the stock with an exercise price of

Marks

TOTAL: MARKS

Page of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started